Comcast 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other

Our other business interests primarily include Comcast Spectacor, which owns the Philadelphia Flyers and

the Wells Fargo Center, a large, multipurpose arena in Philadelphia. Comcast Spector also owns Global

Spectrum, which provides facilities management, and Ovations Food Services, which provides food services,

for sporting events, concerts and other events.

2011 Developments

The following are the more significant developments in our businesses during 2011:

• the close of the NBCUniversal transaction on January 28, 2011; see “NBCUniversal Trans-

action” below for additional information

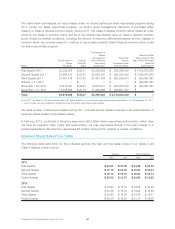

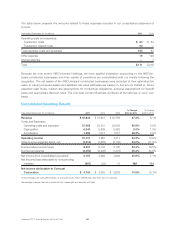

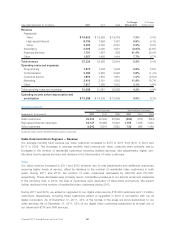

• an increase in consolidated revenue of 47.2% to $55.8 billion and an increase in con-

solidated operating income of 34.3% to $10.7 billion; the NBCUniversal acquired

businesses contributed $14.5 billion to revenue and $1.4 billion to operating income

• an increase in Cable Communications segment revenue of 5.3% to $37.2 billion and an

increase in Cable Communications segment operating income before depreciation and

amortization of 6.9% to $15.3 billion

• the entry into an agreement by SpectrumCo to sell its advanced wireless services spectrum

licenses to Verizon Wireless, subject to regulatory approval, for $3.6 billion, of which our

portion of the proceeds is expected to be $2.3 billion, and the entry into agency agree-

ments with Verizon Wireless providing, among other things, for Verizon Wireless’ sale of our

cable services and our sale of Verizon Wireless’ products and services

• NBCUniversal’s entry into several significant sports broadcast rights agreements, including

with the NFL, the International Olympic Committee, the NHL, FIFA and the PGA TOUR

• NBCUniversal’s acquisition of the 50% equity interest that it did not already own in Universal

Orlando for $1 billion on July 1, 2011

NBCUniversal Transaction

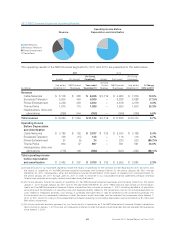

On January 28, 2011, we closed our transaction with GE to form a new company named NBCUniversal, LLC

(“NBCUniversal Holdings”). We now control and own 51% of NBCUniversal Holdings, and GE owns the

remaining 49%. As part of the NBCUniversal transaction, GE contributed the businesses of NBCUniversal,

which is now a wholly owned subsidiary of NBCUniversal Holdings. The NBCUniversal businesses that were

contributed included its national cable networks, the NBC and Telemundo broadcast networks and its NBC

and Telemundo owned local television stations, Universal Pictures, the Universal Studios Hollywood theme

park, and other related assets. We contributed our national cable networks, our regional sports and news

networks, certain of our Internet businesses, including DailyCandy and Fandango, and other related assets

(the “Comcast Content Business”). In addition to contributing the Comcast Content Business to NBCUni-

versal, we made a cash payment to GE of $6.2 billion, which included transaction-related costs. We expect

to receive tax benefits related to the transaction and have agreed to share with GE certain of these future tax

benefits as they are realized.

We have incurred significant transaction costs directly related to the NBCUniversal transaction. The

incremental expenses related to legal, accounting and valuation services and investment banking fees are

reflected in operating costs and expenses. We also incurred certain financing costs and other shared costs

with GE associated with NBCUniversal debt facilities that were entered into in December 2009 and the issu-

ance of NBCUniversal’s senior notes in 2010, which are included in other expense and interest expense. In

addition, during 2011, NBCUniversal incurred transaction-related costs associated with severance and other

related compensation charges, which are included in operating costs and expenses.

45 Comcast 2011 Annual Report on Form 10-K