Berkshire Hathaway 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Underwriting

We engage in both primary insurance and reinsurance of property/casualty, life and health risks. In primary insurance

activities, we assume defined portions of the risks of loss from persons or organizations that are directly subject to the risks. In

reinsurance activities, we assume defined portions of similar or dissimilar risks that other insurers or reinsurers have subjected

themselves to in their own insuring activities. Our insurance and reinsurance businesses are: (1) GEICO, (2) General Re,

(3) Berkshire Hathaway Reinsurance Group (“BHRG”) and (4) Berkshire Hathaway Primary Group.

Our management views insurance businesses as possessing two distinct operations – underwriting and investing.

Underwriting decisions are the responsibility of the unit managers; investing decisions, with limited exceptions, are the

responsibility of Berkshire’s Chairman and CEO, Warren E. Buffett. Accordingly, we evaluate performance of underwriting

operations without any allocation of investment income.

The timing and amount of catastrophe losses can produce significant volatility in our periodic underwriting results. In

2012, we recorded aggregate pre-tax losses of approximately $1.1 billion attributable to Hurricane Sandy. In 2011, we recorded

pre-tax losses of approximately $2.6 billion, arising primarily from the earthquakes in Japan and New Zealand in the first

quarter, as well as weather related events in the Pacific Rim and the U.S.

Our periodic underwriting results are regularly affected by changes in estimates for unpaid losses and loss adjustment

expenses, including amounts established for occurrences in prior years. In 2011, we reduced estimated liabilities related to

certain retroactive reinsurance contracts which resulted in an increase in pre-tax underwriting earnings of approximately $875

million. These reductions were primarily due to lower than expected loss experience of one ceding company. Actual claim

settlements and revised loss estimates will develop over time, which will likely differ from the liability estimates recorded as of

year-end (approximately $64 billion). Accordingly, the unpaid loss estimates recorded as of December 31, 2012 may develop

upward or downward in future periods with a corresponding decrease or increase, respectively, to pre-tax earnings.

Our periodic underwriting results may also include significant foreign currency transaction gains and losses arising from

the changes in the valuation of certain non-U.S. Dollar denominated reinsurance liabilities of our U.S. based subsidiaries as a

result of foreign currency exchange rate fluctuations. In recent years, currency exchange rates have been volatile and the

resulting impact on our underwriting earnings has been significant.

A key marketing strategy followed by all of our insurance businesses is the maintenance of extraordinary capital strength.

Statutory surplus of our insurance businesses was approximately $106 billion at December 31, 2012. This superior capital

strength creates opportunities, especially with respect to reinsurance activities, to negotiate and enter into insurance and

reinsurance contracts specially designed to meet the unique needs of insurance and reinsurance buyers.

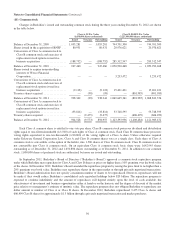

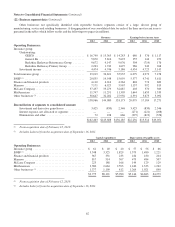

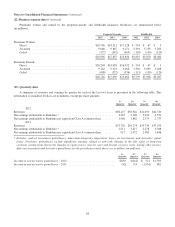

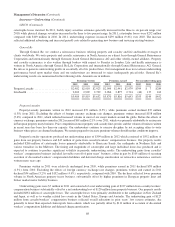

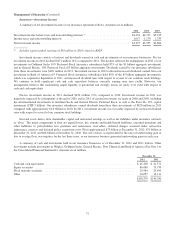

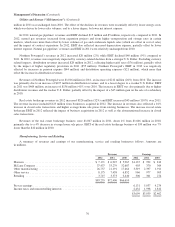

Underwriting results from our insurance businesses are summarized below. Amounts are in millions.

2012 2011 2010

Underwriting gain (loss) attributable to:

GEICO ....................................................................... $ 680 $576 $1,117

General Re .................................................................... 355 144 452

Berkshire Hathaway Reinsurance Group ............................................. 304 (714) 176

Berkshire Hathaway Primary Group ................................................ 286 242 268

Pre-tax underwriting gain ............................................................ 1,625 248 2,013

Income taxes and noncontrolling interests ................................................ 579 94 712

Net underwriting gain ....................................................... $1,046 $ 154 $1,301

66