GameStop 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-12

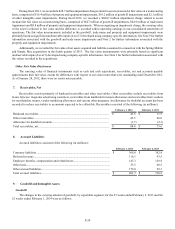

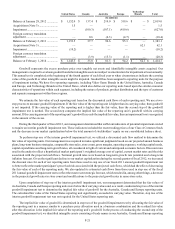

determined based on the period in which they are expected to contribute directly to cash flows. Intangible assets that are determined

to have a definite life are amortized over that period. Leasehold rights which were recorded as a result of the purchase of SFMI

Micromania SAS (“Micromania”) represent the value of rights of tenancy under commercial property leases for properties located

in France. Rights pertaining to individual leases can be sold by us to a new tenant or recovered by us from the landlord if the

exercise of the automatic right of renewal is refused. Leasehold rights are amortized on a straight-line basis over the expected

lease term not to exceed 20 years, with no residual value. Advertising relationships, which were recorded as a result of digital

acquisitions, are relationships with existing advertisers who pay to place ads on our digital Web sites and are amortized on a

straight-line basis over 10 years. Favorable leasehold interests represent the value of the contractual monthly rental payments that

are less than the current market rent at stores acquired as part of the Micromania acquisition or the EB merger. Favorable leasehold

interests are amortized on a straight-line basis over their remaining lease term with no expected residual value.

Intangible assets that are determined to have an indefinite life are not amortized, but are required to be evaluated at least

annually for impairment. Trade names which were recorded as a result of acquisitions, primarily Micromania, are considered

indefinite-lived intangible assets as they are expected to contribute to cash flows indefinitely and are not subject to amortization,

but are subject to annual impairment testing. If the carrying value of an individual indefinite-lived intangible asset exceeds its fair

value as determined by its discounted cash flows, such individual indefinite-lived intangible asset is written down by the amount

of the excess.

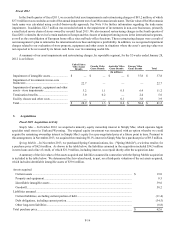

During the third quarter of fiscal 2012, our management determined that sufficient indicators of potential impairment existed

to require an interim impairment test of our Micromania trade name. As a result of the interim impairment test of the Micromania

trade name, we recorded a $44.9 million impairment charge during the third quarter of fiscal 2012. We completed the annual

impairment tests of indefinite-lived intangible assets as of the first day of the fourth quarter of fiscal 2013 and fiscal 2012 and

concluded that none of our intangible assets were impaired. We completed the annual impairment test of indefinite-lived intangible

assets as of the first day of the fourth quarter of fiscal 2011 and concluded that the Micromania trade name was impaired due to

revenue forecasts that had declined since the initial valuation. As a result, we recorded a $37.8 million impairment charge for fiscal

2011. The impairment charges are recorded in asset impairments and restructuring charges in our consolidated statements of

operations and are recorded in the Europe segment. See Note 9.

Revenue Recognition

Revenue from the sales of our products is recognized at the time of sale, net of sales discounts and net of an estimated sales

return reserve, based on historical return rates, with a corresponding reduction in cost of sales. Our sales return policy is generally

limited to less than 30 days and as such our sales returns are, and have historically been, immaterial.

The sales of pre-owned video game products are recorded at the retail price charged to the customer. Advertising revenues

for Game Informer are recorded upon release of magazines for sale to consumers. Subscription revenues for our PowerUp Rewards

loyalty program and magazines are recognized on a straight-line basis over the subscription period. Revenue from the sales of

product replacement plans is recognized on a straight-line basis over the coverage period. The deferred revenues for our PowerUp

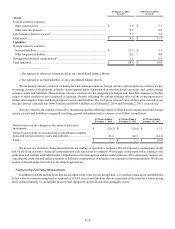

Rewards loyalty program, gift cards, customer credits, magazines and product replacement plans are included in accrued liabilities

(see Note 8). Gift cards sold to customers are recognized as a liability on the consolidated balance sheet until redeemed or until

a reasonable point at which breakage related to non-redemption can be recognized.

We also sell a variety of digital products which generally allow consumers to download software or play games on the

internet. Certain of these products do not require us to purchase inventory or take physical possession of, or take title to, inventory.

When purchasing these products from us, consumers pay a retail price and we earn a commission based on a percentage of the

retail sale as negotiated with the product publisher. We recognize these commissions as revenue on the sale of these digital products.

Revenues do not include sales taxes or other taxes collected from customers.

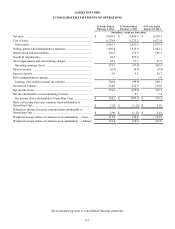

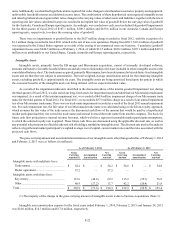

Cost of Sales and Selling, General and Administrative Expenses Classification

The classification of cost of sales and selling, general and administrative expenses varies across the retail industry. We

include purchasing, receiving and distribution costs in selling, general and administrative expenses, rather than cost of goods sold,

in the consolidated statements of operations. For the 52 weeks ended February 1, 2014, the 53 weeks ended February 2, 2013 and

the 52 weeks ended January 28, 2012, these purchasing, receiving and distribution costs amounted to $56.4 million, $58.8 million

and $61.7 million, respectively.

We include processing fees associated with purchases made by check and credit cards in cost of sales, rather than selling,

general and administrative expenses, in the consolidated statements of operations. For the 52 weeks ended February 1, 2014, the

53 weeks ended February 2, 2013 and the 52 weeks ended January 28, 2012, these processing fees amounted to $61.5 million,

$54.2 million and $65.1 million, respectively.