Berkshire Hathaway 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Finance and Financial Products (Continued)

Earnings from our other finance business activities include investment income from a portfolio of fixed maturity and equity

investments, a commercial mortgage servicing business in which we own 50% and from a small portfolio of long-held

commercial real estate loans, which during the third and fourth quarters of 2012 were repaid in full. In addition, other earnings

include income from interest rate spreads charged to Clayton Homes on borrowings (approximately $11.2 billion as of

December 31, 2012) by a Berkshire financing subsidiary. The borrowings are used to fund loans to Clayton Homes.

Corresponding charges for this interest spread (approximately $90 million in 2012, $100 million in 2011 and $110 million in

2010) are reflected in Clayton Homes’ earnings. In addition, other earnings include guaranty fee income of $30 million in 2012,

$41 million in 2011 and $38 million in 2010 from NetJets. Corresponding expenses are included in NetJets’ results.

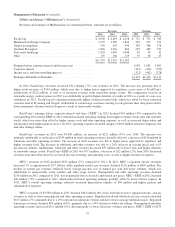

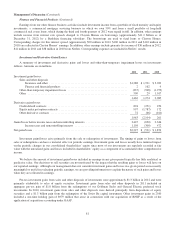

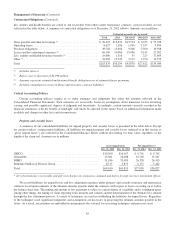

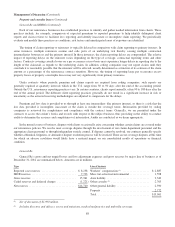

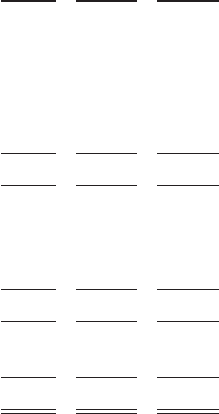

Investment and Derivative Gains/Losses

A summary of investment and derivative gains and losses and other-than-temporary impairment losses on investments

follows. Amounts are in millions.

2012 2011 2010

Investment gains/losses:

Sales and other disposals

Insurance and other ....................................................... $1,288 $ 1,991 $ 3,032

Finance and financial products .............................................. 2 162 9

Other-than-temporary impairment losses .......................................... (337) (908) (1,973)

Other ...................................................................... 509 29 1,017

1,462 1,274 2,085

Derivative gains/losses:

Credit default contracts ........................................................ 894 (251) 250

Equity index put option contracts ................................................ 997 (1,787) 172

Other derivative contracts ...................................................... 72 (66) (161)

1,963 (2,104) 261

Gains/losses before income taxes and noncontrolling interests ............................. 3,425 (830) 2,346

Income taxes and noncontrolling interests ..................................... 1,198 (309) 472

Net gains/losses .................................................................. $2,227 $ (521) $ 1,874

Investment gains/losses arise primarily from the sale or redemption of investments. The timing of gains or losses from

sales or redemptions can have a material effect on periodic earnings. Investment gains and losses usually have minimal impact

on the periodic changes in our consolidated shareholders’ equity since most of our investments are regularly recorded at fair

value with the unrealized gains and losses included in shareholders’ equity as a component of accumulated other comprehensive

income.

We believe the amount of investment gains/losses included in earnings in any given period typically has little analytical or

predictive value. Our decisions to sell securities are not motivated by the impact that the resulting gains or losses will have on

our reported earnings. Although our management does not consider investment gains and losses in a given period as necessarily

meaningful or useful in evaluating periodic earnings, we are providing information to explain the nature of such gains and losses

when they are reflected in earnings.

Pre-tax investment gains from sales and other disposals of investments were approximately $1.3 billion in 2012 and were

primarily attributable to sales of equity securities. Investment gains from sales and other disposals in 2011 included an

aggregate pre-tax gain of $1.8 billion from the redemptions of our Goldman Sachs and General Electric preferred stock

investments. In 2010, investment gains from sales and other disposals were derived principally from dispositions of equity

securities and a $1.3 billion gain from the redemption of the Swiss Re capital instrument. Other investment gains in 2010

included a one-time holding gain of $979 million that arose in connection with our acquisition of BNSF as a result of the

application of acquisition accounting under GAAP.

81