Berkshire Hathaway 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

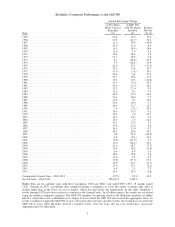

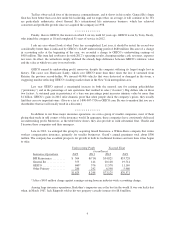

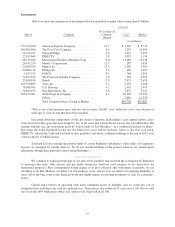

In Matt Rose, at BNSF, and Greg Abel, at MidAmerican, we have two outstanding CEOs. They are

extraordinary managers who have developed businesses that serve both their customers and owners well. Each has

my gratitude and each deserves yours. Here are the key figures for their businesses:

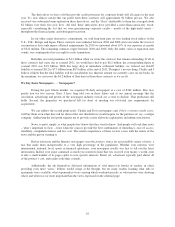

MidAmerican (89.8% owned) Earnings (in millions)

2012 2011

U.K. utilities .................................................... $ 429 $ 469

Iowa utility ..................................................... 236 279

Western utilities ................................................. 737 771

Pipelines ....................................................... 383 388

HomeServices ................................................... 82 39

Other (net) ...................................................... 91 36

Operating earnings before corporate interest and taxes ................... 1,958 1,982

Interest ........................................................ 314 336

Income taxes .................................................... 172 315

Net earnings .................................................... $ 1,472 $ 1,331

Earnings applicable to Berkshire .................................... $ 1,323 $ 1,204

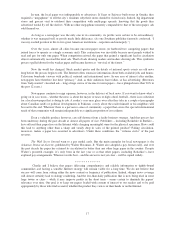

BNSF Earnings (in millions)

2012 2011

Revenues ....................................................... $20,835 $19,548

Operating expenses ............................................... 14,835 14,247

Operating earnings before interest and taxes ........................... 6,000 5,301

Interest (net) .................................................... 623 560

Income taxes .................................................... 2,005 1,769

Net earnings .................................................... $ 3,372 $ 2,972

Sharp-eyed readers will notice an incongruity in the MidAmerican earnings tabulation. What in the world

is HomeServices, a real estate brokerage operation, doing in a section entitled “Regulated, Capital-Intensive

Businesses?”

Well, its ownership came with MidAmerican when we bought control of that company in 2000. At that

time, I focused on MidAmerican’s utility operations and barely noticed HomeServices, which then owned only a

few real estate brokerage companies.

Since then, however, the company has regularly added residential brokers – three in 2012 – and now has

about 16,000 agents in a string of major U.S. cities. (Our real estate brokerage companies are listed on page 107.)

In 2012, our agents participated in $42 billion of home sales, up 33% from 2011.

Additionally, HomeServices last year purchased 67% of the Prudential and Real Living franchise

operations, which together license 544 brokerage companies throughout the country and receive a small royalty on

their sales. We have an arrangement to purchase the balance of those operations within five years. In the coming

years, we will gradually rebrand both our franchisees and the franchise firms we own as Berkshire Hathaway

HomeServices.

Ron Peltier has done an outstanding job in managing HomeServices during a depressed period. Now, as

the housing market continues to strengthen, we expect earnings to rise significantly.

11