Berkshire Hathaway 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(k) Revenue recognition (Continued)

securities, anticipated prepayments are estimated and evaluated periodically. Dividends from equity securities are

recognized when earned, which is on the ex-dividend date or the declaration date, when there is no ex-dividend date.

(l) Losses and loss adjustment expenses

Liabilities for unpaid losses and loss adjustment expenses represent estimated claim and claim settlement costs of

property/casualty insurance and reinsurance contracts issued by our insurance subsidiaries with respect to losses that

have occurred as of the balance sheet date. The liabilities for losses and loss adjustment expenses are recorded at the

estimated ultimate payment amounts, except that amounts arising from certain workers’ compensation reinsurance

business are discounted as discussed below. Estimated ultimate payment amounts are based upon (1) reports of losses

from policyholders, (2) individual case estimates and (3) estimates of incurred but not reported losses.

Provisions for losses and loss adjustment expenses are charged to earnings after deducting amounts recovered and

estimates of recoverable amounts under ceded reinsurance contracts. Reinsurance contracts do not relieve the ceding

company of its obligations to indemnify policyholders with respect to the underlying insurance and reinsurance

contracts.

The estimated liabilities of workers’ compensation claims assumed under certain reinsurance contracts are carried at

discounted amounts. Discounted amounts are based upon an annual discount rate of 4.5% for claims arising prior to

January 1, 2003 and 1% for claims arising thereafter, consistent with discount rates used under insurance statutory

accounting principles. The change in such reserve discounts, including the periodic discount accretion is included in

earnings as a component of losses and loss adjustment expenses.

(m) Deferred charges reinsurance assumed

The excess, if any, of the estimated ultimate liabilities for claims and claim costs over the premiums earned with

respect to retroactive property/casualty reinsurance contracts are established as deferred charges at inception of such

contracts. Deferred charges are subsequently amortized using the interest method over the expected claim settlement

periods. Changes to the estimated timing or amount of loss payments produce changes in periodic amortization.

Changes in such estimates are applied retrospectively and are included in insurance losses and loss adjustment

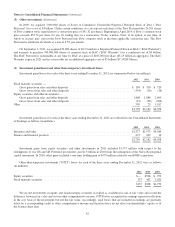

expenses in the period of the change. The unamortized balances are included in other assets and were $4,019 million

and $4,139 million at December 31, 2012 and 2011, respectively.

(n) Insurance policy acquisition costs

With regards to insurance policies issued or renewed on or after January 1, 2012, incremental costs that are directly

related to the successful acquisition of new or renewal of insurance contracts are capitalized, subject to ultimate

recoverability, and are subsequently amortized to underwriting expenses as the related premiums are earned. Direct

incremental acquisition costs include commissions, premium taxes, and certain other costs associated with successful

efforts. Prior to January 1, 2012, in addition to these direct incremental costs, capitalized costs also included certain

advertising and other costs that are no longer eligible to be capitalized. All other underwriting costs are expensed as

incurred. The recoverability of capitalized insurance policy acquisition costs generally reflects anticipation of

investment income. The unamortized balances are included in other assets and were $1,682 million and $1,890 million

at December 31, 2012 and 2011, respectively.

(p) Regulated utilities and energy businesses

Certain domestic energy subsidiaries prepare their financial statements in accordance with authoritative guidance for

regulated operations, reflecting the economic effects of regulation from the ability to recover certain costs from customers

and the requirement to return revenues to customers in the future through the regulated rate-setting process. Accordingly,

certain costs are deferred as regulatory assets and obligations are accrued as regulatory liabilities which will be amortized

into operating expenses and revenues over various future periods. At December 31, 2012, our Consolidated Balance Sheet

includes $2,909 million in regulatory assets and $1,813 million in regulatory liabilities. At December 31, 2011, our

Consolidated Balance Sheet includes $2,918 million in regulatory assets and $1,731 million in regulatory liabilities.

Regulatory assets and liabilities are components of other assets and other liabilities of utilities and energy businesses.

36