Berkshire Hathaway 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

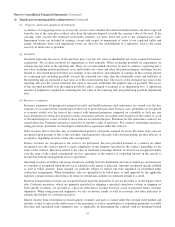

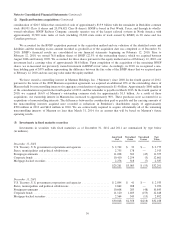

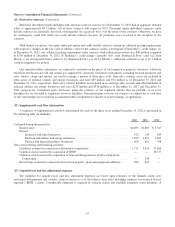

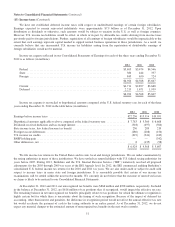

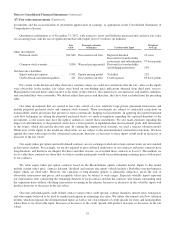

(10) Property, plant and equipment

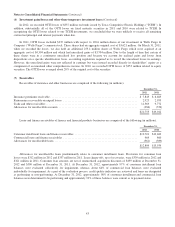

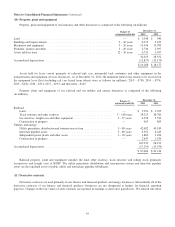

Property, plant and equipment of our insurance and other businesses is comprised of the following (in millions).

Ranges of

estimated useful life

December 31,

2012 2011

Land ................................................................ — $ 1,048 $ 940

Buildings and improvements ............................................. 2–40years 6,074 5,429

Machinery and equipment ............................................... 3–20years 15,436 13,589

Furniture, fixtures and other .............................................. 2–20years 2,736 2,397

Assets held for lease .................................................... 12–30years 6,731 5,997

32,025 28,352

Accumulated depreciation ............................................... (12,837) (10,175)

$ 19,188 $ 18,177

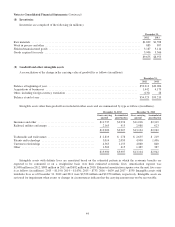

Assets held for lease consist primarily of railroad tank cars, intermodal tank containers and other equipment in the

transportation and equipment services businesses. As of December 31, 2012, the minimum future lease rentals to be received on

the equipment lease fleet (including rail cars leased from others) were as follows (in millions): 2013 – $730; 2014 – $574;

2015 – $436; 2016 – $314; 2017 – $193; and thereafter – $245.

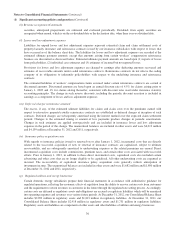

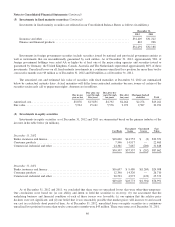

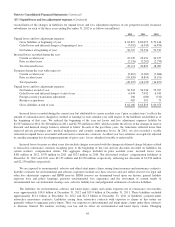

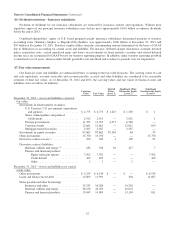

Property, plant and equipment of our railroad and our utilities and energy businesses is comprised of the following

(in millions).

Ranges of

estimated useful life

December 31,

2012 2011

Railroad:

Land ............................................................ — $ 5,950 $ 5,925

Track structure and other roadway .................................... 5–100years 38,255 36,760

Locomotives, freight cars and other equipment ........................... 5–37years 6,528 5,533

Construction in progress ............................................ — 963 885

Utilities and energy:

Utility generation, distribution and transmission system .................... 5–80years 42,682 40,180

Interstate pipeline assets ............................................ 3–80years 6,354 6,245

Independent power plants and other assets .............................. 3–30years 1,860 1,106

Construction in progress ............................................ — 2,647 1,559

105,239 98,193

Accumulated depreciation ............................................... (17,555) (15,979)

$ 87,684 $ 82,214

Railroad property, plant and equipment includes the land, other roadway, track structure and rolling stock (primarily

locomotives and freight cars) of BNSF. The utility generation, distribution and transmission system and interstate pipeline

assets are the regulated assets of public utility and natural gas pipeline subsidiaries.

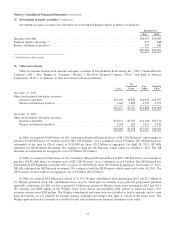

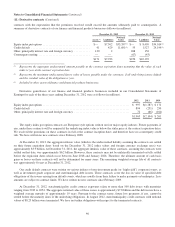

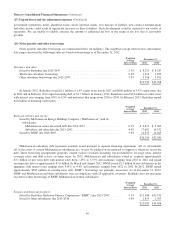

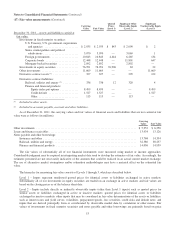

(11) Derivative contracts

Derivative contracts are used primarily in our finance and financial products and energy businesses. Substantially all of the

derivative contracts of our finance and financial products businesses are not designated as hedges for financial reporting

purposes. Changes in the fair values of such contracts are reported in earnings as derivative gains/losses. We entered into these

45