Berkshire Hathaway 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2012

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2012 ANNUAL REPORT -

Page 2

Business Activities Berkshire Hathaway Inc. is a holding company owning subsidiaries that engage in a number of diverse business activities including insurance and reinsurance, freight rail transportation, utilities and energy, finance, manufacturing, services and retailing. Included in the group of... -

Page 3

BERKSHIRE HATHAWAY INC. 2012 ANNUAL REPORT TABLE OF CONTENTS Business Activities ...Inside Front Cover Corporate Performance vs. the S&P 500 ...Chairman's Letter* ...Acquisition Criteria ...Management's Report on Internal Control Over Financial Reporting ...Selected Financial Data for the Past Five... -

Page 4

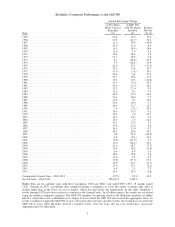

Berkshire's Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included (1) (2) ...23.8 20.3 11.0 19.0 16.2 12.0 16.4 21.7 4.7 5.5 21.9 59.3 31.9 24.0 35.7 19.3 31.4 40.0 32.3 13.6 48.2 26.1 19.5 20.1 44.4 7.4 39.6 ... -

Page 5

... Munger, the company's Vice Chairman, and I will not change yardsticks. It's our job to increase intrinsic business value - for which we use book value as a significantly understated proxy - at a faster rate than the market gains of the S&P. If we do so, Berkshire's share price, though unpredictable... -

Page 6

...holding company. Berkshire will also invest $8 billion in preferred shares that pay a 9% dividend. The preferred has two other features that materially increase its value: at some point it will be redeemed at a significant premium price and the preferred also comes with warrants permitting us to buy... -

Page 7

... Combs and Ted Weschler, our new investment managers, have proved to be smart, models of integrity, helpful to Berkshire in many ways beyond portfolio management, and a perfect cultural fit. We hit the jackpot with these two. In 2012 each outperformed the S&P 500 by double-digit margins. They left... -

Page 8

...Berkshire shares. Those building blocks rest on a rock-solid foundation. A century hence, BNSF and MidAmerican Energy will continue to play major roles in the American economy. Insurance, moreover, will always be essential for both businesses and individuals - and no company brings greater resources... -

Page 9

... for Berkshire's benefit. Though individual policies and claims come and go, the amount of float we hold remains quite stable in relation to premium volume. Consequently, as our business grows, so does our float. And how we have grown, as the following table shows: Year 1970 1980 1990 2000 2010 2012... -

Page 10

... "Berkshire-quality" float existing in the insurance world. In 37 of the 45 years ending in 2011, the industry's premiums have been inadequate to cover claims plus expenses. Consequently, the industry's overall return on tangible equity has for many decades fallen far short of the average return... -

Page 11

...workers compensation insurance, primarily for smaller businesses. Guard's annual premiums total about $300 million. The company has excellent prospects for growth in both its traditional business and new lines it has begun to offer. Underwriting Profit Yearend Float (in millions) 2012 2011 2012 2011... -

Page 12

... GAAP balance sheet and income statement. A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact not needed because each business... -

Page 13

... in a string of major U.S. cities. (Our real estate brokerage companies are listed on page 107.) In 2012, our agents participated in $42 billion of home sales, up 33% from 2011. Additionally, HomeServices last year purchased 67% of the Prudential and Real Living franchise operations, which together... -

Page 14

Manufacturing, Service and Retailing Operations Our activities in this part of Berkshire cover the waterfront. Let's look, though, at a summary balance sheet and earnings statement for the entire group. Balance Sheet 12/31/12 (in millions) Assets Cash and equivalents ...Accounts and notes receivable... -

Page 15

...therefore, the companies in this group are an excellent business. They employ $22.6 billion of net tangible assets and, on that base, earned 16.3% after-tax. Of course, a business with terrific economics can be a bad investment if the price paid is excessive. We have paid substantial premiums to net... -

Page 16

... other businesses in this segment. Companyspecific information about the 2012 operations of some of the larger units appears on pages 76 to 79. Finance and Financial Products This sector, our smallest, includes two rental companies, XTRA (trailers) and CORT (furniture), as well as Clayton Homes, the... -

