Berkshire Hathaway 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

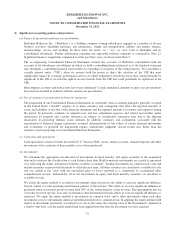

(1) Significant accounting policies and practices (Continued)

(t) New accounting pronouncements (Continued)

Berkshire adopted ASU 2010-26 on a prospective basis. The impact of the adoption of this new standard primarily

relates to certain advertising costs of GEICO, which were capitalized prior to the adoption of ASU 2010-26, but are no

longer eligible to be capitalized. The adoption of this new standard did not have a material effect on our Consolidated

Financial Statements.

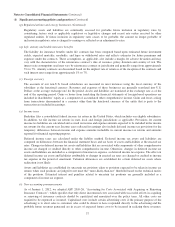

As of January 1, 2012, we also adopted ASU 2011-04, “Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and IFRSs.” As a result of adopting ASU 2011-04, we have expanded our

fair value disclosures.

In December 2011, the FASB issued ASU 2011-11, “Disclosures about Offsetting Assets and Liabilities” and in

January 2013, the FASB issued ASU 2013-01, “Clarifying the Scope of Disclosures about Offsetting Assets and

Liabilities.” ASU 2011-11, as c1arified, enhances disclosures surrounding offsetting (netting) assets and liabilities. The

clarified standard applies to derivatives, repurchase agreements and securities lending transactions and requires

companies to disclose gross and net information about financial instruments and derivatives eligible for offset and to

disclose financial instruments and derivatives subject to master netting arrangements in financial statements. The

clarified standard is effective for fiscal years beginning on or after January 1, 2013 and is required to be applied

retrospectively.

In July 2012, the FASB issued ASU 2012-02, “Testing Indefinite-Lived Intangible Assets for Impairment.” ASU 2012-

02 allows an entity to first assess qualitative factors in determining whether events and circumstances indicate that it is

more-likely-than not that an indefinite-lived intangible asset is impaired. If an entity determines that it is not more-

likely-than not that the indefinite-lived intangible asset is impaired, then the entity is not required to perform a

quantitative impairment test. ASU 2012-02 is effective for fiscal years beginning after September 15, 2012.

In February 2013, the FASB issued ASU 2013-02, “Reporting of Amounts Reclassified Out of Accumulated Other

Comprehensive Income.” ASU 2013-02 requires disclosure by component of other comprehensive income of the

amounts reclassified out of accumulated other comprehensive income by component and into net earnings for the

reporting period. ASU 2013-02 is effective for reporting periods beginning on or after December 15, 2012.

We do not believe that the adoption of these new pronouncements will have a material effect on our Consolidated

Financial Statements.

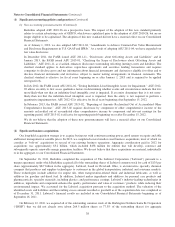

(2) Significant business acquisitions

Our long-held acquisition strategy is to acquire businesses with consistent earning power, good returns on equity and able

and honest management at sensible prices. In 2012, we completed several smaller-sized business acquisitions, most of which we

consider as “bolt-on” acquisitions to several of our existing business operations. Aggregate consideration paid in 2012 for

acquisitions was approximately $3.2 billion, which included $438 million for entities that will develop, construct and

subsequently operate renewable energy generation facilities. We do not believe that these acquisitions are material, individually

or in the aggregate, to our Consolidated Financial Statements.

On September 16, 2011, Berkshire completed the acquisition of The Lubrizol Corporation (“Lubrizol”) pursuant to a

merger agreement, under which Berkshire acquired all of the outstanding shares of Lubrizol common stock for cash of $135 per

share (approximately $8.7 billion in the aggregate). Lubrizol, based in Cleveland, Ohio, is an innovative specialty chemical

company that produces and supplies technologies to customers in the global transportation, industrial and consumer markets.

These technologies include additives for engine oils, other transportation-related fluids and industrial lubricants, as well as

additives for gasoline and diesel fuel. In addition, Lubrizol makes ingredients and additives for personal care products and

pharmaceuticals; specialty materials, including plastics; and performance coatings. Lubrizol’s industry-leading technologies in

additives, ingredients and compounds enhance the quality, performance and value of customers’ products, while reducing their

environmental impact. We accounted for the Lubrizol acquisition pursuant to the acquisition method. The valuation of the

identified assets and liabilities and the resulting excess amount recorded as goodwill as of the acquisition date was completed as

of December 31, 2011. Lubrizol’s financial results are included in our Consolidated Financial Statements beginning as of

September 16, 2011.

On February 12, 2010, we acquired all of the outstanding common stock of the Burlington Northern Santa Fe Corporation

(“BNSF”) that we did not already own (about 264.5 million shares or 77.5% of the outstanding shares) for aggregate

38