Comcast 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

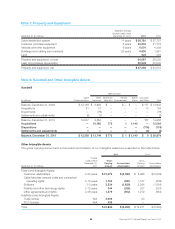

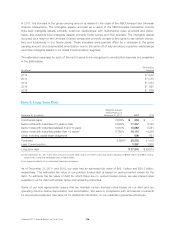

Note 6: Investments

December 31 (in millions) 2011 2010

Fair Value Method $ 3,028 $ 2,815

Equity Method:

A&E Television Networks 2,021 —

SpectrumCo 1,417 1,413

The Weather Channel 463 —

MSNBC.com 174 —

Clearwire LLC 69 357

Other 736 423

4,880 2,193

Cost Method:

AirTouch 1,523 1,508

Other 477 235

2,000 1,743

Total investments 9,908 6,751

Less: Current investments(a) 54 81

Noncurrent investments $ 9,854 $ 6,670

(a) Current investments are included in other current assets in our consolidated balance sheet.

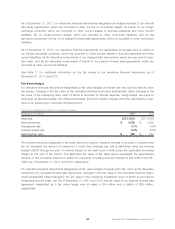

Fair Value Method

As of December 31, 2011, we held as collateral $3.0 billion of fair value method equity securities related to

our obligations under prepaid forward sale agreements, which represents 98.5% of the total fair value method

debt and equity securities held as of the balance sheet date. These investments were primarily in Liberty

Media-related and Cablevision-related investments. The obligations related to these investments are recorded

to other noncurrent liabilities and terminate between 2013 and 2015. At termination, the counterparties are

entitled to receive some or all of the equity securities, or an equivalent amount of cash at our option, based

on the market value of the equity securities at that time. As of December 31, 2011 and 2010, our prepaid

forward sale obligations had an estimated fair value of $2.5 billion and $2.4 billion, respectively.

Equity Method

Equity method investments held as of December 31, 2011 consist primarily of our investments in A&E Tele-

vision Networks LLC (“A&E Television Networks”) (16%), SpectrumCo, LLC (“SpectrumCo”) (64%), The

Weather Channel Holding Corp. (“The Weather Channel”) (25%), MSNBC Interactive News, LLC

(“MSNBC.com”) (50%) and Clearwire Communications LLC (“Clearwire LLC”) (6%). NBCUniversal’s recorded

investments as of December 31, 2011, exceeded their proportionate interests in book value of the investees’

net assets by $1.9 billion. The difference in values is primarily related to our investments in A&E Television

Networks and MSNBC.com. This difference is amortized in equity in net income (losses) of investees, net

over a period of less than 20 years. See below for additional information on certain of our larger equity

method investments.

97 Comcast 2011 Annual Report on Form 10-K