Comcast 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

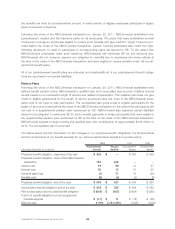

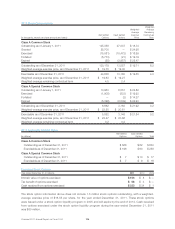

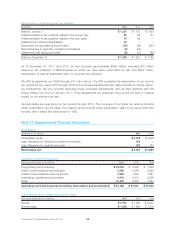

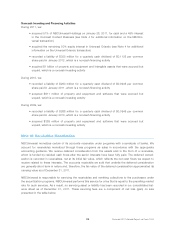

Components of Net Deferred Tax Liability

December 31 (in millions) 2011 2010

Deferred Tax Assets:

Net operating loss carryforwards $ 468 $ 343

Differences between book and tax basis of long-term debt 114 123

Nondeductible accruals and other 1,583 1,301

Less: Valuation allowance 297 207

1,868 1,560

Deferred Tax Liabilities:

Differences between book and tax basis of property and equipment and intangible assets 29,185 28,468

Differences between book and tax basis of investments 616 627

Differences between book and tax basis of indexed debt securities 560 537

Differences between book and tax outside basis of NBCUniversal 1,214 —

31,575 29,632

Net deferred tax liability $ 29,707 $ 28,072

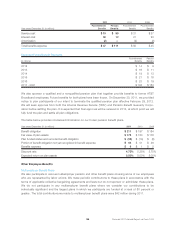

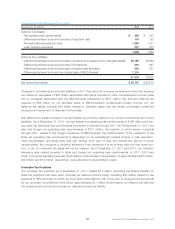

Changes in net deferred income tax liabilities in 2011 that were not recorded as deferred income tax expense

are related to decreases of $32 million associated with items included in other comprehensive income (loss)

and to increases associated with the NBCUniversal transaction of $611 million. We accrued deferred tax

expense of $85 million for our allocable share of NBCUniversal’s undistributed foreign income. Our net

deferred tax liability includes $23 billion related to franchise rights that will remain unchanged unless we

recognize an impairment or dispose of a franchise.

Net deferred tax assets included in current assets are primarily related to our current investments and current

liabilities. As of December 31, 2011, we had federal net operating loss carryforwards of $166 million and vari-

ous state net operating loss carryforwards that expire in periods through 2031. As of December 31, 2011, we

also had foreign net operating loss carryforwards of $271 million, the majority of which expire in periods

through 2021, related to the foreign operations of NBCUniversal. The determination of the realization of the

state net operating loss carryforwards is dependent on our subsidiaries’ taxable income or loss, apportion-

ment percentages, and state laws that can change from year to year and impact the amount of such

carryforwards. We recognize a valuation allowance if we determine it is more likely than not that some por-

tion, or all, of a deferred tax asset will not be realized. As of December 31, 2011 and 2010, our valuation

allowance was related primarily to state and foreign net operating loss carryforwards. In 2011, 2010 and

2009, income tax benefits (expense) attributable to share-based compensation of approximately $(38) million,

$(3) million and $14 million, respectively, were allocated to shareholders’ equity.

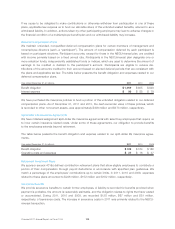

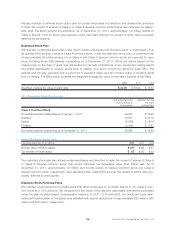

Uncertain Tax Positions

Our uncertain tax positions as of December 31, 2011 totaled $1.4 billion, excluding the federal benefits on

state tax positions that have been recorded as deferred income taxes, including $50 million related to tax

positions of NBCUniversal for which we have been indemnified by GE. If we were to recognize the tax benefit

for our uncertain tax positions in the future, approximately $1.1 billion would impact our effective tax rate and

the remaining amount would increase our deferred income tax liability.

117 Comcast 2011 Annual Report on Form 10-K