Berkshire Hathaway 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

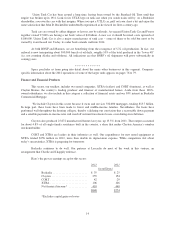

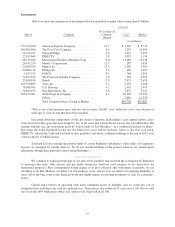

Investments

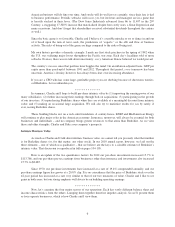

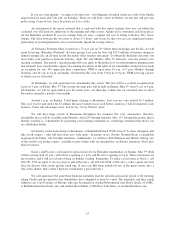

Below we show our common stock investments that at yearend had a market value of more than $1 billion.

12/31/12

Shares Company

Percentage of

Company

Owned

Cost* Market

(in millions)

151,610,700 American Express Company .............. 13.7 $ 1,287 $ 8,715

400,000,000 The Coca-Cola Company ................. 8.9 1,299 14,500

24,123,911 ConocoPhillips ......................... 2.0 1,219 1,399

22,999,600 DIRECTV ............................ 3.8 1,057 1,154

68,115,484 International Business Machines Corp. ...... 6.0 11,680 13,048

28,415,250 Moody’s Corporation .................... 12.7 287 1,430

20,060,390 Munich Re ............................ 11.3 2,990 3,599

20,668,118 Phillips 66 ............................ 3.3 660 1,097

3,947,555 POSCO ............................... 5.1 768 1,295

52,477,678 The Procter & Gamble Company ........... 1.9 336 3,563

25,848,838 Sanofi ................................ 2.0 2,073 2,438

415,510,889 Tesco plc ............................. 5.2 2,350 2,268

78,060,769 U.S. Bancorp .......................... 4.2 2,401 2,493

54,823,433 Wal-Mart Stores, Inc. .................... 1.6 2,837 3,741

456,170,061 Wells Fargo & Company ................. 8.7 10,906 15,592

Others ................................ 7,646 11,330

Total Common Stocks Carried at Market .... $49,796 $87,662

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases because of

write-ups or write-downs that have been required.

One point about the composition of this list deserves mention. In Berkshire’s past annual reports, every

stock itemized in this space has been bought by me, in the sense that I made the decision to buy it for Berkshire. But

starting with this list, any investment made by Todd Combs or Ted Weschler – or a combined purchase by them –

that meets the dollar threshold for the list ($1 billion this year) will be included. Above is the first such stock,

DIRECTV, which both Todd and Ted hold in their portfolios and whose combined holdings at the end of 2012 were

valued at the $1.15 billion shown.

Todd and Ted also manage the pension funds of certain Berkshire subsidiaries, while others, for regulatory

reasons, are managed by outside advisers. We do not include holdings of the pension funds in our annual report

tabulations, though their portfolios often overlap Berkshire’s.

************

We continue to wind down the part of our derivatives portfolio that involved the assumption by Berkshire

of insurance-like risks. (Our electric and gas utility businesses, however, will continue to use derivatives for

operational purposes.) New commitments would require us to post collateral and, with minor exceptions, we are

unwilling to do that. Markets can behave in extraordinary ways, and we have no interest in exposing Berkshire to

some out-of-the-blue event in the financial world that might require our posting mountains of cash on a moment’s

notice.

Charlie and I believe in operating with many redundant layers of liquidity, and we avoid any sort of

obligation that could drain our cash in a material way. That reduces our returns in 99 years out of 100. But we will

survive in the 100th while many others fail. And we will sleep well in all 100.

15