Comcast 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

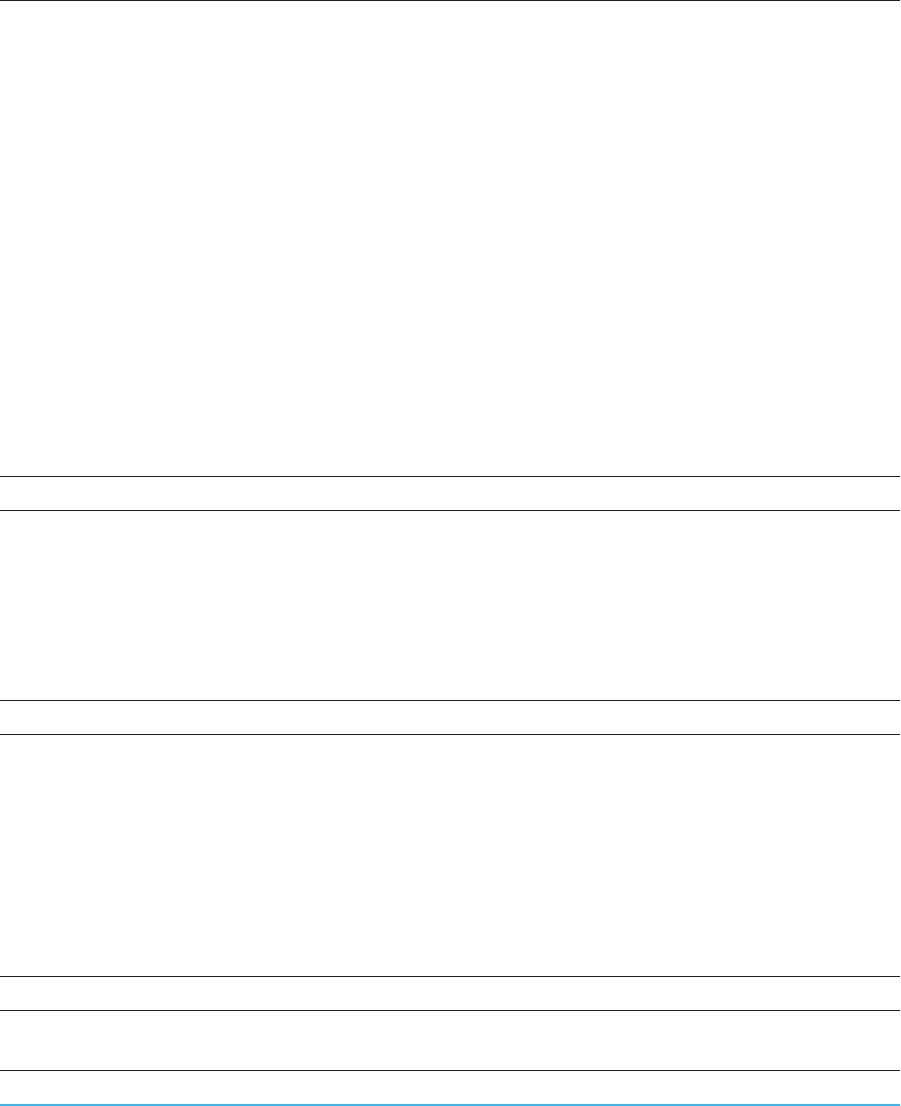

Consolidated Statement of Cash Flows

Year ended December 31 (in millions) 2011 2010 2009

Operating Activities

Net income from consolidated operations $ 5,157 $ 3,668 $ 3,628

Adjustments to reconcile net income from consolidated operations to net cash

provided by operating activities:

Depreciation and amortization 7,636 6,616 6,500

Amortization of film and television costs 6,787 187 349

Share-based compensation 344 300 257

Noncash interest expense (income), net 146 141 160

Equity in net (income) losses of investees, net 35 141 64

Cash received from investees 311 ——

Net (gain) loss on investment activity and other 23 (267) (201)

Deferred income taxes 1,058 549 832

Changes in operating assets and liabilities, net of effects of acquisitions and

divestitures:

Change in receivable, net (18) (131) (84)

Change in film and television costs (7,080) (191) (404)

Change in accounts payable and accrued expenses related to trade creditors (45) 37 (136)

Change in other operating assets and liabilities (9) 129 (684)

Net cash provided by (used in) operating activities 14,345 11,179 10,281

Investing Activities

Capital expenditures (5,307) (4,961) (5,117)

Cash paid for intangible assets (954) (536) (522)

Acquisitions, net of cash acquired (6,407) (183) (88)

Proceeds from sales of businesses and investments 277 99 102

Purchases of investments (135) (260) (346)

Other 18 130 74

Net cash provided by (used in) investing activities (12,508) (5,711) (5,897)

Financing Activities

Proceeds from (repayments of) short-term borrowings, net 544 ——

Proceeds from borrowings —3,420 1,564

Repurchases and repayments of debt (3,216) (1,153) (4,738)

Repurchases and retirements of common stock (2,141) (1,200) (765)

Dividends paid (1,187) (1,064) (761)

Issuances of common stock 283 34 1

Distributions to noncontrolling interests (325) (67) (49)

Other (159) (125) (160)

Net cash provided by (used in) financing activities (6,201) (155) (4,908)

Increase (decrease) in cash and cash equivalents (4,364) 5,313 (524)

Cash and cash equivalents, beginning of year 5,984 671 1,195

Cash and cash equivalents, end of year $ 1,620 $ 5,984 $ 671

See accompanying notes to consolidated financial statements.

Comcast 2011 Annual Report on Form 10-K 80