Berkshire Hathaway 2012 Annual Report Download - page 72

Download and view the complete annual report

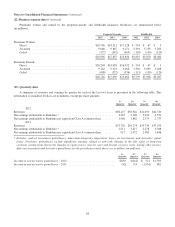

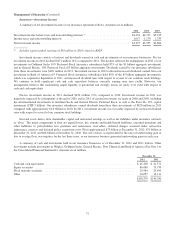

Please find page 72 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

capacity and desire to write substantially more business when appropriate pricing can be obtained. Premiums earned in 2012

from catastrophe and individual risk contracts exceeded 2011 by $65 million (9%), which increased 21% compared with 2010.

In 2012, catastrophe and individual risk underwriting results reflected estimated losses of $96 million in connection with

Hurricane Sandy. In 2011, we incurred estimated losses of approximately $800 million attributable to the earthquakes in Japan

and New Zealand, while in 2010 we incurred estimated losses of $322 million arising from several loss events. Changes in

estimated losses attributable to prior years’ events were relatively insignificant in 2012 and 2011. In 2010, underwriting results

were favorably impacted from the reductions of estimated unpaid losses for prior years’ loss events due to lower than expected

reported claims.

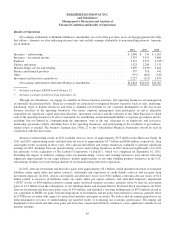

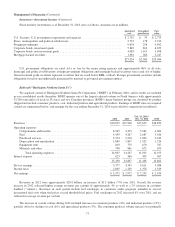

Retroactive reinsurance policies provide indemnification of unpaid losses and loss adjustment expenses with respect to past

loss events, and related claims are generally expected to be paid over long periods of time. Premiums and limits of

indemnification are often very large in amount. Coverages are generally subject to policy limits. Premiums earned in 2012

derived from several relatively small contracts. Premiums earned under retroactive reinsurance contracts in 2011 included

approximately $1.7 billion from a reinsurance contract with Eaglestone Reinsurance Company, a subsidiary of American

International Group, Inc. (“AIG”). Under the contract, we agreed to reinsure the bulk of AIG’s U.S. asbestos liabilities. The

agreement provides for a maximum limit of indemnification of $3.5 billion. Premiums earned in 2010 included approximately

$2.25 billion from a contract with Continental Casualty Company, a subsidiary of CNA Financial Corporation, and several of its

other insurance subsidiaries (collectively the “CNA Companies”). Under the terms of the reinsurance agreement, BHRG

assumed certain asbestos and environmental pollution liabilities of the CNA Companies subject to an aggregate limit of

indemnification of $4 billion.

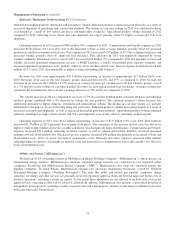

Underwriting results attributable to retroactive reinsurance include the recurring periodic amortization of deferred charges

that are established with respect to these contracts. At the inception of a contract, deferred charge assets are recorded as the

excess, if any, of the estimated ultimate losses payable over the premiums earned. Deferred charge balances are subsequently

amortized over the estimated claims payment period using the interest method, which reflects estimates of the timing and

amount of loss payments. Deferred charge balances are also adjusted to reflect changes in the timing and amount of actual and

re-estimated future loss payments. The recurring periodic amortization of deferred charges and deferred charge adjustments

resulting from changes to the estimated timing and amount of loss payments are included in earnings as a component of losses

and loss adjustment expenses. At December 31, 2012 and 2011, unamortized deferred charges for all of BHRG’s retroactive

reinsurance contracts were approximately $3.9 billion and $4.0 billion, respectively.

In 2012, the underwriting loss from retroactive reinsurance contracts was $201 million, which was primarily attributable to

deferred charge amortization. In 2012, changes in estimated ultimate unpaid losses with respect to prior years’ contracts were

not significant. In 2011, the net underwriting gain from retroactive reinsurance contracts was $645 million. The net gain

reflected the favorable impact of a reduction of approximately $865 million in the estimated liability originally established

under an adverse loss development contract with Swiss Re, which was attributable to better than expected loss experience. In

2010, underwriting results benefitted from reductions in liabilities for prior years’ contracts and slower than expected loss

payments. Gross unpaid losses from retroactive reinsurance contracts were approximately $18.0 billion at December 31, 2012,

$18.8 billion at December 31, 2011 and $18.7 billion as of December 31, 2010.

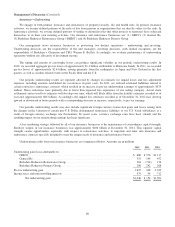

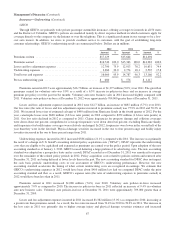

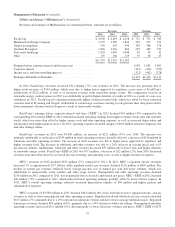

Premiums earned from other multi-line property and casualty business included $3.4 billion in 2012, $2.9 billion in 2011

and $2.4 billion in 2010 from the Swiss Re 20% quota-share contract. As previously noted, the Swiss Re quota-share contract

expired on December 31, 2012. Unearned premiums as of December 31, 2012 ($1.4 billion) will be earned as the contract runs

off, with a majority of that amount to be earned in 2013. Accordingly, multi-line premium volume is expected to decline

significantly in 2013. Underwriting results of our other multi-line property/casualty business can be significantly impacted by

the timing and magnitude of catastrophe losses. In 2012, we incurred estimated losses of $268 million from Hurricane Sandy. In

2011 and 2010, other multi-line property and casualty business included estimated catastrophe losses of approximately $933

million and $308 million, respectively. In 2011, the losses were primarily from the earthquakes in Japan and New Zealand and

from floods in Thailand, while the losses in 2010 related to the Chilean and New Zealand earthquakes, the Gulf of Mexico BP

Deepwater Horizon oil rig explosion and Australian floods. The catastrophe losses in all three years arose primarily under the

Swiss Re quota-share contract.

70