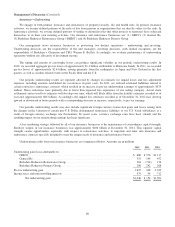

Berkshire Hathaway 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

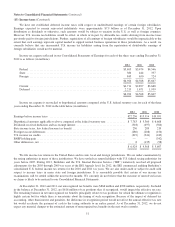

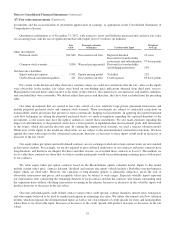

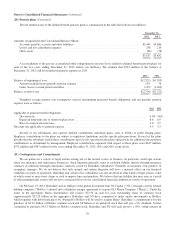

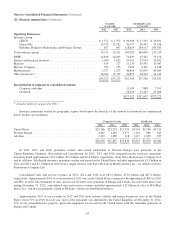

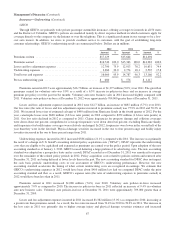

(19) Accumulated other comprehensive income

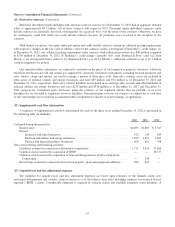

A summary of the net changes in after-tax accumulated comprehensive income attributable to Berkshire Hathaway

shareholders’ for each of the three years ending December 31, 2012 follows (in millions).

Unrealized

appreciation of

investments

Foreign

currency

translation

Prior service

and actuarial

gains/losses of

defined benefit

plans Other

Accumulated

other

comprehensive

income

Balance at December 31, 2009 ........................ $18,785 $ (30) $ (824) $(138) $17,793

Other comprehensive income (loss) .................... 2,838 (193) (51) 195 2,789

Transactions with noncontrolling interests ............... 15 (17) 22 (19) 1

Balance at December 31, 2010 ........................ 21,638 (240) (853) 38 20,583

Other comprehensive income (loss) .................... (2,144) (144) (720) 3 (3,005)

Transactions with noncontrolling interests ............... 132 1 (16) (41) 76

Balance at December 31, 2011 ........................ 19,626 (383) (1,589) — 17,654

Other comprehensive income (loss) .................... 9,647 267 (21) (47) 9,846

Transactions with noncontrolling interests ............... (19) (4) 9 14 —

Balance at December 31, 2012 ........................ $29,254 $(120) $(1,601) $ (33) $27,500

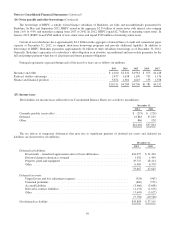

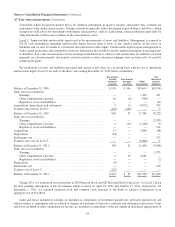

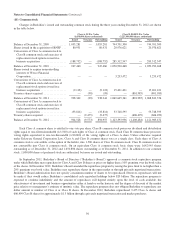

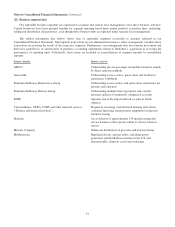

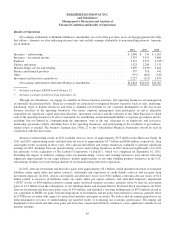

(20) Pension plans

Several of our subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under

the plans are generally based on years of service and compensation, although benefits under certain plans are based on years of

service and fixed benefit rates. Our subsidiaries make contributions to the plans, generally, to meet regulatory requirements.

Additional amounts may be contributed on a discretionary basis.

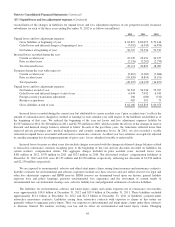

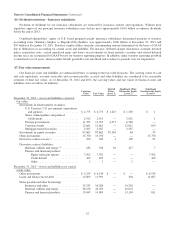

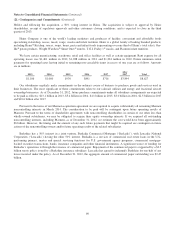

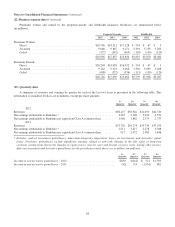

The components of net periodic pension expense for each of the three years ending December 31, 2012 are as follows

(in millions).

2012 2011 2010

Service cost ......................................................................... $247 $191 $165

Interest cost ......................................................................... 583 568 543

Expected return on plan assets .......................................................... (610) (579) (528)

Other, primarily amortization of actuarial losses ............................................ 220 102 69

Net pension expense .................................................................. $440 $282 $249

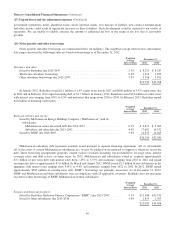

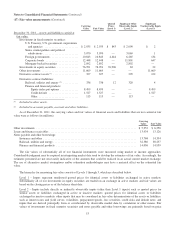

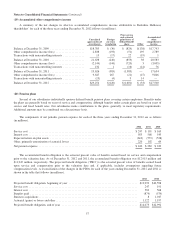

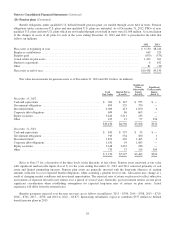

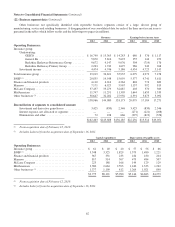

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation

prior to the valuation date. As of December 31, 2012 and 2011, the accumulated benefit obligation was $12,915 million and

$11,947 million, respectively. The projected benefit obligation (“PBO”) is the actuarial present value of benefits earned based

upon service and compensation prior to the valuation date and, if applicable, includes assumptions regarding future

compensation levels. A reconciliation of the changes in the PBOs for each of the years ending December 31, 2012 and 2011 is

shown in the table that follows (in millions).

2012 2011

Projected benefit obligation, beginning of year ................................................ $12,992 $10,598

Service cost ............................................................................ 247 191

Interest cost ............................................................................ 583 568

Benefits paid ........................................................................... (879) (579)

Business acquisitions ..................................................................... 8 1,017

Actuarial (gains) or losses and other ......................................................... 1,122 1,197

Projected benefit obligation, end of year ..................................................... $14,073 $12,992

57