Comcast 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

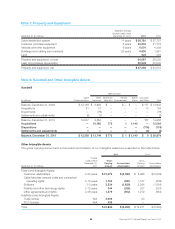

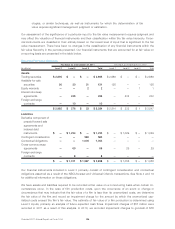

In 2011, the increase in the gross carrying amount is related to the close of the NBCUniversal and Universal

Orlando transactions. The intangible assets recorded as a result of the NBCUniversal transaction include

finite-lived intangible assets, primarily customer relationships with multichannel video providers and adver-

tisers, and indefinite-lived intangible assets, primarily trade names and FCC licenses. The intangible assets

recorded as a result of the Universal Orlando transaction primarily consist of the rights to use certain charac-

ters and trademarks in our theme parks. These increases were partially offset by a decrease in the gross

carrying amount and accumulated amortization due to the write-off of fully amortized customer relationships

and other intangible assets in our Cable Communication segment.

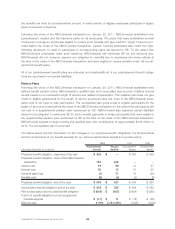

The estimated expenses for each of the next 5 years to be recognized in amortization expense are presented

in the table below.

(in millions)

Amortization

Expense

2012 $ 1,512

2013 $ 1,315

2014 $ 1,134

2015 $ 997

2016 $ 805

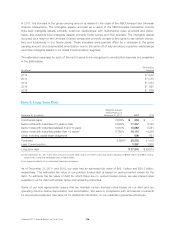

Note 9: Long-Term Debt

December 31 (in millions)

Weighted Average

Interest Rate as of

December 31, 2011 2011 2010

Commercial paper 0.508% $ 550 $—

Senior notes with maturities of 5 years or less 5.829% 11,347 8,145

Senior notes with maturities between 6 and 10 years 5.512% 10,689 8,381

Senior notes with maturities greater than 10 years(a) 6.780% 16,115 14,258

Other, including capital lease obligations — 608 631

Total debt 5.89%(b) 39,309 31,415

Less: Current portion 1,367 1,800

Long-term debt $ 37,942 $ 29,615

(a) The December 31, 2011 and 2010 amounts include £625 million of 5.50% notes due 2029 translated at $969 million and $976 million,

respectively, using the exchange rates at these dates.

(b) Includes the effects of our derivative financial instruments.

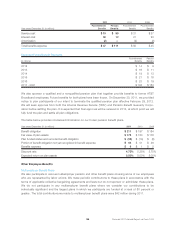

As of December 31, 2011 and 2010, our debt had an estimated fair value of $45.1 billion and $34.3 billion,

respectively. The estimated fair value of our publicly traded debt is based on quoted market values for the

debt. To estimate the fair value of debt for which there are no quoted market prices, we use interest rates

available to us for debt with similar terms and remaining maturities.

Some of our loan agreements require that we maintain certain financial ratios based on our debt and our

operating income before depreciation and amortization. We were in compliance with all financial covenants

for all periods presented. See Note 22 for additional information on our subsidiary guarantee structures.

Comcast 2011 Annual Report on Form 10-K 100