Berkshire Hathaway 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

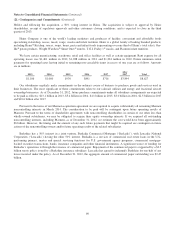

(21) Contingencies and Commitments (Continued)

Holdco and following the acquisition, a 50% voting interest in Heinz. The acquisition is subject to approval by Heinz

shareholders, receipt of regulatory approvals and other customary closing conditions, and is expected to close in the third

quarter of 2013.

Heinz Company is one of the world’s leading marketers and producers of healthy, convenient and affordable foods

specializing in ketchup, sauces, meals, soups, snacks and infant nutrition. Heinz is a global family of leading branded products,

including Heinz®Ketchup, sauces, soups, beans, pasta and infant foods (representing over one third of Heinz’s total sales), Ore-

Ida®potato products, Weight Watchers®Smart Ones®entrées, T.G.I. Friday’s®snacks, and Plasmon infant nutrition.

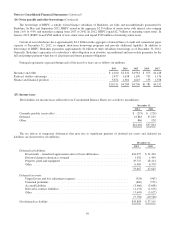

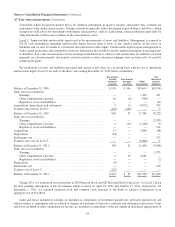

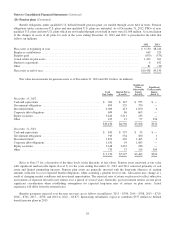

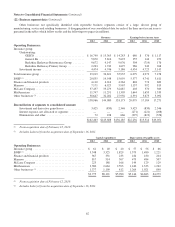

We lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all

operating leases was $1,401 million in 2012, $1,288 million in 2011 and $1,204 million in 2010. Future minimum rental

payments for operating leases having initial or remaining non-cancelable terms in excess of one year are as follows. Amounts

are in millions.

2013 2014 2015 2016 2017

After

2017 Total

$1,186 $1,060 $930 $841 $716 $3,894 $8,627

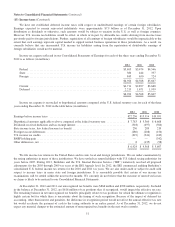

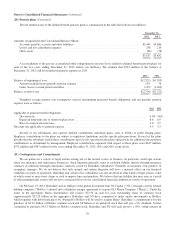

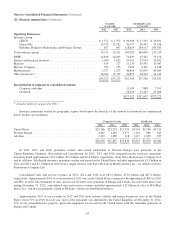

Our subsidiaries regularly make commitments in the ordinary course of business to purchase goods and services used in

their businesses. The most significant of these commitments relate to our railroad, utilities and energy and fractional aircraft

ownership businesses. As of December 31, 2012, future purchase commitments under all subsidiary arrangements are expected

to be paid as follows: $13.1 billion in 2013, $5.4 billion in 2014, $4.1 billion in 2015, $3.0 billion in 2016, $2.5 billion in 2017

and $10.6 billion after 2017.

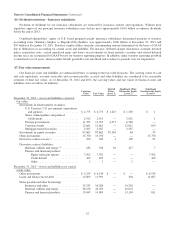

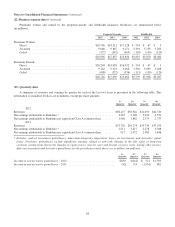

Pursuant to the terms of our Marmon acquisition agreement we are required to acquire substantially all remaining Marmon

noncontrolling interests in March 2014. The consideration to be paid will be contingent upon future operating results of

Marmon. Pursuant to the terms of shareholder agreements with noncontrolling shareholders in certain of our other less than

wholly-owned subsidiaries, we may be obligated to acquire their equity ownership interests. If we acquired all outstanding

noncontrolling interests, including Marmon, as of December 31, 2012, we estimate the cost would have been approximately

$6 billion. However, the timing and the amount of any such future payments that might be required are contingent on future

actions of the noncontrolling owners and/or future operating results of the related subsidiaries.

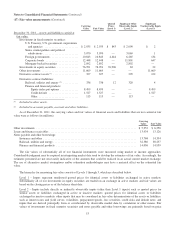

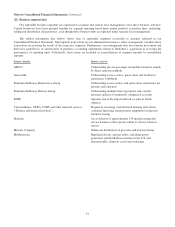

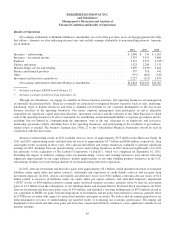

Berkshire has a 50% interest in a joint venture, Berkadia Commercial Mortgage (“Berkadia”), with Leucadia National

Corporation (“Leucadia”) having the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S.,

performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgage-

backed securities transactions, banks, insurance companies and other financial institutions. A significant source of funding for

Berkadia’s operations is through the issuance of commercial paper. Repayment of the commercial paper is supported by a $2.5

billion surety policy issued by a Berkshire insurance subsidiary. Leucadia has agreed to indemnify Berkshire for one-half of any

losses incurred under the policy. As of December 31, 2012, the aggregate amount of commercial paper outstanding was $2.47

billion.

60