GameStop 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

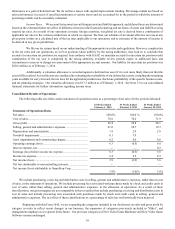

sales was due primarily to a decrease in store traffic related to lower sales of new release video game titles and the late stages of

the current console cycle. The increase in digital, mobile and consumer electronics and other product sales was primarily due to

an increase in digital products and PC entertainment software sales and sales of mobile devices.

The segment operating loss for fiscal 2012 was $74.4 million compared to operating earnings of $12.4 million for fiscal

2011. The decrease in operating earnings was primarily due to the goodwill and asset impairment charges of $100.7 million

recognized during fiscal 2012 compared to $1.3 million in fiscal 2011. Excluding the impact of the goodwill and asset impairment

charges, adjusted segment operating earnings were $26.3 million in fiscal 2012, compared to $13.7 million in fiscal 2011. The

increase in adjusted segment operating earnings was due to an increase in gross profit dollars as a result of the shift in sales mix

from hardware to higher margin categories and an increase in gross profit percent in pre-owned and value video games products.

The increase in adjusted segment operating earnings was also due to a decrease in selling, general and administrative expenses as

a result of lower sales and lower store count when compared to fiscal 2011.

Australia

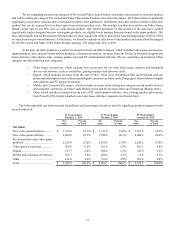

Segment results for Australia include retail operations and e-commerce sites in Australia and New Zealand. As of February

2, 2013, the Australian segment included 416 stores, compared to 411 stores as of January 28, 2012. Net sales for the 53 weeks

ended February 2, 2013 increased 0.4% compared to the 52 weeks ended January 28, 2012. The increase in net sales was primarily

due to the additional sales in the 53rd week of fiscal 2012 and the impact of five new stores opened after January 28, 2012, offset

by a decrease in sales at existing stores of 2.4%. The decrease in sales at existing stores was due to a decrease in new video game

hardware sales, new video game software sales and pre-owned and value video game product sales, offset by an increase in digital,

mobile and consumer electronics and other product sales. The decrease in new video game hardware sales is primarily due to a

decrease in hardware unit sell-through related to being in the late stages of the current console cycle. The decrease in new video

game software sales is primarily due to lower sales of new release video game titles and the late stages of the current console

cycle. The decrease in pre-owned and value video game product sales is due primarily to a decrease in store traffic related to lower

sales of new release video game titles and the late stages of the current console cycle. The increase in digital, mobile and consumer

electronics and other product sales was primarily due to an increase in digital products and PC entertainment software sales and

sales of mobile devices.

The segment operating loss for fiscal 2012 was $71.6 million compared to operating earnings of $35.4 million for fiscal

2011. The decrease in operating earnings was primarily due to the goodwill and asset impairment charges of $107.3 million

recognized during fiscal 2012 compared to $0.6 million in fiscal 2011. Excluding the impact of the goodwill and asset impairment

charges, adjusted segment operating earnings remained relatively flat at $35.7 million in fiscal 2012, when compared to $36.0

million in fiscal 2011.

Europe

Segment results for Europe include retail operations in 11 European countries and e-commerce operations in six countries.

As of February 2, 2013, the European segment operated 1,425 stores, compared to 1,423 stores as of January 28, 2012. For the

53 weeks ended February 2, 2013, European net sales decreased 11.1% compared to the 52 weeks ended January 28, 2012. This

decrease in net sales was partially due to the unfavorable impact of changes in exchange rates in fiscal 2012, which had the effect

of decreasing sales by $95.7 million when compared to fiscal 2011. Excluding the impact of changes in exchange rates, sales in

the European segment decreased 5.9%. The decrease in sales was primarily due to a decrease in sales at existing stores of 8.3%,

offset by additional sales in the 53rd week of fiscal 2012 when compared to fiscal 2011. The decrease in net sales at existing stores

was primarily due to decreases in new video game hardware sales, new video game software sales and pre-owned and value video

game product sales, offset partially by an increase in digital, mobile and consumer electronics and other product sales. The decrease

in new video game hardware sales is primarily due to a decrease in hardware unit sell-through related to being in the late stages

of the console cycle. The decrease in new video game software sales is primarily due to lower sales of new release video game

titles and the late stages of the console cycle. The decrease in pre-owned and value video game product sales is due primarily to

a decrease in store traffic related to lower sales of new release video game titles and the late stages of the console cycle. The

increase in digital, mobile and consumer electronics and other product sales is due to an increase in sales of digital products, PC

entertainment software and sales of mobile devices.

The segment operating loss was $397.5 million for fiscal 2012 compared to operating earnings of $20.2 million for fiscal

2011. The decrease in operating earnings was primarily due to the goodwill and asset impairments and restructuring charges of

$467.0 million recognized during fiscal 2012 compared to $50.4 million during fiscal 2011. Excluding the impact of the goodwill

and asset impairment charges, adjusted segment operating earnings remained relatively flat at $69.5 million in fiscal 2012 compared

to $70.6 million in fiscal 2011.