Berkshire Hathaway 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Property and casualty losses (Continued)

General Re (Continued)

General Re’s loss reserve estimation process is based upon a ground-up approach, beginning with case estimates and

supplemented by additional case reserves (“ACRs”) and IBNR reserves. The critical processes in establishing loss reserves

involve the establishment of ACRs by claim examiners, the determination of expected ultimate loss ratios which drive IBNR

reserve amounts and the comparison of case reserve reporting trends to the expected loss reporting patterns. Recorded reserve

amounts are subject to “tail risk” where reported losses develop beyond the maximum expected loss emergence time period.

We do not routinely determine loss reserve ranges. We believe that the techniques necessary to make such determinations

have not sufficiently developed and that the myriad of assumptions required render such resulting ranges to be unreliable. In

addition, claim counts or average amounts per claim are not utilized because clients do not consistently provide reliable data in

sufficient detail.

Upon notification of a reinsurance claim from a ceding company, our claim examiners make independent evaluations of

loss amounts. In some cases, examiners’ estimates differ from amounts reported by ceding companies. If the examiners’

estimates are significantly greater than the ceding company’s estimates, the claims are further investigated. If deemed

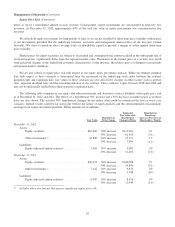

appropriate, ACRs are established above the amount reported by the ceding company. As of December 31, 2012, ACRs

aggregated approximately $2.5 billion before discounts and were concentrated in workers’ compensation reserves, and to a

lesser extent in professional liability reserves. Our examiners also periodically conduct detailed claim reviews of individual

clients and case reserves are often increased as a result. In 2012, we conducted 270 claim reviews.

Our actuaries classify all loss and premium data into segments (“reserve cells”) primarily based on product (e.g., treaty,

facultative and program) and line of business (e.g., auto liability, property, etc.). For each reserve cell, premiums and losses are

aggregated by accident year, policy year or underwriting year (depending on client reporting practices) and analyzed over time.

We internally refer to these loss aggregations as loss triangles, which serve as the primary basis for our IBNR reserve

calculations. We review over 300 reserve cells for our North American business and approximately 900 reserve cells with

respect to our international business.

We use loss triangles to determine the expected case loss emergence patterns for most coverages and, in conjunction with

expected loss ratios by accident year, loss triangles are further used to determine IBNR reserves. While additional calculations

form the basis for estimating the expected loss emergence pattern, the determination of the expected loss emergence pattern is

not strictly a mechanical process. In instances where the historical loss data is insufficient, we use estimation formulas along

with reliance on other loss triangles and judgment. Factors affecting our loss development triangles include but are not limited

to the following: changes in client claims practices, changes in claim examiners’ use of ACRs or the frequency of client

company claim reviews, changes in policy terms and coverage (such as client loss retention levels and occurrence and aggregate

policy limits), changes in loss trends and changes in legal trends that result in unanticipated losses, as well as other sources of

statistical variability. Collectively, these factors influence the selection of the expected loss emergence patterns.

We select expected loss ratios by reserve cell, by accident year, based upon reviewing forecasted losses and indicated

ultimate loss ratios that are predicted from aggregated pricing statistics. Indicated ultimate loss ratios are calculated using the

selected loss emergence pattern, reported losses and earned premium. If the selected emergence pattern is not accurate, then the

indicated ultimate loss ratios may not be accurate, which can affect the selected loss ratios and hence the IBNR reserve. As with

selected loss emergence patterns, selecting expected loss ratios is not a strictly mechanical process and judgment is used in the

analysis of indicated ultimate loss ratios and department pricing loss ratios.

We estimate IBNR reserves by reserve cell, by accident year, using the expected loss emergence patterns and the expected

loss ratios. The expected loss emergence patterns and expected loss ratios are the critical IBNR reserving assumptions and are

updated annually. Once the annual IBNR reserves are determined, our actuaries calculate expected case loss emergence for the

upcoming calendar year. These calculations do not involve new assumptions and use the prior year-end expected loss

emergence patterns and expected loss ratios. The expected losses are then allocated into interim estimates that are compared to

actual reported losses in the subsequent year. This comparison provides a test of the adequacy of prior year-end IBNR reserves

and forms the basis for possibly changing IBNR reserve assumptions during the course of the year.

89