Berkshire Hathaway 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our luck, however, changed early this year. In February, we agreed to buy 50% of a holding company that

will own all of H. J. Heinz. The other half will be owned by a small group of investors led by Jorge Paulo

Lemann, a renowned Brazilian businessman and philanthropist.

We couldn’t be in better company. Jorge Paulo is a long-time friend of mine and an extraordinary

manager. His group and Berkshire will each contribute about $4 billion for common equity in the holding

company. Berkshire will also invest $8 billion in preferred shares that pay a 9% dividend. The preferred

has two other features that materially increase its value: at some point it will be redeemed at a significant

premium price and the preferred also comes with warrants permitting us to buy 5% of the holding

company’s common stock for a nominal sum.

Our total investment of about $12 billion soaks up much of what Berkshire earned last year. But we still

have plenty of cash and are generating more at a good clip. So it’s back to work; Charlie and I have again

donned our safari outfits and resumed our search for elephants.

Now to some good news from 2012:

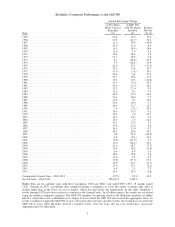

ŠLast year I told you that BNSF, Iscar, Lubrizol, Marmon Group and MidAmerican Energy – our five most

profitable non-insurance companies – were likely to earn more than $10 billion pre-tax in 2012. They

delivered. Despite tepid U.S. growth and weakening economies throughout much of the world, our

“powerhouse five” had aggregate earnings of $10.1 billion, about $600 million more than in 2011.

Of this group, only MidAmerican, then earning $393 million pre-tax, was owned by Berkshire eight years

ago. Subsequently, we purchased another three of the five on an all-cash basis. In acquiring the fifth,

BNSF, we paid about 70% of the cost in cash, and for the remainder, issued shares that increased the

amount outstanding by 6.1%. Consequently, the $9.7 billion gain in annual earnings delivered Berkshire

by the five companies has been accompanied by only minor dilution. That satisfies our goal of not simply

growing, but rather increasing per-share results.

Unless the U.S. economy tanks – which we don’t expect – our powerhouse five should again deliver higher

earnings in 2013. The five outstanding CEOs who run them will see to that.

Š

Though I failed to land a major acquisition in 2012, the managers of our subsidiaries did far better. We had

a record year for “bolt-on” purchases, spending about $2.3 billion for 26 companies that were melded into

our existing businesses. These transactions were completed without Berkshire issuing any shares.

Charlie and I love these acquisitions: Usually they are low-risk, burden headquarters not at all, and expand

the scope of our proven managers.

ŠOur insurance operations shot the lights out last year. While giving Berkshire $73 billion of free money to

invest, they also delivered a $1.6 billion underwriting gain, the tenth consecutive year of profitable

underwriting. This is truly having your cake and eating it too.

GEICO led the way, continuing to gobble up market share without sacrificing underwriting discipline.

Since 1995, when we obtained control, GEICO’s share of the personal-auto market has grown from 2.5% to

9.7%. Premium volume meanwhile increased from $2.8 billion to $16.7 billion. Much more growth lies

ahead.

The credit for GEICO’s extraordinary performance goes to Tony Nicely and his 27,000 associates. And to

that cast, we should add our Gecko. Neither rain nor storm nor gloom of night can stop him; the little lizard

just soldiers on, telling Americans how they can save big money by going to GEICO.com.

When I count my blessings, I count GEICO twice.

4