GameStop 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

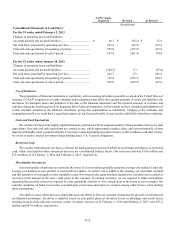

F-20

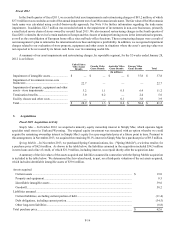

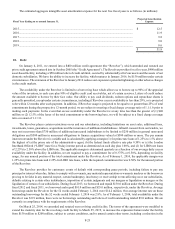

During fiscal 2013, we recorded a $28.7 million impairment charge related to assets measured at fair value on a nonrecurring

basis, comprised of $16.4 million of property and equipment impairments, $10.2 million of goodwill impairments and $2.1 million

of other intangible asset impairments. During fiscal 2012, we recorded a $680.7 million impairment charge related to assets

measured at fair value on a nonrecurring basis, comprised of $627 million of goodwill impairments, $44.9 million of trade name

impairment and $8.8 million of property and equipment impairments. When recognizing an impairment charge, the carrying value

of the asset is reduced to fair value and the difference is recorded within operating earnings in our consolidated statements of

operations. The fair value measurements included in the goodwill, trade name and property and equipment impairments were

primarily based on significant unobservable inputs (Level 3) developed using company-specific information. See Note 9 for further

information associated with the goodwill and trade name impairments and Note 2 for further information associated with the

property and equipment impairments.

Additionally, we recorded the fair value of net assets acquired and liabilities assumed in connection with the Spring Mobile

and Simply Mac acquisitions in the fourth quarter of 2013. The fair value measurements were primarily based on significant

unobservable inputs (Level 3) developed using company-specific information. See Note 3 for further information associated with

the values recorded in the acquisitions.

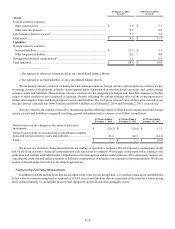

Other Fair Value Disclosures

The carrying value of financial instruments such as cash and cash equivalents, receivables, net and accounts payable

approximates their fair value, except for differences with respect to our senior notes that were outstanding until December 2011.

As of January 28, 2012, there were no senior notes payable.

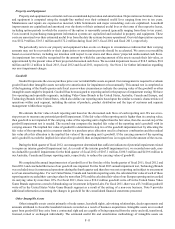

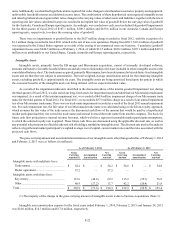

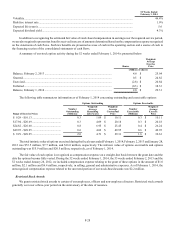

7. Receivables, Net

Receivables consist primarily of bankcard receivables and other receivables. Other receivables include receivables from

Game Informer magazine advertising customers, receivables from landlords for tenant allowances and receivables from vendors

for merchandise returns, vendor marketing allowances and various other programs. An allowance for doubtful accounts has been

recorded to reduce receivables to an amount expected to be collectible. Receivables consisted of the following (in millions):

February 1, 2014 February 2, 2013

Bankcard receivables ................................................................................................ $ 42.6 $ 35.9

Other receivables ...................................................................................................... 45.5 40.0

Allowance for doubtful accounts.............................................................................. (3.7)(2.3)

Total receivables, net ................................................................................................ $ 84.4 $ 73.6

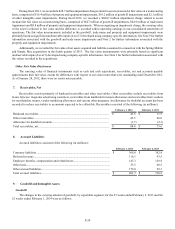

8. Accrued Liabilities

Accrued liabilities consisted of the following (in millions):

February 1, 2014 February 2, 2013

Customer liabilities.................................................................................................... $ 368.8 $ 362.8

Deferred revenue ....................................................................................................... 118.1 93.5

Employee benefits, compensation and related taxes ................................................. 145.3 129.8

Other taxes................................................................................................................. 53.5 60.5

Other accrued liabilities............................................................................................. 176.0 92.3

Total accrued liabilities.............................................................................................. $ 861.7 $ 738.9

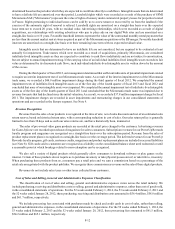

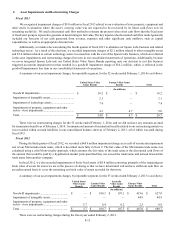

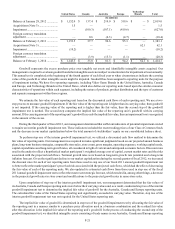

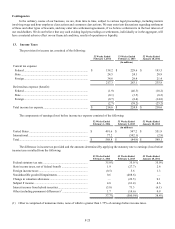

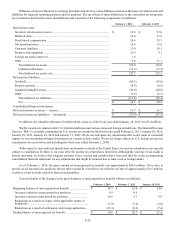

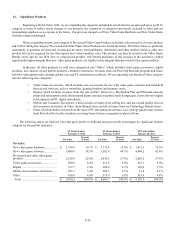

9. Goodwill and Intangible Assets

Goodwill

The changes in the carrying amount of goodwill, by reportable segment, for the 53 weeks ended February 2, 2013 and the

52 weeks ended February 1, 2014 were as follows: