Comcast 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

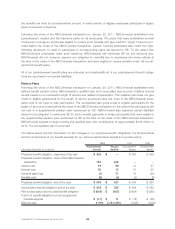

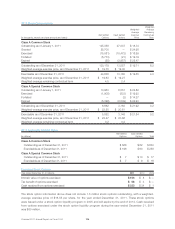

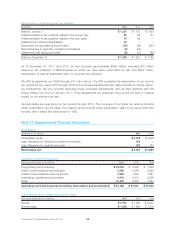

Reconciliation of Unrecognized Tax Benefits

(in millions) 2011 2010 2009

Balance, January 1 $ 1,251 $ 1,185 $ 1,450

Additions based on tax positions related to the current year 87 69 57

Additions based on tax positions related to the prior years 75 59 —

Additions from acquired subsidiaries 57 ——

Reductions for tax positions of prior years (22) (28) (257)

Reductions due to expiration of statute of limitations (5) (24) —

Settlements with taxing authorities (8) (10) (65)

Balance, December 31 $ 1,435 $ 1,251 $ 1,185

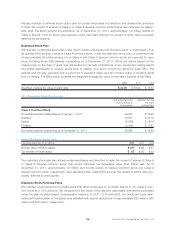

As of December 31, 2011 and 2010, we had accrued approximately $698 million, including $10 million

related to tax positions of NBCUniversal for which we have been indemnified by GE, and $604 million,

respectively, of interest associated with our uncertain tax positions.

The IRS is examining our 2009 through 2011 tax returns. The IRS completed its examination of our income

tax returns for the years 2000 through 2008 and proposed adjustments that relate primarily to certain financ-

ing transactions. We are currently disputing those proposed adjustments, and we filed petitions with the

United States Tax Court in January 2011. If the adjustments are sustained, they would not have a material

impact on our effective tax rate.

Various states are examining our tax returns through 2010. The tax years of our state tax returns currently

under examination vary by state. The majority of the periods under examination relate to tax years 2000 and

forward, with a select few dating back to 1993.

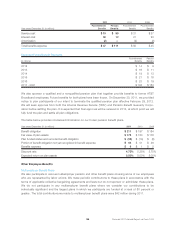

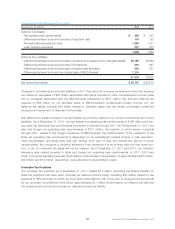

Note 17: Supplemental Financial Information

Receivables

December 31 (in millions) 2011 2010

Receivables, gross $ 4,978 $ 2,028

Less: Allowance for returns and customer incentives 425 —

Less: Allowance for doubtful accounts 202 173

Receivables, net $ 4,351 $ 1,855

Operating Costs and Expenses

Year ended December 31 (in millions) 2011 2010 2009

Programming and production $ 16,623 $ 8,555 $ 7,846

Cable Communications technical labor 2,280 2,263 2,295

Cable Communications customer service 1,855 1,833 1,881

Advertising, marketing and promotion 4,240 2,415 2,056

Other 12,487 8,275 7,964

Operating costs and expenses (excluding depreciation and amortization) $ 37,485 $ 23,341 $ 22,042

Cash Payments for Interest and Income Taxes

Year ended December 31 (in millions) 2011 2010 2009

Interest $ 2,441 $ 1,983 $ 2,040

Income taxes $ 1,626 $ 1,864 $ 1,303

Comcast 2011 Annual Report on Form 10-K 118