Berkshire Hathaway 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Union Tank Car has been around a long time, having been owned by the Standard Oil Trust until that

empire was broken up in 1911. Look for its UTLX logo on tank cars when you watch trains roll by. As a Berkshire

shareholder, you own the cars with that insignia. When you spot a UTLX car, puff out your chest a bit and enjoy the

same satisfaction that John D. Rockefeller undoubtedly experienced as he viewed his fleet a century ago.

Tank cars are owned by either shippers or lessors, not by railroads. At yearend Union Tank Car and Procor

together owned 97,000 cars having a net book value of $4 billion. A new car, it should be noted, costs upwards of

$100,000. Union Tank Car is also a major manufacturer of tank cars – some of them to be sold but most to be

owned by it and leased out. Today, its order book extends well into 2014.

At both BNSF and Marmon, we are benefitting from the resurgence of U.S. oil production. In fact, our

railroad is now transporting about 500,000 barrels of oil daily, roughly 10% of the total produced in the “lower 48”

(i.e. not counting Alaska and offshore). All indications are that BNSF’s oil shipments will grow substantially in

coming years.

************

Space precludes us from going into detail about the many other businesses in this segment. Company-

specific information about the 2012 operations of some of the larger units appears on pages 76 to 79.

Finance and Financial Products

This sector, our smallest, includes two rental companies, XTRA (trailers) and CORT (furniture), as well as

Clayton Homes, the country’s leading producer and financer of manufactured homes. Aside from these 100%-

owned subsidiaries, we also include in this category a collection of financial assets and our 50% interest in Berkadia

Commercial Mortgage.

We include Clayton in this sector because it owns and services 332,000 mortgages, totaling $13.7 billion.

In large part, these loans have been made to lower and middle-income families. Nevertheless, the loans have

performed well throughout the housing collapse, thereby validating our conviction that a reasonable down payment

and a sensible payments-to-income ratio will ward off outsized foreclosure losses, even during stressful times.

Clayton also produced 25,872 manufactured homes last year, up 13.5% from 2011. That output accounted

for about 4.8% of all single-family residences built in the country, a share that makes Clayton America’s number

one homebuilder.

CORT and XTRA are leaders in their industries as well. Our expenditures for new rental equipment at

XTRA totaled $256 million in 2012, more than double its depreciation expense. While competitors fret about

today’s uncertainties, XTRA is preparing for tomorrow.

Berkadia continues to do well. Our partners at Leucadia do most of the work in this venture, an

arrangement that Charlie and I happily embrace.

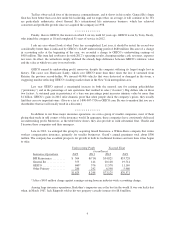

Here’s the pre-tax earnings recap for this sector:

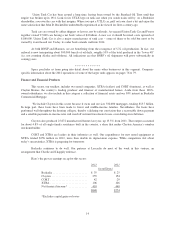

2012 2011

(in millions)

Berkadia ........................ $ 35 $ 25

Clayton ......................... 255 154

CORT .......................... 42 29

XTRA .......................... 106 126

Net financial income* ............. 410 440

$848 $774

*Excludes capital gains or losses

14