Comcast 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

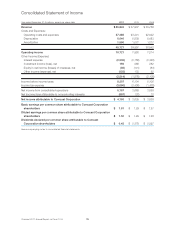

Consolidated Statement of Comprehensive Income

Year ended December 31 (in millions) 2011 2010 2009

Net income from consolidated operations $ 5,157 $ 3,668 $ 3,628

Unrealized gains (losses) on marketable securities, net of deferred taxes

of $(2), $ — and $(4) 498

Deferred gains (losses) on cash flow hedges, net of deferred taxes

of $15, $47 and $ — (25) (80) —

Amounts reclassified to net income:

Realized (gains) losses on marketable securities, net of deferred taxes

of $5, $2 and $2 (8) (2) (4)

Realized (gains) losses on cash flow hedges, net of deferred taxes

of $(11), $(21) and $(20) 20 34 34

Employee benefit obligations, net of deferred taxes of $22, $9 and $(15) (70) (13) 25

Currency translation adjustments, net of deferred taxes of $3, $ — , and $ — (12) (1) 4

Comprehensive income 5,066 3,615 3,695

Net (income) loss attributable to noncontrolling interests (997) (33) 10

Other comprehensive (income) loss attributable to noncontrolling interests 38 ——

Comprehensive income attributable to Comcast Corporation $ 4,107 $ 3,582 $ 3,705

See accompanying notes to consolidated financial statements.

79 Comcast 2011 Annual Report on Form 10-K