Berkshire Hathaway 2012 Annual Report Download - page 76

Download and view the complete annual report

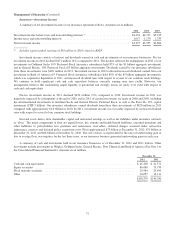

Please find page 76 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

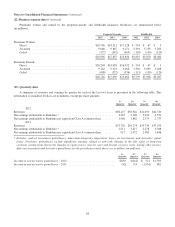

Railroad (“Burlington Northern Santa Fe”) (Continued)

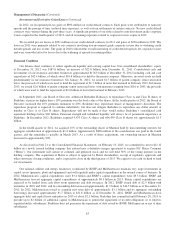

attributable to higher domestic intermodal and automotive volume. Industrial products volume increased primarily as a result of

increased shipments of petroleum and construction products. The decline in coal unit volume in 2012 was attributed to lower

coal demand as a result of low natural gas prices and high utility stockpiles. Agricultural product volume declined in 2012

compared to 2011, reflecting lower wheat and corn shipments for export partially offset by higher soybean and U.S. corn

shipments.

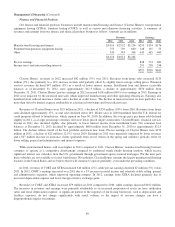

Operating expenses in 2012 increased $588 million (4%) compared to 2011. Compensation and benefits expenses in 2012

increased $190 million (4%) over 2011 due to the increased volume as well as wage inflation, partially offset by increased

productivity and lower weather-related costs. Fuel expenses in 2012 increased $192 million (4.5%) due to higher fuel prices and

increased volume, partially offset by improved fuel efficiency. Fuel efficiency in 2011 was negatively impacted by severe

weather conditions. Purchased services costs in 2012 increased $156 million (7%) compared to 2011 due primarily to increased

volume, increased purchased transportation services of BNSF Logistics, a wholly-owned third party logistics company, and

increased equipment maintenance costs, partially offset by lower weather-related costs. Interest expense in 2012 increased $63

million (11%) versus 2011, due principally to higher average outstanding debt balances.

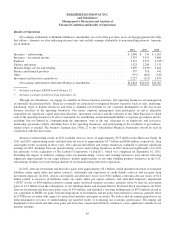

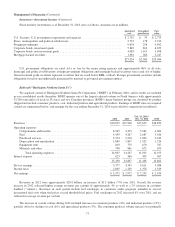

Revenues for 2011 were approximately $19.5 billion, representing an increase of approximately $2.7 billion (16%) over

2010. Revenues from each of the four business groups increased between 8% and 19% as compared to 2010. Overall, the

increases in revenues in 2011 reflected a 12% increase in average revenues per car/unit across all four business groups, as well

as a 3% increase in the volume of cars/units handled. Revenues in each period include fuel surcharges. Average revenues per

car/unit in 2011 included the effects of fuel surcharge increases of 35% in 2011 as compared to 2010.

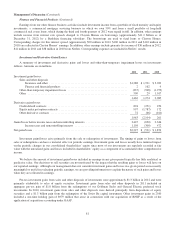

The volume increase in 2011 is comprised of increases of 7% in cars/units handled in the consumer products and industrial

products groups combined with a 4% decrease in volume for coal products. The consumer products volume increase was

attributable primarily to higher domestic intermodal and international volume. The decline in coal unit volume was partially

attributable to the impacts of severe flooding along key coal routes. Industrial products volume increased primarily as a result of

increased steel and sand shipments, as well as increased demand in petroleum products. Agricultural product volume remained

relatively unchanged, as higher wheat exports and U.S. corn shipments were mostly offset by declining soybean exports.

Operating expenses in 2011 were $14.2 billion, representing an increase of $1.9 billion (15%) over 2010. Fuel expenses

increased $1.3 billion in 2011 primarily due to higher fuel prices. The remainder of the increase in fuel costs was driven by

higher overall freight volumes and severe weather conditions, which negatively impacted efficiency. Compensation and benefits

expenses increased $311 million, reflecting increased volume, as well as salaries and benefits inflation, increased personnel

training costs and flood-related costs. Purchased services expenses increased $49 million due primarily to increased volume and

flood-related costs, offset by lower locomotive maintenance costs. Materials and other expenses increased $186 million,

reflecting higher locomotive and freight car material costs and increased crew transportation, travel and casualty costs offset by

lower environmental costs.

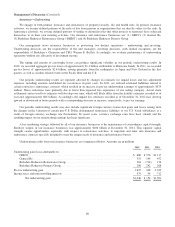

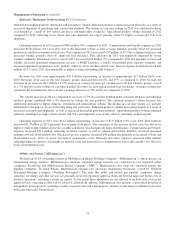

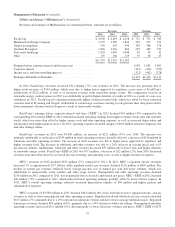

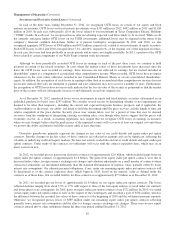

Utilities and Energy (“MidAmerican”)

We hold an 89.8% ownership interest in MidAmerican Energy Holdings Company (“MidAmerican”), which operates an

international energy business. MidAmerican’s domestic regulated energy interests are comprised of two regulated utility

companies, PacifiCorp and MidAmerican Energy Company (“MEC”). MidAmerican also owns two interstate natural gas

pipeline companies. In Great Britain, MidAmerican operates two electricity distribution businesses, owned by Northern

Powergrid Holdings Company (“Northern Powergrid”). The rates that utility and natural gas pipeline companies charge

customers for energy and other services are generally subject to regulatory approval. Rates are based in large part on the costs of

business operations, including a return on capital. To the extent these operations are not allowed to include such costs in the

approved rates, operating results will be adversely affected. In addition, MidAmerican also operates a diversified portfolio of

independent power projects, including recently-acquired solar and wind projects, and the second-largest residential real estate

brokerage firm in the United States.

74