Comcast 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

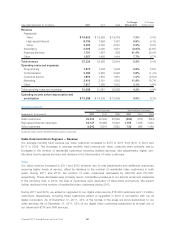

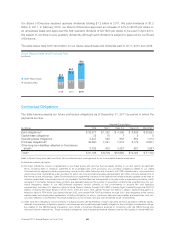

Filmed Entertainment Segment — Actual and Pro Forma Results of Operations

2011 2010

Actual(a) Pro Forma(b)

Pro Forma

Combined(c) Pro Forma(b)

(in millions)

For the period

January 29

through

December 31

For the period

January 1

through

January 28

Year ended

December 31

Year ended

December 31

% Change

2010 to 2011

Revenue

Theatrical $ 983 $ 58 $ 1,041 $ 900 15.6%

Content licensing 1,234 171 1,405 1,336 5.2%

Home entertainment 1,559 96 1,655 1,732 (4.4)%

Other 463 28 491 608 (19.3)%

Total revenue 4,239 353 4,592 4,576 0.3%

Operating costs and expenses 4,212 356 4,568 4,346 5.1%

Operating income (loss) before

depreciation and amortization $ 27 $ (3) $24 $ 230 (89.7)%

(a) Actual amounts include the results of operations for the NBCUniversal acquired businesses for the period January 29, 2011 through

December 31, 2011.

(b) Pro forma amounts include the results of operations for the NBCUniversal acquired businesses for the period January 1, 2011 through

January 28, 2011 and for the year ended December 31, 2010. These amounts also include pro forma adjustments as if the NBCUniversal

transaction had occurred on January 1, 2010, including the effects of acquisition accounting and the elimination of operating costs and

expenses directly related to the transaction, but do not include adjustments for costs related to integration activities, cost savings or

synergies that have been or may be achieved by the combined businesses. Pro forma amounts are not necessarily indicative of what the

results would have been had we operated the businesses since January 1, 2010.

(c) Pro forma combined amounts represent our pro forma results of operations as if the NBCUniversal transaction had occurred on Jan-

uary 1, 2010 but are not necessarily indicative of what the results would have been had we operated the businesses since January 1,

2010.

Filmed Entertainment Segment — Revenue

Theatrical

Theatrical revenue is generated from the worldwide theatrical release of our owned and acquired films and is

significantly affected by the timing and number of our theatrical releases, as well as their acceptance by

consumers. Theatrical release dates are determined by several factors, including production schedules, vaca-

tion and holiday periods, and the timing of competitive releases. Theatrical revenue is also affected by the

number of exhibition screens, ticket prices, the percentage of ticket sale retention by theatrical exhibitors and

the popularity of competing films at the time our films are released. The theatrical success of a film is a sig-

nificant factor in determining the revenue a film is likely to generate in succeeding distribution platforms.

Our pro forma combined theatrical revenue increased in 2011 primarily due to an increase in the number of

theatrical releases in our 2011 slate and the strong performance of the second quarter 2011 releases of Fast

Five and Bridesmaids.

Content Licensing

Content licensing revenue is generated primarily from the licensing of our owned and acquired films to broad-

cast, cable and premium networks, as well as other distribution platforms.

Our pro forma combined content licensing revenue increased in 2011 primarily due to the timing of when our

owned and acquired films were made available to licensees.

Comcast 2011 Annual Report on Form 10-K 58