Berkshire Hathaway 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

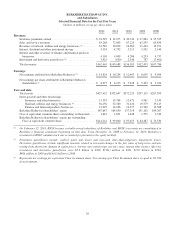

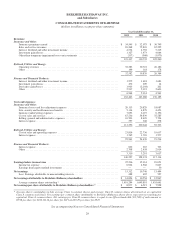

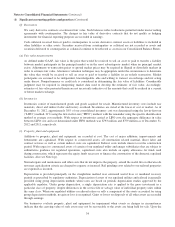

BERKSHIRE HATHAWAY INC.

and Subsidiaries

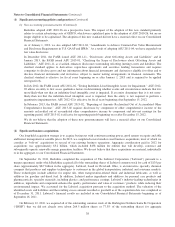

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(dollars in millions)

2012 2011 2010

Net earnings ............................................................... $15,312 $10,746 $13,494

Other comprehensive income:

Net change in unrealized appreciation of investments ........................... 15,700 (2,146) 5,398

Applicable income taxes ................................................. (5,434) 811 (1,866)

Reclassification of investment appreciation in net earnings ...................... (953) (1,245) (1,068)

Applicable income taxes ................................................. 334 436 374

Foreign currency translation .............................................. 276 (126) (172)

Applicable income taxes ................................................. (9) (18) (21)

Prior service cost and actuarial gains/losses of defined benefit plans ............... 5 (1,121) (76)

Applicable income taxes ................................................. (26) 401 25

Other, net ............................................................. (32) (104) 204

Other comprehensive income, net .............................................. 9,861 (3,112) 2,798

Comprehensive income .......................................................... 25,173 7,634 16,292

Comprehensive income attributable to noncontrolling interests ........................... 503 385 536

Comprehensive income attributable to Berkshire Hathaway shareholders ................... $24,670 $ 7,249 $15,756

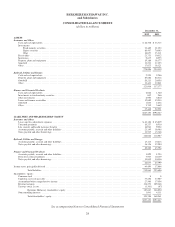

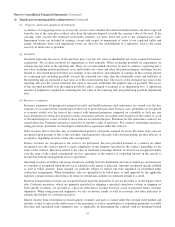

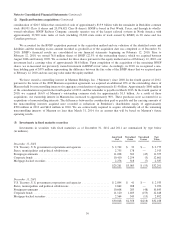

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(dollars in millions)

Berkshire Hathaway shareholders’ equity

Total

Common stock

and capital in

excess of par

value

Accumulated

other

comprehensive

income

Retained

earnings

Treasury

stock

Non-

controlling

interests

Balance at December 31, 2009 ...................... $27,082 $17,793 $ 86,227 $ — $ 4,683 $135,785

Net earnings ................................ — — 12,967 — 527 13,494

Other comprehensive income, net ................ — 2,789 — — 9 2,798

Issuance of common stock and other transactions . . . 11,096 — — — — 11,096

Changes in noncontrolling interests:

Interests acquired and other transactions ...... (637) 1 — — 397 (239)

Balance at December 31, 2010 ...................... 37,541 20,583 99,194 — 5,616 162,934

Net earnings ................................ — — 10,254 — 492 10,746

Other comprehensive income, net ................ — (3,005) — — (107) (3,112)

Issuance and repurchase of common stock ......... 355 — — (67) — 288

Changes in noncontrolling interests:

Interests acquired and other transactions ...... (81) 76 — — (1,890) (1,895)

Balance at December 31, 2011 ...................... 37,815 17,654 109,448 (67) 4,111 168,961

Net earnings ................................ — — 14,824 — 488 15,312

Other comprehensive income, net ................ — 9,846 — — 15 9,861

Issuance and repurchase of common stock ......... 118 — — (1,296) — (1,178)

Changes in noncontrolling interests:

Interests acquired and other transactions ...... (695) — — — (673) (1,368)

Balance at December 31, 2012 ...................... $37,238 $27,500 $124,272 $(1,363) $ 3,941 $191,588

See accompanying Notes to Consolidated Financial Statements

30