Berkshire Hathaway 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

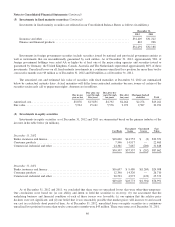

(5) Other investments (Continued)

In 2009, we acquired 3,000,000 shares of Series A Cumulative Convertible Perpetual Preferred Stock of Dow (“Dow

Preferred”) for a cost of $3 billion. Under certain conditions, we can convert each share of the Dow Preferred into 24.201 shares

of Dow common stock (equivalent to a conversion price of $41.32 per share). Beginning in April 2014, if Dow’s common stock

price exceeds $53.72 per share for any 20 trading days in a consecutive 30-day window, Dow, at its option, at any time, in

whole or in part, may convert the Dow Preferred into Dow common stock at the then applicable conversion rate. The Dow

Preferred is entitled to dividends at a rate of 8.5% per annum.

On September 1, 2011, we acquired 50,000 shares of 6% Cumulative Perpetual Preferred Stock of BAC (“BAC Preferred”)

and warrants to purchase 700,000,000 shares of common stock of BAC (“BAC Warrants”) for a combined cost of $5 billion.

The BAC Preferred is redeemable at any time by BAC at a price of $105,000 per share ($5.25 billion in aggregate). The BAC

Warrants expire in 2021 and are exercisable for an additional aggregate cost of $5 billion ($7.142857/share).

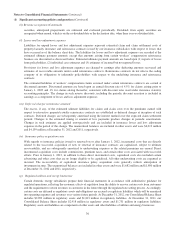

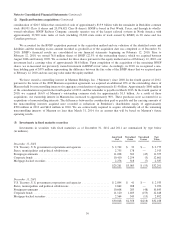

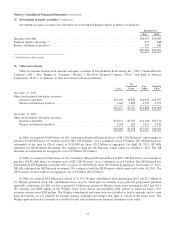

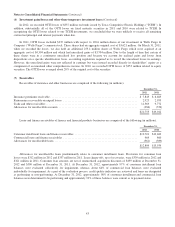

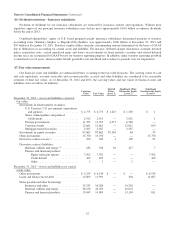

(6) Investment gains/losses and other-than-temporary investment losses

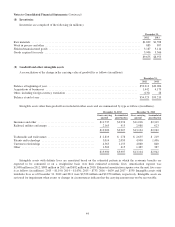

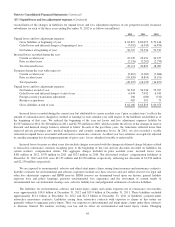

Investment gains/losses for each of the three years ending December 31, 2012 are summarized below (in millions).

2012 2011 2010

Fixed maturity securities —

Gross gains from sales and other disposals .......................................... $ 188 $ 310 $ 720

Gross losses from sales and other disposals .......................................... (354) (10) (16)

Equity securities and other investments —

Gross gains from sales and other disposals .......................................... 1,468 1,889 2,603

Gross losses from sales and other disposals .......................................... (12) (36) (266)

Other ............................................................................ 509 29 1,017

$1,799 $2,182 $4,058

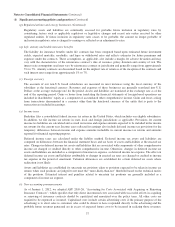

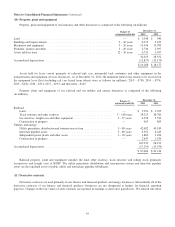

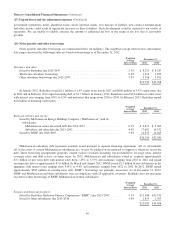

Investment gains/losses for each of the three years ending December 31, 2012 are reflected in our Consolidated Statements

of Earnings as follows (in millions).

2012 2011 2010

Insurance and other ................................................................ $1,327 $1,973 $4,044

Finance and financial products ........................................................ 472 209 14

$1,799 $2,182 $4,058

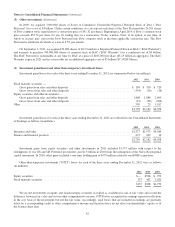

Investment gains from equity securities and other investments in 2011 included $1,775 million with respect to the

redemptions of our GS and GE Preferred investments and $1.3 billion in 2010 from the redemption of the Swiss Re perpetual

capital instrument. In 2010, other gains included a one-time holding gain of $979 million related to our BNSF acquisition.

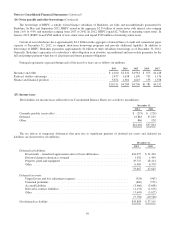

Other-than-temporary investment (“OTTI”) losses for each of the three years ending December 31, 2012 were as follows

(in millions).

2012 2011 2010

Equity securities ...................................................................... $— $506 $ 953

Fixed maturity securities ............................................................... 337 402 1,020

$337 $908 $1,973

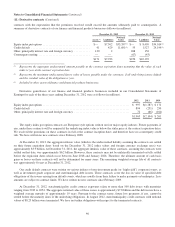

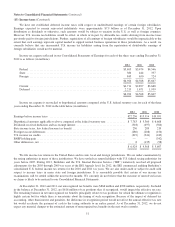

We record investments in equity and fixed maturity securities classified as available-for-sale at fair value and record the

difference between fair value and cost in other comprehensive income. OTTI losses recognized in earnings represent reductions

in the cost basis of the investment, but not the fair value. Accordingly, such losses that are included in earnings are generally

offset by a corresponding credit to other comprehensive income and therefore have no net effect on shareholders’ equity as of

the balance sheet date.

42