Comcast 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

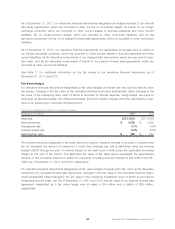

As of December 31, 2011 and 2010, accrued interest on our debt was $612 million and $524 million,

respectively, which is included in accrued expenses and other current liabilities.

As of the close of the NBCUniversal transaction on January 28, 2011, we consolidated $9.1 billion of NBCUni-

versal senior debt securities with maturities ranging from 2014 to 2041. We do not guarantee NBCUniversal’s

debt obligations. On July 1, 2011, we consolidated $1.5 billion of long-term debt obligations as a result of the

Universal Orlando transaction. In accordance with acquisition accounting, these debt securities were

recorded at fair value as of the respective acquisition dates. Borrowings under the NBCUniversal revolving

credit facility, along with cash on hand at Universal Orlando, were used to terminate Universal Orlando’s exist-

ing $801 million term loan immediately following the acquisition. In addition, on August 1, 2011, Universal

Orlando redeemed $140 million aggregate principal amount of its 8.875% senior notes due 2015 and $79

million aggregate principal amount of its 10.875% senior subordinated notes due 2016. As of December 31,

2011, the carrying value on our consolidated balance sheet of Universal Orlando’s senior notes and senior

subordinated notes was $418 million.

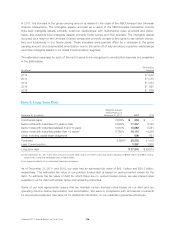

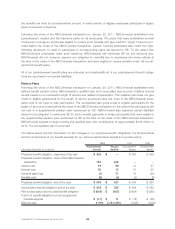

Debt Maturities

December 31, 2011 (in millions)

2012 $ 1,367

2013 $ 2,411

2014 $ 1,992

2015 $ 3,660

2016 $ 2,951

Thereafter $ 26,928

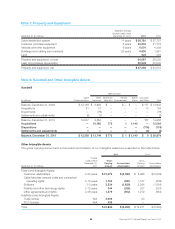

Debt Repayments and Repurchases

Year ended December 31, 2011 (in millions)

Comcast 6.75% notes due 2011 $ 1,000

Comcast 5.5% notes due 2011 750

Universal Orlando term loan 801

Comcast 7% notes due 2055 345

Universal Orlando 8.875% notes due 2015 140

Universal Orlando 10.875% notes due 2016 79

Other 101

Total $ 3,216

During the first quarter of 2012, we plan to redeem $563 million principal amount of our $1.1 billion aggregate

principal amount of 7% senior notes due 2055.

Debt Instruments

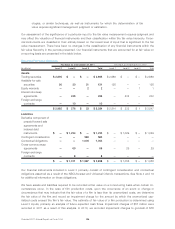

Commercial Paper Programs

Our commercial paper programs provide a lower cost source of borrowing to fund our short-term working

capital requirements and are supported by our revolving credit facilities. Comcast has a maximum borrowing

capacity of $2.25 billion and NBCUniversal has a maximum borrowing capacity of $1.5 billion. As of

December 31, 2011, NBCUniversal had $550 million face amount of commercial paper outstanding. The

proceeds from NBCUniversal’s issuances of commercial paper, along with cash from operations, were used

to repay the borrowings under the NBCUniversal revolving credit facility and fund NBCUniversal’s short-term

working capital requirements.

101 Comcast 2011 Annual Report on Form 10-K