Berkshire Hathaway 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Foreign Currency Risk

We generally do not use derivative contracts to hedge foreign currency price changes primarily because of the natural hedging

that occurs between assets and liabilities denominated in foreign currencies in our Consolidated Financial Statements. In addition, we

hold investments in major multinational companies that have significant foreign business and foreign currency risk of their own, such

as The Coca-Cola Company. Our net assets subject to translation are primarily in our insurance and utilities and energy businesses, and

to a lesser extent in our manufacturing and services businesses. The translation impact is somewhat offset by transaction gains or

losses on net reinsurance liabilities of certain U.S. subsidiaries that are denominated in foreign currencies as well as the equity index

put option liabilities of U.S. subsidiaries relating to contracts that would be settled in foreign currencies.

Commodity Price Risk

Our diverse group of operating businesses use commodities in various ways in manufacturing and providing services. As

such, we are subject to price risks related to various commodities. In most instances, we attempt to manage these risks through

the pricing of our products and services to customers. To the extent that we are unable to sustain price increases in response to

commodity price increases, our operating results will likely be adversely affected. We utilize derivative contracts to a limited

degree in managing commodity price risks, most notably at MidAmerican. MidAmerican’s exposures to commodities include

variations in the price of fuel required to generate electricity, wholesale electricity that is purchased and sold and natural gas

supply for customers. Commodity prices are subject to wide price swings as supply and demand are impacted by, among many

other unpredictable items, weather, market liquidity, generating facility availability, customer usage, storage and transmission

and transportation constraints. To mitigate a portion of the risk, MidAmerican uses derivative instruments, including forwards,

futures, options, swaps and other agreements, to effectively secure future supply or sell future production generally at fixed

prices. The settled cost of these contracts is generally recovered from customers in regulated rates. Financial results would be

negatively impacted if the costs of wholesale electricity, fuel or natural gas are higher than what is permitted to be recovered in

rates. MidAmerican also uses futures, options and swap agreements to economically hedge gas and electric commodity prices

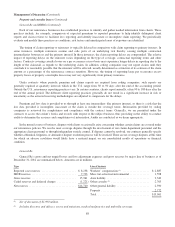

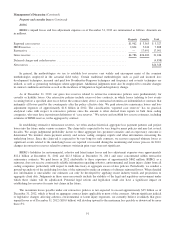

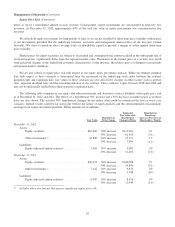

for physical delivery to non-regulated customers. The table that follows summarizes our commodity price risk on energy

derivative contracts of MidAmerican as of December 31, 2012 and 2011 and shows the effects of a hypothetical 10% increase

and a 10% decrease in forward market prices by the expected volumes for these contracts as of each date. The selected

hypothetical change does not reflect what could be considered the best or worst case scenarios. Dollars are in millions.

Fair Value

Net Assets

(Liabilities) Hypothetical Price Change

Estimated Fair Value after

Hypothetical Change in

Price

December 31, 2012 .................................... $(235) 10% increase $(187)

10% decrease (285)

December 31, 2011 .................................... $(445) 10% increase $(348)

10% decrease (542)

FORWARD-LOOKING STATEMENTS

Investors are cautioned that certain statements contained in this document as well as some statements in periodic press releases

and some oral statements of Berkshire officials during presentations about Berkshire or its subsidiaries are “forward-looking”

statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking statements

include statements which are predictive in nature, which depend upon or refer to future events or conditions, which include words such

as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” or similar expressions. In addition, any statements concerning

future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects and

possible future Berkshire actions, which may be provided by management, are also forward-looking statements as defined by the Act.

Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties

and assumptions about Berkshire and its subsidiaries, economic and market factors and the industries in which we do business, among

other things. These statements are not guaranties of future performance and we have no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number

of factors. The principal important risk factors that could cause our actual performance and future events and actions to differ

materially from such forward-looking statements include, but are not limited to, changes in market prices of our investments in fixed

maturity and equity securities, losses realized from derivative contracts, the occurrence of one or more catastrophic events, such as an

earthquake, hurricane or act of terrorism that causes losses insured by our insurance subsidiaries, changes in laws or regulations

affecting our insurance, railroad, utilities and energy and finance subsidiaries, changes in federal income tax laws, and changes in

general economic and market factors that affect the prices of securities or the industries in which we do business.

96