Comcast 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a cash payment to GE of $6.2 billion, which included transaction-related costs. We expect to receive tax benefits related

to the transaction and have agreed to share with GE certain of these future tax benefits as they are realized.

Under the terms of the operating agreement of NBCUniversal Holdings, during the six month period begin-

ning on July 28, 2014, GE has the right to cause NBCUniversal Holdings to redeem, in cash, half of GE’s

interest in NBCUniversal Holdings, and we would have the immediate right to purchase the remainder of GE’s

interest. If, however, we elect not to exercise this right, during the six month period beginning January 28,

2018, GE has the right to cause NBCUniversal Holdings to redeem GE’s remaining interest, if any. If GE does

not exercise its first redemption right, we have the right, during the six month period beginning January 28,

2016, to purchase half of GE’s interest in NBCUniversal Holdings, and during the six month period beginning

January 28, 2019, we have the right to purchase GE’s remaining interest, if any, in NBCUniversal Holdings.

The purchase price to be paid in connection with any purchase or redemption described in this paragraph will

be equal to the ownership percentage being purchased multiplied by an amount equal to 120% of the fully

distributed public market trading value of NBCUniversal Holdings (determined pursuant to an appraisal proc-

ess if NBCUniversal Holdings is not then publicly traded), less 50% of an amount (not less than zero) equal to

the excess of 120% of the fully distributed public market trading value over $28.4 billion. Subject to various

limitations, we are committed to fund up to $2.875 billion in cash or our common stock for each of the two

redemptions (up to an aggregate of $5.75 billion) to the extent NBCUniversal Holdings cannot fund the

redemptions, with amounts not used in the first redemption to be available for the second redemption.

Until July 28, 2014, GE may not directly or indirectly transfer its interest in NBCUniversal Holdings. Thereafter, GE may

transfer its interest to a third party, subject to our right of first offer. The right of first offer would permit us to purchase all,

but not less than all, of the interests proposed to be transferred. If GE makes a registration request in accordance with

certain registration rights that are granted to it under the agreement, we will have the right to purchase, for cash at the

market value (determined pursuant to an appraisal process if NBCUniversal Holdings is not then publicly traded), all of

GE’s interest in NBCUniversal Holdings that GE is seeking to register.

For so long as GE continues to own at least 20% of NBCUniversal Holdings, GE will have veto rights with

respect to certain matters, which include: (i) certain issuances or repurchases of equity; (ii) certain dis-

tributions to equity holders; (iii) certain debt incurrences; and (iv) certain loans to or guarantees for other

persons made outside of the ordinary course of business.

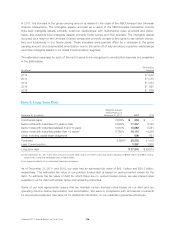

Allocation of Purchase Price

Because we now control NBCUniversal Holdings, we have applied acquisition accounting to the NBCUni-

versal contributed businesses and their results of operations are included in our consolidated results of

operations following the acquisition date. The net assets of the NBCUniversal contributed businesses were

recorded at their estimated fair value primarily using Level 3 inputs (see Note 11 for an explanation of Level 3

inputs). In valuing acquired assets and liabilities, fair value estimates are based on, but are not limited to,

future expected cash flows, market rate assumptions for contractual obligations, actuarial assumptions for

benefit plans and appropriate discount rates. The Comcast Content Business continues at its historical or

carry-over basis. GE’s interest in NBCUniversal Holdings is recorded as a redeemable noncontrolling interest

in our consolidated financial statements due to the redemption provisions outlined above. GE’s redeemable

noncontrolling interest has been recorded at fair value for the portion attributable to the net assets we

acquired, and at our historical cost for the portion attributable to the Comcast Content Business.

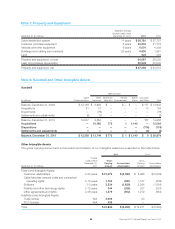

The tables below present the fair value of the consideration transferred and the allocation of purchase price to the assets

and liabilities of the NBCUniversal businesses acquired as a result of the NBCUniversal transaction. We have revised our

estimates during the year, which resulted in a decrease in goodwill of $1.1 billion from our initial allocation of purchase

price. The changes related primarily to revisions in the estimated fair value of investments, property and equipment, and

intangible assets.

Comcast 2011 Annual Report on Form 10-K 92