Comcast 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

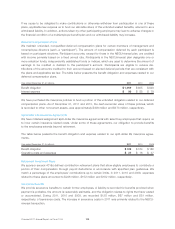

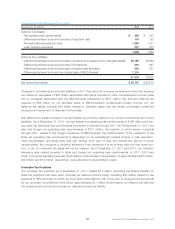

Effect on Income from Receivables Monetization and Cash Flows on Transfers

Year ended December 31 (in millions) 2011

Net (loss) gain on sale(a) $ (36)

Net cash proceeds (payments) on transfers(b) $ (237)

(a) Net (loss) gain on sale is included in other income (expense), net in our consolidated statement of income.

(b) Net cash proceeds (payments) on transfers are included within net cash provided by operating activities in our consolidated statement of

cash flows.

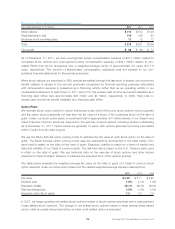

Receivables Monetized and Deferred Consideration

December 31 (in millions) 2011

Monetized receivables sold $ 961

Deferred consideration $ 268

In addition to the amounts presented above, we had $781 million payable to our securitization programs as of

December 31, 2011. This amount represents cash receipts that are not yet remitted to the securitization

program as of the balance sheet date and is recorded to accounts payable and accrued expenses related to

trade creditors.

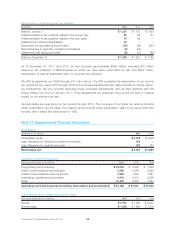

Note 19: Commitments and Contingencies

Commitments

NBCUniversal enters into long-term commitments with third parties in the ordinary course of its business,

including commitments to acquire film and television programming, take or pay creative talent and employ-

ment agreements, and various other television commitments. Many of NBCUniversal’s employees, including

writers, directors, actors, technical and production personnel, and others, as well as some of its on-air and

creative talent, are covered by collective bargaining agreements or works councils. As of December 31, 2011,

the total number of NBCUniversal employees on its payroll covered by collective bargaining agreements was

approximately 4,000 full-time equivalent employees. Of this total, approximately 46% of these full-time equiv-

alent employees were covered by collective bargaining agreements that have expired or are scheduled to

expire during 2012.

We, through Comcast Spectacor, have employment agreements with both players and coaches of the Phila-

delphia Flyers. Certain of these employment agreements, which provide for payments that are guaranteed

regardless of employee injury or termination, are covered by disability insurance if certain conditions are met.

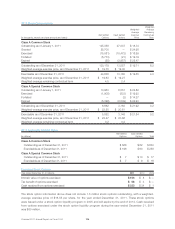

The table below summarizes our minimum annual programming and talent commitments and our minimum

annual rental commitments for office space, equipment and transponder service agreements under operating

leases. Programming and talent commitments include acquired film and television programming, including

U.S. television rights to the future Olympic Games through 2020, NBC’s Sunday Night Football through the

2022-23 season, and other programming commitments, as well as our various contracts with creative talent

and employment agreements under take-or-pay contracts.

As of December 31, 2011 (in millions)

Programming and

Talent Commitments Operating Leases

2012 $ 4,793 $ 548

2013 $ 2,388 $ 448

2014 $ 2,887 $ 388

2015 $ 1,976 $ 333

2016 $ 3,104 $ 320

Thereafter $ 17,301 $ 1,410

Comcast 2011 Annual Report on Form 10-K 120