Comcast 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

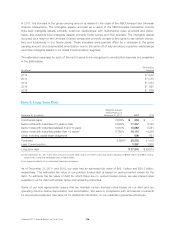

As of December 31, 2011, our derivative financial instruments designated as hedges included (i) our interest

rate swap agreements, which are recorded to other current or noncurrent assets, (ii) certain of our foreign

exchange contracts, which are recorded to other current assets or accrued expenses and other current

liabilities, (iii) our cross-currency swaps, which are recorded to other noncurrent liabilities, and (iv) the

derivative component of one of our prepaid forward sale agreements, which is recorded to other noncurrent

liabilities.

As of December 31, 2011, our derivative financial instruments not designated as hedges were (i) certain of

our foreign exchange contracts, which are recorded to other current assets or accrued expenses and other

current liabilities, (ii) the derivative components of our indexed debt instruments, which are recorded to long-

term debt, and (iii) the derivative components of certain of our prepaid forward sale agreements, which are

recorded to other noncurrent liabilities.

See Note 11 for additional information on the fair values of our derivative financial instruments as of

December 31, 2011 and 2010.

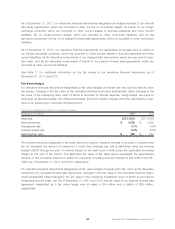

Fair Value Hedges

For derivative financial instruments designated as fair value hedges of interest rate risk, such as fixed to varia-

ble swaps, changes in the fair value of the derivative financial instrument substantially offset changes in the

fair value of the underlying debt, each of which is recorded to interest expense. Using swaps, we agree to

exchange, at specified dates, the difference between fixed and variable interest amounts calculated by refer-

ence to an agreed-upon notional principal amount.

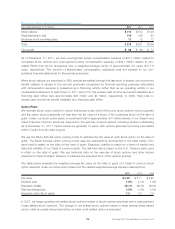

Terms of Outstanding Fixed to Variable Swaps

December 31 (in millions) 2011 2010

Maturities 2012-2018 2011-2018

Notional amount $ 4,500 $ 5,300

Average pay rate 4.1% 4.8%

Average receive rate 6.2% 6.6%

Estimated fair value $ 280 $ 273

The notional amounts presented in the table above are used to measure interest to be paid or received and

do not represent the amount of exposure to credit loss. Average pay rate is estimated using the average

implied LIBOR through the year of maturity based on the yield curve in effect plus the applicable borrowing

margin at the end of the period. The estimated fair value in the table above represents the approximate

amount of net proceeds required to settle the contracts, including accrued interest of $34 million and $41

million as of December 31, 2011 and 2010, respectively.

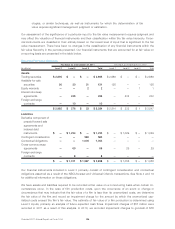

For derivative financial instruments designated as fair value hedges of equity price risk, such as the derivative

component of a prepaid forward sale agreement, changes in the fair value of the derivative financial instru-

ment substantially offset changes in the fair value of the underlying investment, each of which is recorded to

investment income (loss), net. As of December 31, 2011 and 2010, the fair value of our prepaid forward sale

agreement designated as a fair value hedge was an asset of $4 million and a liability of $29 million,

respectively.

103 Comcast 2011 Annual Report on Form 10-K