Comcast 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

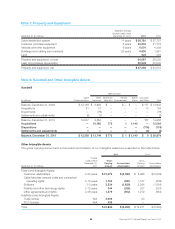

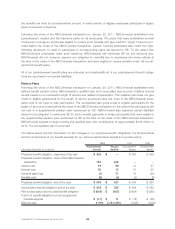

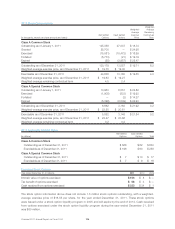

Amount of Gain (Loss) Recognized in Income

Year ended December 31 (in millions) 2011 2010

Interest Income (Expense):

Interest rate swap agreements (fixed to variable) $15 $90

Long-term debt — interest rate swap agreements (fixed to variable) (15) (90)

Investment Income (Loss), Net:

Mark to market adjustments on derivative component of prepaid forward sale agreements 32 (49)

Unrealized gains (losses) on securities underlying prepaid forward sale agreements (48) 74

Gain (loss) on fair value hedging relationships $ (16) $25

Cash Flow Hedges

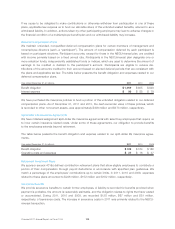

For derivative financial instruments designated as cash flow hedges of interest rate risk, such as variable to

fixed swaps, rate locks and collars, the effective portion of the hedge is reported in accumulated other com-

prehensive income (loss) and recognized as an adjustment to interest expense over the period in which the

related interest cost is recognized in earnings. When hedged variable-rate debt is settled prior to maturity,

any remaining unrealized gain or loss from the hedge is recognized in interest expense in a manner similar to

debt extinguishment costs. When hedged forecasted debt issuances become probable of not occurring, any

unrealized gain or loss is recognized in other income (expense).

For derivative financial instruments designated as cash flow hedges of foreign exchange risk, such as forward

contracts, currency options and cross-currency swaps, the effective portion of the hedge is reported in

accumulated other comprehensive income (loss). These amounts are recognized as an adjustment to earn-

ings in the period in which the effects of the remeasurement of changes in exchange rates on the foreign

currency denominated hedged items are recognized in earnings. When foreign currency denominated hedged

items are settled, any remaining unrealized gain or loss from the hedge is recognized in earnings.

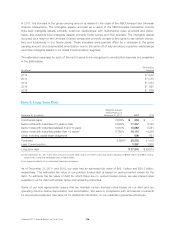

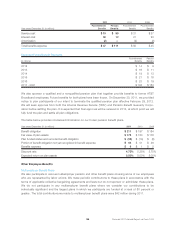

Pretax Amount of Gain (Loss) Recognized in Accumulated Other Comprehensive Income

2011 2010

Year ended December 31 (in millions)

Interest

Rate Risk

Foreign

Exchange

Risk Total

Interest

Rate Risk

Foreign

Exchange

Risk Total

Deferred gain (loss) recognized $ — $ (40) $ (40) $ (98) $ (29) $ (127)

Deferred (gain) loss reclassified to income(a) 23 8 31 34 21 55

Total change in accumulated other comprehensive

income $ 23 $ (32) $ (9) $ (64) $ (8) $ (72)

(a) The interest rate risk amount in 2010 includes an $18 million loss related to a forecasted debt issuance that did not occur.

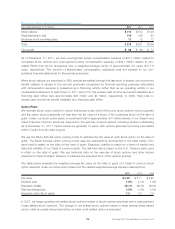

Interest rate risk deferred losses relate to interest rate lock and collar agreements entered into to fix the inter-

est rates of certain of our debt obligations in advance of their issuance. Unless we retire this debt early, these

unrealized losses will be reclassified as an adjustment to interest expense, primarily through 2022, in the

period in which the related interest expense is recognized in earnings. The foreign exchange risk deferred

losses for 2011 relate to cross-currency swap agreements on foreign currency denominated debt due 2029

and foreign exchange contracts with initial maturities generally not exceeding 1 year and up to 18 months in

certain circumstances. The amount of unrealized gains and losses expected to be reclassified to earnings

over the next 12 months was not material as of December 31, 2011. See Note 14 for the components of

accumulated other comprehensive income (loss).

Ineffectiveness related to our cash flow hedges was not material for 2011 or 2010.

Comcast 2011 Annual Report on Form 10-K 104