Berkshire Hathaway 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

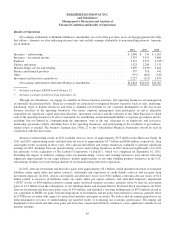

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Property/casualty (Continued)

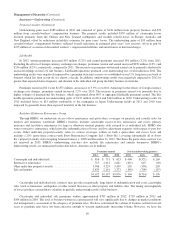

Underwriting gains were $289 million in 2010 and consisted of gains of $236 million from property business and $53

million from casualty/workers’ compensation business. The property results included $339 million of catastrophe losses

incurred primarily from the Chilean and New Zealand earthquakes and weather related losses in Europe, Australia and

New England, offset by reductions in liability estimates for prior years’ losses. The underwriting gains of $53 million from

casualty/workers’ compensation business reflected overall reductions in estimated prior years’ loss reserves, offset in part by

$125 million of accretion of discounted workers’ compensation liabilities and amortization of deferred charges.

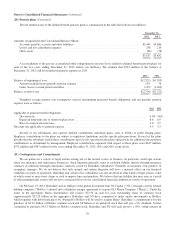

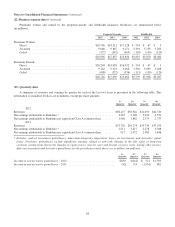

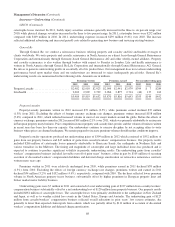

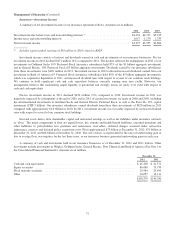

Life/health

In 2012, written premiums increased $93 million (3.2%) and earned premiums increased $91 million (3.2%) from 2011.

Excluding the effects of foreign currency exchange rate changes, premiums written and earned increased $239 million (8.2%) and

$236 million (8.2%), respectively, compared to 2011. The increases in premiums written and earned can be primarily attributed to

increased writings in non-U.S. life business. Life/health operations produced a net underwriting loss of $44 million in 2012. The

underwriting results were negatively impacted by a premium deficiency reserve we established on our U.S. long-term care book of

business which has been in run-off for almost a decade. In addition, underwriting results were negatively impacted in 2012 by

greater than expected claims frequency and duration in the individual and group disability business in Australia.

Premiums earned in 2011 were $2,875 million, an increase of 5.9% over 2010. Adjusting for the effects of foreign currency

exchange rate changes, premiums earned increased 2.2% over 2010. The increase in premiums earned was primarily due to

higher volumes of international life business, which represented about 60% of aggregate life/health premiums earned. The life/

health operations produced net underwriting gains of $137 million in 2011 and $163 million in 2010. Underwriting results for

2011 included losses of $15 million attributable to the earthquake in Japan. Underwriting results in 2011 and 2010 were

impacted by generally lower than expected mortality in the life business.

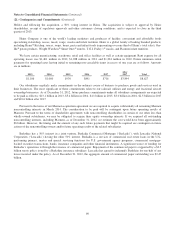

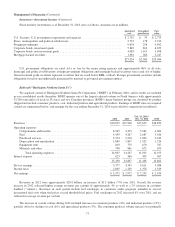

Berkshire Hathaway Reinsurance Group

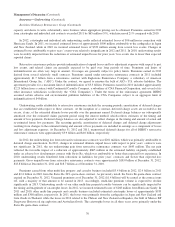

Through BHRG, we underwrite excess-of-loss reinsurance and quota-share coverages on property and casualty risks for

insurers and reinsurers worldwide. BHRG’s business includes catastrophe excess-of-loss reinsurance and excess primary

insurance and facultative reinsurance for large or otherwise unusual property risks referred to as individual risk. BHRG also

writes retroactive reinsurance, which provides indemnification of losses and loss adjustment expenses with respect to past loss

events. Other multi-line property/casualty refers to various coverages written on both a quota-share and excess basis and

includes a 20% quota-share contract with Swiss Reinsurance Company Ltd. (“Swiss Re”) covering substantially all of Swiss

Re’s property/casualty risks incepting between January 1, 2008 and December 31, 2012. The Swiss Re quota-share contract was

not renewed in 2013. BHRG’s underwriting activities also include life reinsurance and annuity businesses. BHRG’s

underwriting results are summarized in the table below. Amounts are in millions.

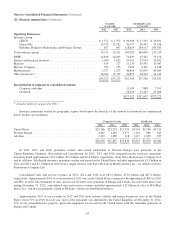

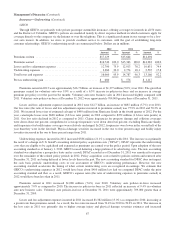

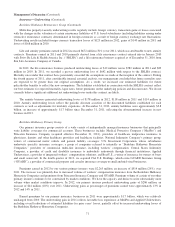

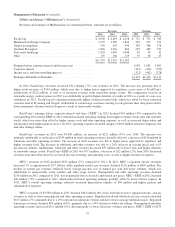

Premiums earned Pre-tax underwriting gain/loss

2012 2011 2010 2012 2011 2010

Catastrophe and individual risk ........................... $ 816 $ 751 $ 623 $400 $(321) $ 260

Retroactive reinsurance ................................. 717 2,011 2,621 (201) 645 (90)

Other multi-line property/casualty ........................ 5,306 4,224 3,459 295 (338) 203

Life and annuity ....................................... 2,833 2,161 2,373 (190) (700) (197)

$9,672 $9,147 $9,076 $ 304 $(714) $ 176

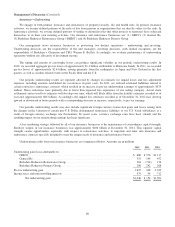

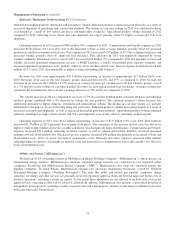

Catastrophe and individual risk contracts may provide exceptionally large limits of indemnification and cover catastrophe

risks (such as hurricanes, earthquakes or other natural disasters) or other property and liability risks. The timing and magnitude

of losses produces extraordinary volatility in periodic underwriting results of this business.

Catastrophe and individual risk premiums written approximated $785 million in 2012, $720 million in 2011 and

$584 million in 2010. The level of business written in a given period will vary significantly due to changes in market conditions

and management’s assessment of the adequacy of premium rates. We have constrained the volume of business written in recent

years as premium rates have not been attractive enough to warrant significantly increasing volume. However, we have the

69