Comcast 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

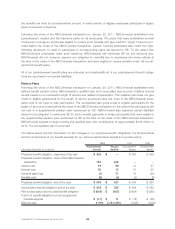

Revolving Credit Facilities

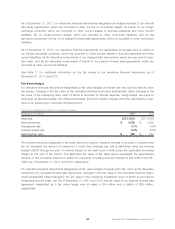

As of December 31, 2011, Comcast and Comcast Cable Communications, LLC had a $6.8 billion revolving

credit facility due January 2013 with a syndicate of banks. The interest rate on this facility consists of a base

rate plus a borrowing margin that is determined based on Comcast’s credit rating. As of December 31, 2011,

the borrowing margin for LIBOR-based borrowings was 0.35%. As of December 31, 2011, amounts available

under this facility totaled approximately $6.5 billion.

As of December 31, 2011, NBCUniversal had a $1.5 billion revolving credit facility due June 2016 with a syndi-

cate of banks. The interest rate on this facility consists of a base rate plus a borrowing margin that is

determined based on NBCUniversal’s credit rating. As of December 31, 2011, the borrowing margin for

LIBOR-based borrowings was 1.125%. As of December 31, 2011, amounts available under this facility

totaled $934 million.

Letters of Credit

As of December 31, 2011, we and certain of our subsidiaries had unused irrevocable standby letters of credit

totaling $552 million to cover potential fundings under various agreements.

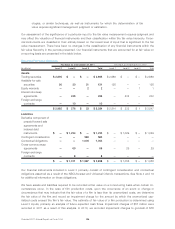

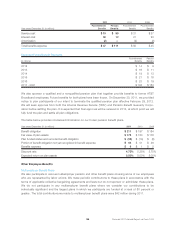

Note 10: Derivative Financial Instruments

We use derivative financial instruments to manage our exposure to the risks associated with fluctuations in

interest rates, foreign exchange rates and equity prices.

We manage our exposure to fluctuations in interest rates by using derivative financial instruments such as

interest rate exchange agreements (“swaps”), interest rate lock agreements (“rate locks”) and interest rate

collars (“collars”). We sometimes enter into rate locks or collars to hedge the risk that the cash flows related

to the interest payments on an anticipated issuance or assumption of fixed-rate debt may be adversely

affected by interest rate fluctuations.

For NBCUniversal’s recognized balance sheet amounts denominated in foreign currency, anticipated foreign

currency denominated production costs and rights, and anticipated international content-related revenue and

royalties, we manage our exposure to fluctuations in foreign exchange rates by using foreign exchange con-

tracts such as forward contracts and currency options. For our foreign currency denominated borrowings, we

manage our exposure to fluctuations in foreign exchange rates by using cross-currency swaps, effectively

converting these borrowings to U.S. dollar denominated borrowings.

We manage our exposure to and benefits from price fluctuations in the common stock of some of our invest-

ments by using equity derivative financial instruments embedded in other contracts, such as prepaid forward

sale agreements, whose values, in part, are derived from the market value of certain publicly traded common

stock.

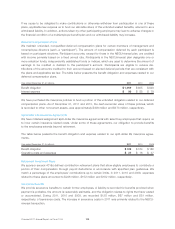

We manage the credit risks associated with our derivative financial instruments through diversification and the

evaluation and monitoring of the creditworthiness of the counterparties. Although we may be exposed to

losses in the event of nonperformance by the counterparties, we do not expect such losses, if any, to be sig-

nificant. We have agreements with certain counterparties that include collateral provisions. These provisions

require a party with an aggregate unrealized loss position in excess of certain thresholds to post cash

collateral for the amount in excess of the threshold. The threshold levels in our collateral agreements are

based on our and the counterparties’ credit ratings. As of December 31, 2011 and 2010, neither we nor any

of the counterparties were required to post collateral under the terms of the agreements.

Comcast 2011 Annual Report on Form 10-K 102