Berkshire Hathaway 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

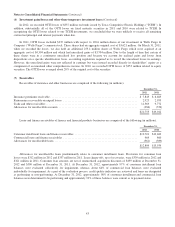

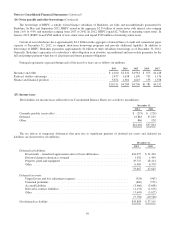

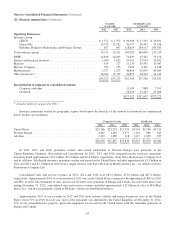

Notes to Consolidated Financial Statements (Continued)

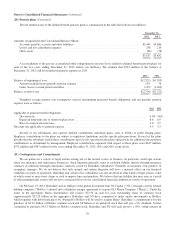

(17) Fair value measurements (Continued)

Carrying

Value Fair Value

Quoted

Prices

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

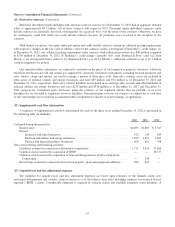

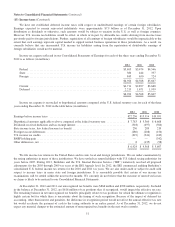

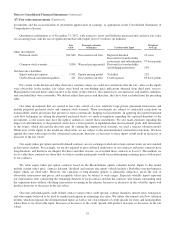

December 31, 2011—Assets and liabilities carried at

fair value:

Investments in fixed maturity securities:

U.S. Treasury, U.S. government corporations

and agencies ........................ $ 2,935 $ 2,935 $ 843 $ 2,090 $ 2

States, municipalities and political

subdivisions ......................... 3,070 3,070 — 3,069 1

Foreign governments .................... 10,843 10,843 4,444 6,265 134

Corporate bonds ....................... 12,448 12,448 — 11,801 647

Mortgage-backed securities .............. 2,892 2,892 — 2,892 —

Investments in equity securities ............... 76,991 76,991 76,906 63 22

Other investments .......................... 11,669 11,669 — — 11,669

Derivative contract assets (1) .................. 327 327 — 205 122

Derivative contract liabilities:

Railroad, utilities and energy (2) ........... 336 336 12 320 4

Finance and financial products:

Equity index put options ............. 8,499 8,499 — — 8,499

Credit default ..................... 1,527 1,527 — — 1,527

Other ............................ 113 113 — 113 —

(1)Included in other assets.

(2) Included in accounts payable, accruals and other liabilities.

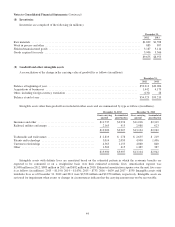

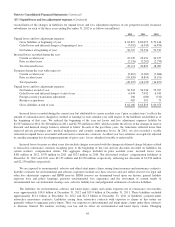

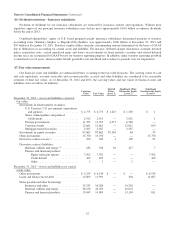

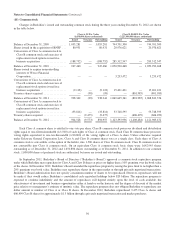

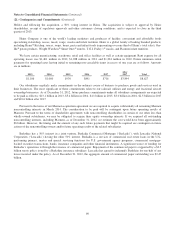

As of December 31, 2011, the carrying values and fair values of financial assets and liabilities that are not carried at fair

value were as follows (in millions).

Carrying

Value Fair Value

Other investments ...................................................................... $ 5,252 $ 6,258

Loans and finance receivables ............................................................. 13,934 13,126

Notes payable and other borrowings:

Insurance and other ................................................................. 13,768 14,334

Railroad, utilities and energy .......................................................... 32,580 38,257

Finance and financial products ........................................................ 14,036 14,959

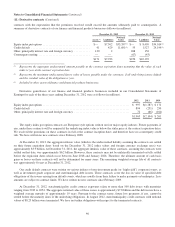

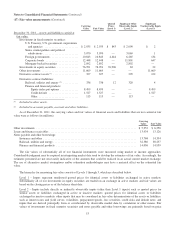

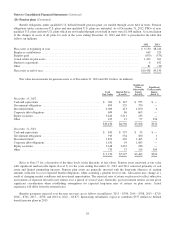

The fair values of substantially all of our financial instruments were measured using market or income approaches.

Considerable judgment may be required in interpreting market data used to develop the estimates of fair value. Accordingly, the

estimates presented are not necessarily indicative of the amounts that could be realized in an actual current market exchange.

The use of alternative market assumptions and/or estimation methodologies may have a material effect on the estimated fair

value.

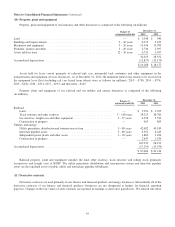

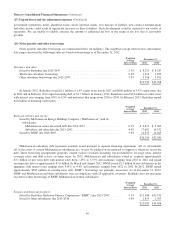

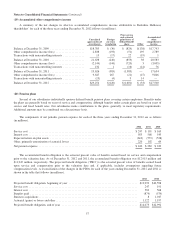

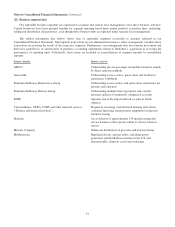

The hierarchy for measuring fair value consists of Levels 1 through 3, which are described below.

Level 1 – Inputs represent unadjusted quoted prices for identical assets or liabilities exchanged in active markets.

Substantially all of our investments in equity securities are traded on an exchange in active markets and fair values are

based on the closing prices as of the balance sheet date.

Level 2 – Inputs include directly or indirectly observable inputs (other than Level 1 inputs) such as quoted prices for

similar assets or liabilities exchanged in active or inactive markets; quoted prices for identical assets or liabilities

exchanged in inactive markets; other inputs that may be considered in fair value determinations of the assets or liabilities,

such as interest rates and yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates; and

inputs that are derived principally from or corroborated by observable market data by correlation or other means. Fair

values of investments in fixed maturity securities and notes payable and other borrowings are primarily based on price

53