Comcast 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

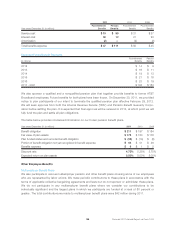

Noncash Investing and Financing Activities

During 2011, we:

• acquired 51% of NBCUniversal Holdings on January 28, 2011, for cash and a 49% interest

in the Comcast Content Business (see Note 4 for additional information on the NBCUni-

versal transaction)

• acquired the remaining 50% equity interest in Universal Orlando (see Note 4 for additional

information on the Universal Orlando transaction)

• recorded a liability of $305 million for a quarterly cash dividend of $0.1125 per common

share paid in January 2012, which is a noncash financing activity

• acquired $1 billion of property and equipment and intangible assets that were accrued but

unpaid, which is a noncash investing activity

During 2010, we:

• recorded a liability of $263 million for a quarterly cash dividend of $0.0945 per common

share paid in January 2011, which is a noncash financing activity

• acquired $611 million of property and equipment and software that were accrued but

unpaid, which is a noncash investing activity

During 2009, we:

• recorded a liability of $268 million for a quarterly cash dividend of $0.0945 per common

share paid in January 2010, which is a noncash financing activity

• acquired $389 million of property and equipment and software that were accrued but

unpaid, which is a noncash investing activity

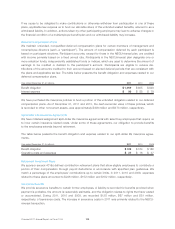

Note 18: Receivables Monetization

NBCUniversal monetizes certain of its accounts receivable under programs with a syndicate of banks. We

account for receivables monetized through these programs as sales in accordance with the appropriate

accounting guidance. We receive deferred consideration from the assets sold in the form of a receivable,

which is funded by residual cash flows after the senior interests have been fully paid. The deferred consid-

eration is recorded in receivables, net at its initial fair value, which reflects the net cash flows we expect to

receive related to these interests. The accounts receivable we sold that underlie the deferred consideration

are generally short-term in nature and, therefore, the fair value of the deferred consideration approximated its

carrying value as of December 31, 2011.

NBCUniversal is responsible for servicing the receivables and remitting collections to the purchasers under

the securitization programs. NBCUniversal performs this service for a fee that is equal to the prevailing market

rate for such services. As a result, no servicing asset or liability has been recorded in our consolidated bal-

ance sheet as of December 31, 2011. These servicing fees are a component of net loss (gain) on sale

presented in the table below.

119 Comcast 2011 Annual Report on Form 10-K