Berkshire Hathaway 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

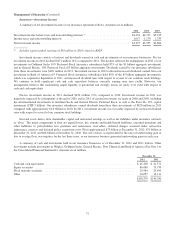

Investment and Derivative Gains/Losses (Continued)

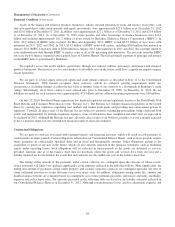

In each of the three years ending December 31, 2012, we recognized OTTI losses on certain of our equity and fixed

maturity investments. OTTI losses on fixed maturity investments were $337 million in 2012, $402 million in 2011 and $1,020

million in 2010. In each year, substantially all of the losses related to our investments in Texas Competitive Electric Holdings

(“TCEH”) bonds. In each year, we recognized losses after reevaluating expected cash flows likely to be received. While we do

not currently anticipate further OTTI losses on our TCEH investments, additional losses may be required in the future if the

company’s financial condition deteriorates further or it pursues bankruptcy reorganization. In 2011 and 2010, we also

recognized aggregate OTTI losses of $506 million and $953 million, respectively, related to our investments in equity securities.

Such OTTI losses in 2011 and 2010 averaged about 7.5% and 20%, respectively, of the original cost of the impaired securities.

In each case, the issuer had been profitable in recent periods and in some cases highly profitable. In 2011, a portion of the OTTI

losses related to certain components of our Wells Fargo common stock investments.

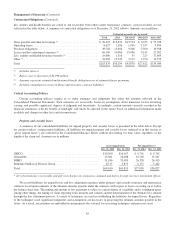

Although we have periodically recorded OTTI losses in earnings in each of the past three years, we continue to hold

positions in certain of the related securities. In cases where the market values of these investments have increased since the

dates the OTTI losses were recorded in earnings, these increases are not reflected in earnings but are instead included in

shareholders’ equity as a component of accumulated other comprehensive income. When recorded, OTTI losses have no impact

whatsoever on the asset values otherwise recorded in our Consolidated Balance Sheets or on our consolidated shareholders’

equity. In addition, the recognition of such losses in earnings rather than in accumulated other comprehensive income does not

necessarily indicate that sales are imminent or planned and sales ultimately may not occur for a number of years. Furthermore,

the recognition of OTTI losses does not necessarily indicate that the loss in value of the security is permanent or that the market

price of the security will not subsequently increase to and ultimately exceed our original cost.

As of December 31, 2012, unrealized losses on our investments in equity and fixed maturity securities (determined on an

individual purchase lot basis) were $257 million. We consider several factors in determining whether or not impairments are

deemed to be other than temporary, including the current and expected long-term business prospects and if applicable, the

creditworthiness of the issuer, our ability and intent to hold the investment until the price recovers and the length of time and

relative magnitude of the price decline. Security prices may remain below cost for a period of time that may be deemed

excessive from the standpoint of interpreting existing accounting rules, even though other factors suggest that the prices will

eventually recover. As a result, accounting regulations may require that we recognize OTTI losses in earnings in instances

where we may strongly believe that the market price of the impaired security will recover to at least our original cost and where

we possess the ability and intent to hold the security until, at least, that time.

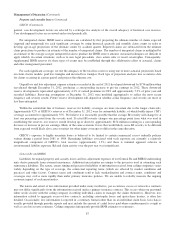

Derivative gains/losses primarily represent the changes in fair value of our credit default and equity index put option

contracts. Periodic changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the

volatility of underlying credit and equity markets. We have not actively traded into and out of credit default and equity index put

option contracts. Under many of the contracts, no settlements will occur until the contract expiration dates, which may occur

many years from now.

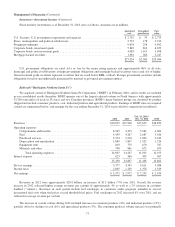

In 2012, we recorded pre-tax gains from derivative contracts of approximately $2.0 billion, which included gains from our

equity index put option contracts of approximately $1.0 billion. The gains from equity index put option contracts were due to

increased index values, foreign currency exchange rate changes and valuation adjustments on a small number of contracts where

contractual settlements are determined differently than the standard determination of intrinsic value, partially offset by lower

interest rate assumptions. Our ultimate payment obligations, if any, under our remaining equity index put option contracts will

be determined as of the contract expiration dates, which begin in 2018, based on the intrinsic value as defined under the

contracts as of those dates. Our recorded liability for these contracts was approximately $7.5 billion as of December 31, 2012.

In 2011, we recorded pre-tax losses of approximately $1.8 billion on our equity index put option contracts. The losses

reflected declines ranging from about 5.5% to 17% with respect to three of the four equity indexes covered under our contracts

and lower interest rate assumptions. In 2010, gains on equity index put option contracts were $172 million. In 2010, we settled

certain equity index put option contracts early at the request of the counterparty and recorded a gain of $561 million, which is

the difference between the recorded fair values of these contracts at the beginning of 2010 and the settlement payment amounts.

Otherwise, we recognized pre-tax losses of $389 million under our remaining equity index put option contracts reflecting

generally lower interest rate assumptions and the effect of foreign currency exchange rate changes. There were no new equity

contracts entered into or other settlements during the three year period ending December 31, 2012.

82