GameStop 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

allowances as a part of deferred rent. We do not have leases with capital improvement funding. Percentage rentals are based on

sales performance in excess of specified minimums at various stores and are accounted for in the period in which the amount of

percentage rentals can be accurately estimated.

Income Taxes. We account for income taxes utilizing an asset and liability approach, and deferred taxes are determined

based on the estimated future tax effect of differences between the financial reporting and tax bases of assets and liabilities using

enacted tax rates. As a result of our operations in many foreign countries, our global tax rate is derived from a combination of

applicable tax rates in the various jurisdictions in which we operate. We base our estimate of an annual effective tax rate at any

given point in time on a calculated mix of the tax rates applicable to our operations and to estimates of the amount of income to

be derived in any given jurisdiction.

We file our tax returns based on our understanding of the appropriate tax rules and regulations. However, complexities

in the tax rules and our operations, as well as positions taken publicly by the taxing authorities, may lead us to conclude that

accruals for uncertain tax positions are required. In accordance with GAAP, we maintain accruals for uncertain tax positions until

examination of the tax year is completed by the taxing authority, available review periods expire or additional facts and

circumstances cause us to change our assessment of the appropriate accrual amount. Our liability for uncertain tax positions was

$20.6 million as of February 1, 2014.

Additionally, a valuation allowance is recorded against a deferred tax asset if it is not more likely than not that the

asset will be realized. Several factors are considered in evaluating the realizability of our deferred tax assets, including the remaining

years available for carry forward, the tax laws for the applicable jurisdictions, the future profitability of the specific business units,

and tax planning strategies. Our valuation allowance was $13.3 million as of February 1, 2014. See Note 13 to our consolidated

financial statements for further information regarding income taxes.

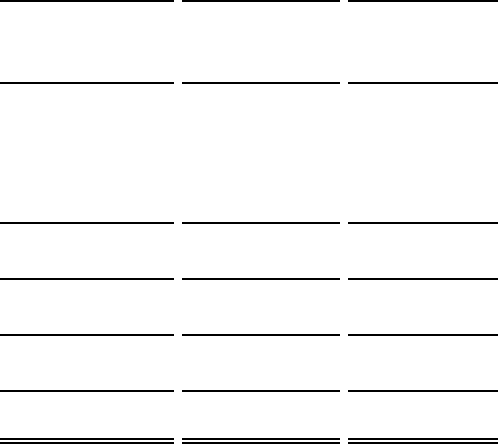

Consolidated Results of Operations

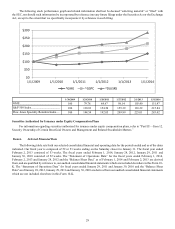

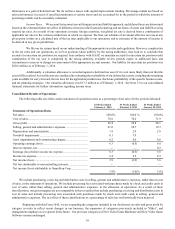

The following table sets forth certain statement of operations items as a percentage of net sales for the periods indicated:

52 Weeks Ended

February 1, 2014

53 Weeks Ended

February 2, 2013

52 Weeks Ended

January 28, 2012

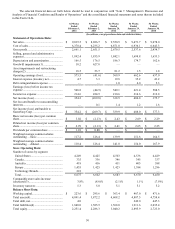

Statement of Operations Data:

Net sales....................................................................................... 100.0% 100.0 % 100.0%

Cost of sales................................................................................. 70.6 70.2 71.9

Gross profit.................................................................................. 29.4 29.8 28.1

Selling, general and administrative expenses.............................. 21.0 20.7 19.3

Depreciation and amortization .................................................... 1.8 2.0 2.0

Goodwill impairments ................................................................. 0.1 7.0 —

Asset impairments and restructuring charges.............................. 0.2 0.6 0.8

Operating earnings (loss)............................................................. 6.3 (0.5) 6.0

Interest expense, net .................................................................... — — 0.2

Earnings (loss) before income tax expense ................................. 6.3 (0.5) 5.8

Income tax expense ..................................................................... 2.4 2.5 2.2

Net income (loss)......................................................................... 3.9 (3.0) 3.6

Net loss attributable to noncontrolling interests.......................... — — —

Net income (loss) attributable to GameStop Corp. .....................

3.9% (3.0)% 3.6%

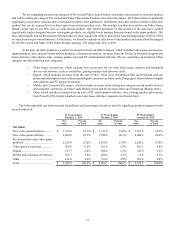

We include purchasing, receiving and distribution costs in selling, general and administrative expenses, rather than in cost

of sales, in the statement of operations. We include processing fees associated with purchases made by check and credit cards in

cost of sales, rather than selling, general and administrative expenses, in the statement of operations. As a result of these

classifications, our gross margins are not comparable to those retailers that include purchasing, receiving and distribution costs in

cost of sales and include processing fees associated with purchases made by check and credit cards in selling, general and

administrative expenses. The net effect of these classifications as a percentage of sales has not historically been material.

Beginning with this Form 10-K, we are expanding the categories included in our disclosures on sales and gross profit by

category in order to reflect recent changes in our business, the expansion of categories previously included in "Other", and

management emphasis as we operate in the future. Our previous categories of New Video Game Hardware and New Video Game

Software remain unchanged.