Comcast 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

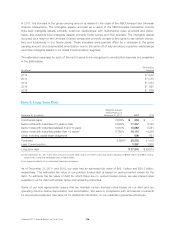

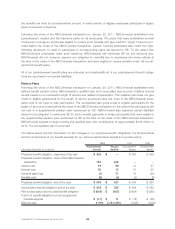

ologies, or similar techniques, as well as instruments for which the determination of fair

value requires significant management judgment or estimation.

Our assessment of the significance of a particular input to the fair value measurement requires judgment and

may affect the valuation of financial instruments and their classification within the fair value hierarchy. Finan-

cial instruments are classified in their entirety based on the lowest level of input that is significant to the fair

value measurement. There have been no changes in the classification of any financial instruments within the

fair value hierarchy in the periods presented. Our financial instruments that are accounted for at fair value on

a recurring basis are presented in the table below.

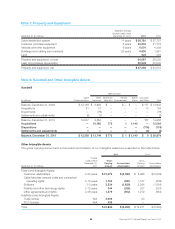

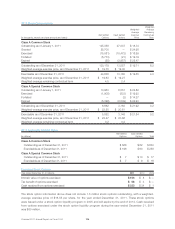

Recurring Fair Value Measures

Fair Value as of December 31, 2011 Fair Value as of December 31, 2010

(in millions) Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Assets

Trading securities $ 2,895 $ — $ — $ 2,895 $ 2,688 $ — $ — $ 2,688

Available-for-sale

securities 90 20 21 131 126 — — 126

Equity warrants —— 2 2——1 1

Interest rate swap

agreements — 246 — 246 — 232 — 232

Foreign exchange

contracts —10—10————

$ 2,985 $ 276 $ 23 $ 3,284 $ 2,814 $ 232 $ 1 $ 3,047

Liabilities

Derivative component of

prepaid forward sale

agreements and

indexed debt

instruments $ — $ 1,234 $ — $ 1,234 $ — $ 1,029 $ — $ 1,029

Contingent consideration — — 583 583 ————

Contractual obligations — — 1,004 1,004 ————

Cross-currency swap

agreements —69—69—29—29

Foreign exchange

contracts —8—8————

$ — $ 1,311 $ 1,587 $ 2,898 $ — $ 1,058 $ — $ 1,058

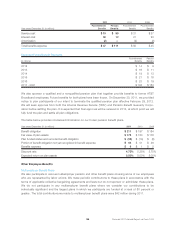

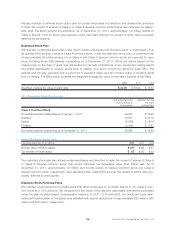

Our financial instruments included in Level 3 primarily consist of contingent consideration and contractual

obligations assumed as a result of the NBCUniversal and Universal Orlando transactions. See Note 4 and 19

for additional information on these obligations.

We have assets and liabilities required to be recorded at fair value on a nonrecurring basis when certain cir-

cumstances occur. In the case of film production costs, upon the occurrence of an event or change in

circumstance that may indicate that the fair value of a film is less than its unamortized costs, we determine

the fair value of the film and record an impairment charge for the amount by which the unamortized cap-

italized costs exceed the film’s fair value. The estimate of fair value of a film production is determined using

Level 3 inputs, primarily an analysis of future expected cash flows. Impairment charges of $57 million were

recorded in 2011 as a result of this analysis. In 2010, we recorded impairment charges to goodwill of $76

Comcast 2011 Annual Report on Form 10-K 106