Berkshire Hathaway 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

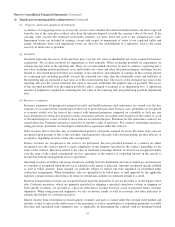

Notes to Consolidated Financial Statements (Continued)

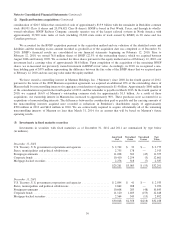

(3) Investments in fixed maturity securities (Continued)

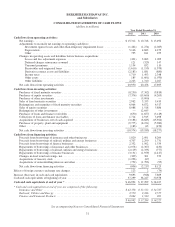

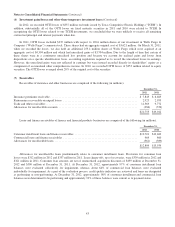

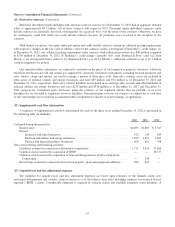

Investments in fixed maturity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2012 2011

Insurance and other ............................................................ $31,449 $31,222

Finance and financial products ................................................... 842 966

$32,291 $32,188

Investments in foreign government securities include securities issued by national and provincial government entities as

well as instruments that are unconditionally guaranteed by such entities. As of December 31, 2012, approximately 96% of

foreign government holdings were rated AA or higher by at least one of the major rating agencies and securities issued or

guaranteed by Germany, the United Kingdom, Canada, Australia and The Netherlands represented approximately 80% of these

investments. Unrealized losses on all fixed maturity investments in a continuous unrealized loss position for more than twelve

consecutive months were $9 million as of December 31, 2012 and $20 million as of December 31, 2011.

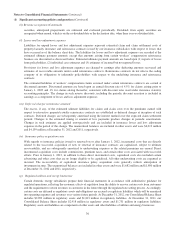

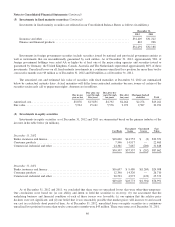

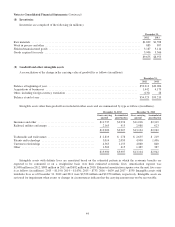

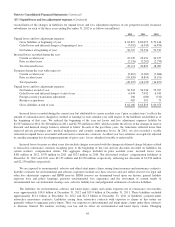

The amortized cost and estimated fair value of securities with fixed maturities at December 31, 2012 are summarized

below by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the

securities retain early call or prepayment rights. Amounts are in millions.

Due in one

year or less

Due after one

year through

five years

Due after five

years through

ten years

Due after

ten years

Mortgage-backed

securities Total

Amortized cost .......................... $5,878 $13,851 $4,792 $2,464 $2,276 $29,261

Fair value .............................. 5,994 15,161 5,576 2,973 2,587 32,291

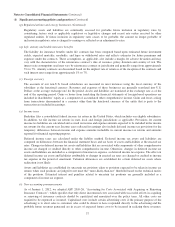

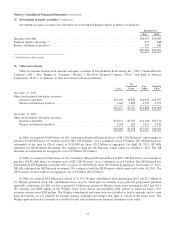

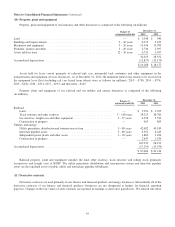

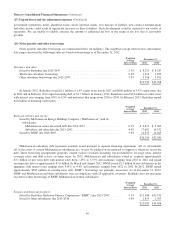

(4) Investments in equity securities

Investments in equity securities as of December 31, 2012 and 2011 are summarized based on the primary industry of the

investee in the table below (in millions).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2012

Banks, insurance and finance ........................................... $18,600 $14,753 $ (2) $33,351

Consumer products ................................................... 7,546 14,917 — 22,463

Commercial, industrial and other ........................................ 24,361 7,687 (200) 31,848

$50,507 $37,357 $ (202) $87,662

December 31, 2011

Banks, insurance and finance ........................................... $16,697 $ 9,480 $(1,269) $24,908

Consumer products ................................................... 12,390 14,320 — 26,710

Commercial, industrial and other ........................................ 20,523 4,973 (123) 25,373

$49,610 $28,773 $(1,392) $76,991

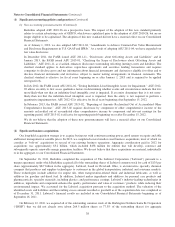

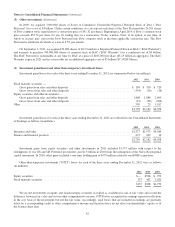

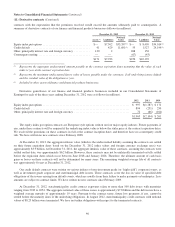

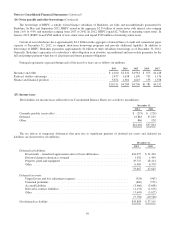

As of December 31, 2012 and 2011, we concluded that there were no unrealized losses that were other-than-temporary.

Our conclusions were based on: (a) our ability and intent to hold the securities to recovery; (b) our assessment that the

underlying business and financial condition of each of these issuers was favorable; (c) our opinion that the relative price

declines were not significant; and (d) our belief that it was reasonably possible that market prices will increase to and exceed

our cost in a relatively short period of time. As of December 31, 2012, unrealized losses on equity securities in a continuous

unrealized loss position for more than twelve consecutive months were $45 million. There were none as of December 31, 2011.

40