Comcast 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

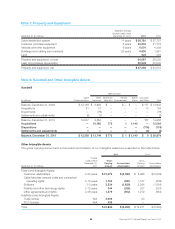

Consideration Transferred

(in millions)

Cash $ 6,120

Fair value of 49% of the Comcast Content Business 4,308

Fair value of contingent consideration 590

Fair value of redeemable noncontrolling interest associated with net assets acquired 13,071

$ 24,089

Allocation of Purchase Price

(in millions)

Film and television costs (see Note 5) $ 5,049

Investments (see Note 6) 4,339

Property and equipment (see Note 7) 2,322

Intangible assets (see Note 8) 14,585

Working capital (1,734)

Long-term debt (see Note 9) (9,115)

Deferred income tax liabilities (35)

Other noncurrent assets and liabilities (2,005)

Noncontrolling interests acquired (262)

Fair value of identifiable net assets acquired 13,144

Goodwill (see Note 8) 10,945

$ 24,089

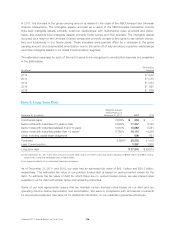

Income Taxes

We are responsible for the tax matters of both NBCUniversal Holdings and NBCUniversal, including the filing

of returns and the administering of any proceedings with taxing authorities. See Note 16 for additional

information on the partnership structure of NBCUniversal Holdings and NBCUniversal. GE has indemnified us

and NBCUniversal Holdings for any income tax liability attributable to the NBCUniversal contributed busi-

nesses for periods prior to the acquisition date. We have also indemnified GE and NBCUniversal Holdings for

any income tax liability attributable to the Comcast Content Business for periods prior to the acquisition date.

NBCUniversal recognized net deferred income tax liabilities of $35 million in the allocation of purchase price

related primarily to acquired intangible assets in state and foreign jurisdictions. In addition, Comcast recog-

nized $576 million of deferred tax liabilities in connection with the NBCUniversal transaction. Because we

maintained control of the Comcast Content Business, the excess of fair value received over historical book

value and the related tax impact were recorded to additional paid-in capital.

We agreed to share with GE certain tax benefits as they are realized that relate to the form and structure of

the transaction. These payments to GE are contingent on us realizing tax benefits in the future and are

accounted for as contingent consideration. We have recorded $590 million in other current and noncurrent

liabilities in our acquisition accounting based on the present value of the expected future payments to GE.

93 Comcast 2011 Annual Report on Form 10-K