Comcast 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

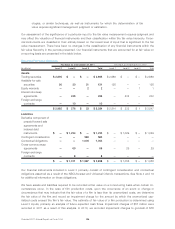

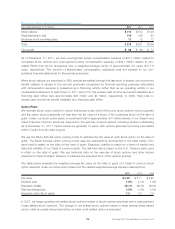

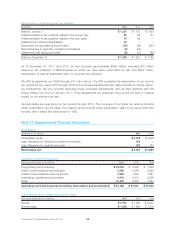

Note 16: Income Taxes

Components of Income Tax Expense

Year ended December 31 (in millions) 2011 2010 2009

Current expense (benefit):

Federal $ 1,480 $ 1,502 $ 802

State 359 385 (156)

Foreign 153 ——

1,992 1,887 646

Deferred expense (benefit):

Federal 658 463 945

State 371 86 (113)

Foreign 29 ——

1,058 549 832

Income tax expense $ 3,050 $ 2,436 $ 1,478

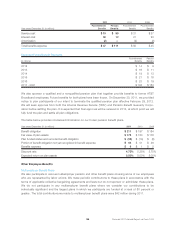

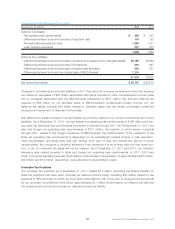

For U.S. federal income tax purposes, NBCUniversal Holdings is treated as a partnership and NBCUniversal

is disregarded as an entity separate from NBCUniversal Holdings. Accordingly, neither NBCUniversal Hold-

ings nor NBCUniversal and its subsidiaries incur any material current or deferred domestic income taxes.

Current and deferred foreign income taxes are incurred by NBCUniversal’s foreign subsidiaries.

In 2011, NBCUniversal had foreign income before taxes of $476 million, on which foreign income tax expense

has been recorded. We recorded U.S. income tax expense on our allocable share of NBCUniversal’s income

before taxes, both domestic and foreign, reduced by a U.S. tax credit equal to our allocable share of

NBCUniversal’s foreign income tax expense.

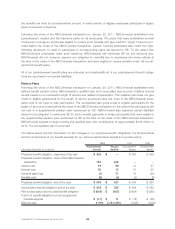

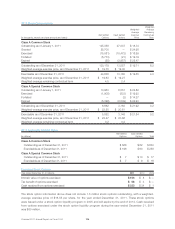

Our income tax expense differs from the federal statutory amount because of the effect of the items detailed

in the table below.

Year ended December 31 (in millions) 2011 2010 2009

Federal tax at statutory rate $ 2,872 $ 2,136 $ 1,787

State income taxes, net of federal benefit 354 204 174

Foreign income taxes, net of federal credit 89 ——

Nontaxable income attributable to noncontrolling interests (410) 2—

Benefit related to certain subsidiary reorganizations —— (151)

Adjustments to uncertain and effectively settled tax positions, net 77 37 (178)

Accrued interest on uncertain and effectively settled tax positions, net 66 60 (120)

Other 2(3) (34)

Income tax expense $ 3,050 $ 2,436 $ 1,478

Comcast 2011 Annual Report on Form 10-K 116