Comcast 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A&E Television Networks

A&E Television Networks consists of, among other channels, A&E, The History Channel, The Biography

Channel and Lifetime. The dividends received from A&E Television Networks were approximately 57% of the

total cash received from investees during 2011. In the first quarter of 2012 and in other specified future peri-

ods, we have the right to require A&E Television Networks to redeem a portion of our equity interest. A&E

Television Networks has certain rights to purchase all or a portion of our interest beginning in the third quarter

of 2017.

SpectrumCo

SpectrumCo is a joint venture in which we, along with Time Warner Cable and Bright House Networks, are

partners. SpectrumCo was the successful bidder for 137 wireless services spectrum licenses for $2.4 billion

in the FCC’s advanced wireless services spectrum auction that concluded in September 2006. Our portion of

the total cost to purchase the licenses was $1.3 billion. We account for this joint venture as an equity method

investment based on its governance structure, notwithstanding our majority interest. In December 2011,

SpectrumCo entered into an agreement to sell its advanced wireless services spectrum licenses for $3.6 bil-

lion, subject to regulatory approval. Our portion of the proceeds is expected to be $2.3 billion and we expect

this transaction to close during 2012.

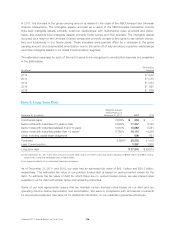

Cost Method

AirTouch Communications, Inc.

We hold two series of preferred stock of AirTouch Communications, Inc. (“AirTouch”), a subsidiary of Voda-

fone, which are redeemable in April 2020. The estimated fair value of the AirTouch preferred stock was $1.8

billion and $1.7 billion as of December 31, 2011 and 2010, respectively.

The dividend and redemption activity of the AirTouch preferred stock determines the dividend and redemption

payments associated with substantially all of the preferred shares issued by one of our consolidated sub-

sidiaries, which is a VIE. The subsidiary has three series of preferred stock outstanding with an aggregate

redemption value of $1.75 billion. Substantially all of the preferred shares are redeemable in April 2020 at a

redemption value of $1.65 billion. As of both December 31, 2011 and 2010, the two redeemable series of

subsidiary preferred shares were recorded at $1.5 billion, and those amounts are included in other non-

current liabilities. As of December 31, 2011 and 2010, these redeemable subsidiary preferred shares had an

estimated fair value of $1.8 billion and $1.7 billion, respectively. The one nonredeemable series of subsidiary

preferred shares was recorded at $100 million as of both December 31, 2011 and 2010 and those amounts

are included in noncontrolling interests in our consolidated balance sheet. The carrying amounts of the non-

redeemable subsidiary preferred shares approximate their fair value.

Investment Income (Loss), Net

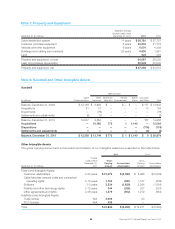

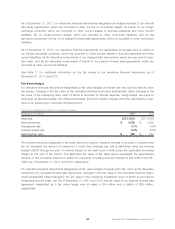

Year ended December 31 (in millions) 2011 2010 2009

Gains on sales and exchanges of investments, net $41 $13 $28

Investment impairment losses (5) (24) (44)

Unrealized gains (losses) on securities underlying prepaid forward sale agreements 192 874 997

Mark to market adjustments on derivative component of prepaid forward sale

agreements and indexed debt instruments (119) (665) (807)

Interest and dividend income 110 94 102

Other, net (60) (4) 6

Investment income (loss), net $ 159 $ 288 $ 282

Comcast 2011 Annual Report on Form 10-K 98