Comcast 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

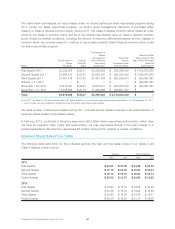

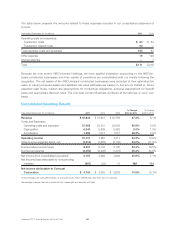

Segment Operating Results

Beginning in the first quarter of 2011, we changed our reporting segments as a result of the close of the

NBCUniversal transaction. We have recast our segment presentation for 2010 and 2009 to reflect our current

operating segments.

Our segment operating results are presented based on how we assess operating performance and internally

report financial information. We use operating income (loss) before depreciation and amortization, excluding

impairments related to fixed and intangible assets and gains or losses from the sale of assets, if any, as the

measure of profit or loss for our operating segments. This measure eliminates the significant level of noncash

depreciation and amortization expense that results from the capital-intensive nature of certain of our busi-

nesses and from intangible assets recognized in business combinations. Additionally, it is unaffected by our

capital structure or investment activities. We use this measure to evaluate our consolidated operating

performance and the operating performance of our operating segments and to allocate resources and capital

to our operating segments. It is also a significant performance measure in our annual incentive compensation

programs. We believe that this measure is useful to investors because it is one of the bases for comparing

our operating performance with that of other companies in our industries, although our measure may not be

directly comparable to similar measures used by other companies. Because we use operating income (loss)

before depreciation and amortization to measure our segment profit or loss, we reconcile it to operating

income, the most directly comparable financial measure calculated and presented in accordance with gen-

erally accepted accounting principles in the United States (“GAAP”) in the business segment footnote to our

consolidated financial statements (see Note 20 to our consolidated financial statements). This measure

should not be considered a substitute for operating income (loss), net income (loss) attributable to Comcast

Corporation, net cash provided by operating activities, or other measures of performance or liquidity we have

reported in accordance with GAAP.

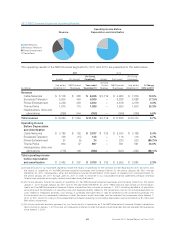

Competition

The results of operations of our reporting segments may be affected by competition, as all of our businesses

operate in intensely competitive industries and compete with a growing number of companies that provide a

broad range of communications products and services and entertainment, news and information content to

consumers. Technological changes are further intensifying and complicating the competitive landscape, as

companies continue to emerge that offer services or devices that enable Internet video streaming and down-

loading of movies, television shows and other video programming and as wireless services and devices

continue to evolve. Moreover, newer services that distribute video programming are also beginning to pro-

duce or acquire their own original content. This competition is further complicated by federal and state

legislative bodies and various regulatory agencies, such as the FCC, which can adopt laws and policies that

provide a favorable operating environment for some of our existing and potential new competitors. See

“Business – Competition” for additional information.

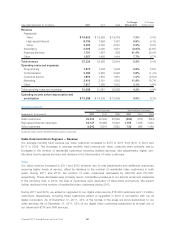

Seasonality and Cyclicality

Each of our businesses is subject to seasonal and cyclical variations. In our Cable Communications segment,

our results are impacted by the seasonal nature of customers receiving our cable services in college and

vacation markets. This generally results in weaker customer metrics in the second calendar quarter.

Revenue in our Cable Communications, Cable Networks and Broadcast Television segments are subject to

cyclical advertising patterns and changes in viewership levels. Our U.S. advertising revenue is generally higher

in the second and fourth calendar quarters of each year, due in part to increases in consumer advertising in

the spring and in the period leading up to and including the holiday season. U.S. advertising revenue is also

cyclical, benefiting in even-numbered years from advertising related to candidates running for political office

and issue-oriented advertising. Broadcast Television revenue and operating costs and expenses also are

Comcast 2011 Annual Report on Form 10-K 48