GameStop 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities

Price Range of Common Stock

Our Class A Common Stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “GME.”

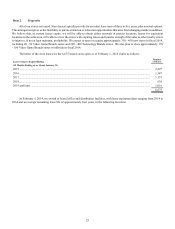

The following table sets forth, for the periods indicated, the high and low sales prices of the Class A Common Stock on the

NYSE Composite Tape:

Fiscal 2013

High Low

Fourth Quarter .............................................................................................................. $ 57.74 $ 34.70

Third Quarter................................................................................................................ $ 56.08 $ 47.04

Second Quarter............................................................................................................. $ 51.36 $ 30.94

First Quarter ................................................................................................................. $ 37.23 $ 23.36

Fiscal 2012

High Low

Fourth Quarter .............................................................................................................. $ 28.35 $ 21.41

Third Quarter................................................................................................................ $ 24.49 $ 15.32

Second Quarter............................................................................................................. $ 23.08 $ 15.47

First Quarter ................................................................................................................. $ 25.86 $ 20.94

Approximate Number of Holders of Common Equity

As of March 20, 2014, there were approximately 1,549 record holders of our Class A Common Stock.

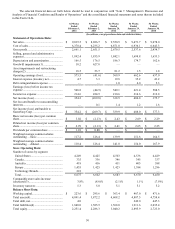

Dividends

Prior to February 2012, we had never declared or paid any dividends on our common stock. During fiscal 2012, we paid

quarterly dividends of $0.15 per share of Class A Common Stock during the first and second fiscal quarters and $0.25 per share

of Class A Common Stock during the third and fourth fiscal quarters. During fiscal 2013, we paid quarterly dividends of $0.275

per share of Class A Common Stock during each of the four fiscal quarters. On March 4, 2014, our Board of Directors authorized

an increase in our annual cash dividend from $1.10 to $1.32 per share of Class A Common Stock and on March 4, 2014, we

declared our first quarterly dividend for fiscal 2014 of $0.33 per share of Class A Common Stock, payable on March 25, 2014 to

stockholders of record on March 17, 2014. Our payment of dividends is and will continue to be restricted by or subject to, among

other limitations, applicable provisions of federal and state laws, our earnings and various business considerations, including our

financial condition, results of operations, cash flow, the level of our capital expenditures, our future business prospects, our status

as a holding company and such other matters that our Board of Directors deems relevant. In addition, the terms of the senior credit

facility restrict our ability to pay dividends under certain circumstances. See “Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations — Liquidity and Capital Resources” herein for further information regarding

restrictions on our dividend payments.