Comcast 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

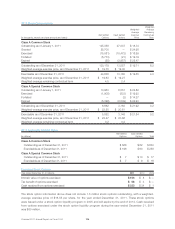

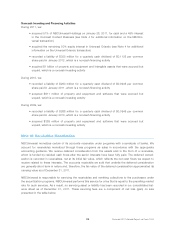

Included in the table above are specific payments for the U.S. television rights to the 2012 London Olympics.

This programming commitment was considered an unfavorable contract in the application of acquisition

accounting for the NBCUniversal transaction. We recorded a liability related to this contract which will be

reversed in our consolidated financial statements at the time the corresponding revenue and expenses asso-

ciated with this contract is recognized.

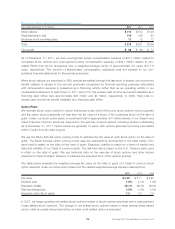

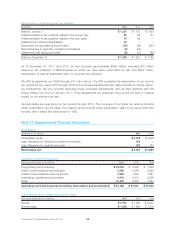

The table below presents our rental expense charged to operations.

Year ended December 31 (in millions) 2011 2010 2009

Rental expense $ 570 $ 424 $ 418

Other Commitments

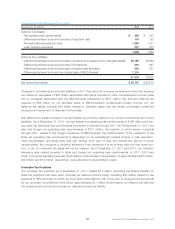

In connection with the NBCUniversal and Universal Orlando transactions, we assumed two contractual obliga-

tions that involve perpetual financial interests held by third parties in certain NBCUniversal businesses. These

interests are based upon a percentage of future revenue of the specified businesses. One of the contractual

obligations provides the third party with the option, beginning in 2017, to require NBCUniversal to purchase

the interest for cash in an amount equal to the fair value of the estimated future payments. These liabilities

were recorded at fair value as of their respective acquisition dates, and subsequent fair value adjustments to

these liabilities are recorded in other income (expense), net in our consolidated statement of income. Fair

values are determined based on the terms of the contracts and Level 3 inputs, primarily including discounted

future expected cash flows. As of December 31, 2011, these liabilities totaled $1 billion and the related

expenses recognized in other income (expense), net in 2011 were $57 million.

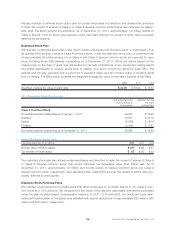

Station Venture

NBCUniversal owns a 79.62% equity interest and a 50% voting interest in Station Venture Holdings, LLC

(“Station Venture”), a variable interest entity. The remaining equity interests in Station Venture are held by LIN

TV, Corp. (“LIN TV”). Station Venture holds an indirect interest in the NBC owned local television stations in

Dallas, Texas and San Diego, California through its ownership interests in Station Venture Operations, LP

(“Station LP”), a less than wholly owned consolidated subsidiary of NBCUniversal. Station Venture is the obli-

gor on an $816 million senior secured note that is due in 2023 to General Electric Capital Corporation, as

servicer. The note is nonrecourse to NBCUniversal, guaranteed by LIN TV and collateralized by substantially

all of the assets of Station Venture and Station LP. In connection with the close of the NBCUniversal trans-

action, GE indemnified NBCUniversal for all liabilities NBCUniversal may incur as a result of any credit

support, risk of loss or similar arrangement related to the senior secured note in existence prior to the close.

We are not the primary beneficiary of, and accordingly do not consolidate, Station Venture. The carrying value

of our equity method investment in Station Venture was zero as of December 31, 2011. Because the assets

of Station LP serve as collateral for Station Venture’s $816 million senior secured note, we have recorded a

$482 million liability in our allocation of purchase price for the NBCUniversal transaction, which represents the

fair value of the assets allocated in acquisition accounting that collateralize the note.

Contingencies

Antitrust Cases

We are defendants in two purported class actions originally filed in December 2003 in the United States Dis-

trict Courts for the District of Massachusetts and the Eastern District of Pennsylvania. The potential class in

the Massachusetts case, which has been transferred to the Eastern District of Pennsylvania, is our customer

base in the “Boston Cluster” area, and the potential class in the Pennsylvania case is our customer base in

the “Philadelphia and Chicago Clusters,” as those terms are defined in the complaints. In each case, the

plaintiffs allege that certain customer exchange transactions with other cable providers resulted in unlawful

horizontal market restraints in those areas and seek damages under antitrust statutes, including treble dam-

ages.

121 Comcast 2011 Annual Report on Form 10-K