Comcast 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

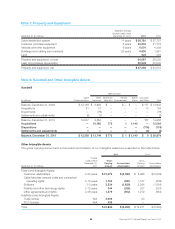

Preliminary Allocation of Purchase Price

Because we now control Universal Orlando, we have applied acquisition accounting and its results of oper-

ations are included in our consolidated results of operations following the acquisition date.

The carrying value of our investment in Universal Orlando on July 1, 2011 was $1 billion, which approximated

its fair value and, therefore, no gain or loss was recognized as a result of the acquisition. The estimated fair

values of the assets and liabilities acquired are not yet final and are subject to change. We will finalize the

amounts recognized as we obtain the information necessary to complete the analysis, but no later than 1 year

from the acquisition date.

The table below presents the fair value of the consideration transferred and the preliminary allocation of pur-

chase price to the assets and liabilities of Universal Orlando.

Consideration Transferred

(in millions)

Cash $ 1,019

Fair value of 50% equity method investment in Universal Orlando 1,039

$ 2,058

Preliminary Allocation of Purchase Price

(in millions)

Property and equipment (see Note 7) $ 2,409

Intangible assets (see Note 8) 492

Working capital 242

Long-term debt (see Note 9) (1,505)

Deferred revenue (89)

Other noncurrent assets and liabilities (626)

Noncontrolling interests acquired (5)

Fair value of identifiable net assets acquired 918

Goodwill (see Note 8) 1,140

$ 2,058

Due to the partnership structure of NBCUniversal Holdings, goodwill is not deductible for tax purposes.

Unaudited Actual and Pro Forma Information

Our consolidated revenue and net income (loss) attributable to Comcast Corporation for the year ended

December 31, 2011 included $14.5 billion and $493 million, respectively, from the NBCUniversal contributed

businesses.

Our consolidated revenue and net income (loss) attributable to Comcast Corporation for the year ended

December 31, 2011 included $712 million and $42 million, respectively, from the acquisition of the remaining

50% equity interest in Universal Orlando.

The following unaudited pro forma information has been presented as if both the NBCUniversal transaction

and the Universal Orlando transaction occurred on January 1, 2010. This information is based on historical

results of operations, adjusted for the allocation of purchase price and other acquisition accounting adjust-

95 Comcast 2011 Annual Report on Form 10-K