Page 17

... of this list deserves mention. In Berkshire's past annual reports, every stock itemized in this space has been bought by me, in the sense that I made the decision to buy it for Berkshire. But starting with this list, any investment made by Todd Combs or Ted Weschler - or a combined purchase by them... -

Page 18

... be considerably less than the amount we currently carry on our books. In the meantime, we can invest the $4.2 billion of float derived from these contracts as we see fit. We Buy Some Newspapers ...Newspapers? During the past fifteen months, we acquired 28 daily newspapers at a cost of $344 million... -

Page 19

... "survival of the fattest." Now the world has changed. Stock market quotes and the details of national sports events are old news long before the presses begin to roll. The Internet offers extensive information about both available jobs and homes. Television bombards viewers with political, national... -

Page 20

... test for acquisitions. Results to date support that belief. Charlie and I, however, still operate under economic principle 11 (detailed on page 99) and will not continue the operation of any business doomed to unending losses. One daily paper that we acquired in a bulk purchase from Media General... -

Page 21

...'s 1986 annual report, I described how twenty years of management effort and capital improvements in our original textile business were an exercise in futility. I wanted the business to succeed and wished my way into a series of bad decisions. (I even bought another New England textile company.) But... -

Page 22

... more cash to spend annually and more capital value. This calculation, of course, assumes that our hypothetical company can earn an average of 12% annually on net worth and that its shareholders can sell their shares for an average of 125% of book value. To that point, the S&P 500 earns considerably... -

Page 23

... turn around and use his dividends to purchase more shares. But he would take a beating in doing so: He would both incur taxes and also pay a 25% premium to get his dividend reinvested. (Keep remembering, open-market purchases of the stock take place at 125% of book value.) The second disadvantage... -

Page 24

... in New York in 3:36. Charlie did not return his questionnaire. GEICO will have a booth in the shopping area, staffed by a number of its top counselors from around the country. Stop by for a quote. In most cases, GEICO will be able to give you a shareholder discount (usually 8%). This special offer... -

Page 25

... planned to rent a car in Omaha. Spend the savings with us. At Nebraska Furniture Mart, located on a 77-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" discount pricing. Last year the store did $35.9 million of business during its annual meeting sale... -

Page 26

... requirements, files a 21,500-page Federal income tax return as well as state and foreign returns, responds to countless shareholder and media inquiries, gets out the annual report, prepares for the country's largest annual meeting, coordinates the Board's activities - and the list goes on and on... -

Page 27

.... We prefer to buy for cash, but will consider issuing stock when we receive as much in intrinsic business value as we give. We don't participate in auctions. Charlie and I frequently get approached about acquisitions that don't come close to meeting our tests: We've found that if you advertise an... -

Page 28

... except per-share data) 2012 Revenues: Insurance premiums earned ...Sales and service revenues ...Revenues of railroad, utilities and energy businesses (1) ...Interest, dividend and other investment income ...Interest and other revenues of finance and financial products businesses ...Investment and... -

Page 29

... ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. Omaha, Nebraska We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2012 and 2011, and the related consolidated statements of... -

Page 30

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions) December 31, 2012 2011 ASSETS Insurance and Other: Cash and cash equivalents ...$ 42,358 $ 33,513 Investments: Fixed maturity securities ...31,449 31,222 Equity securities ...86,467 76,063 Other ...16,057 13,... -

Page 31

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per-share amounts) Year Ended December 31, 2012 2011 2010 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income... -

Page 32

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (dollars in millions) 2012 2011 2010 Net earnings ...Other comprehensive income: Net change in unrealized appreciation of investments ...Applicable income taxes ...Reclassification of investment appreciation in... -

Page 33

... ...Acquisitions of businesses, net of cash acquired ...Purchases of property, plant and equipment ...Other ...Net cash flows from investing activities ...Cash flows from financing activities: Proceeds from borrowings of insurance and other businesses ...Proceeds from borrowings of railroad... -

Page 34

... FINANCIAL STATEMENTS December 31, 2012 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire") is a holding company owning subsidiaries engaged in a number of diverse business activities, including insurance... -

Page 35

... when we have the power to direct and the right to receive residual returns. Substantially all of these loans are secured by real or personal property. Allowances for credit losses from manufactured housing and other real estate loans include estimates of losses on loans currently in foreclosure and... -

Page 36

... our Consolidated Balance Sheets. (g) Fair value measurements As defined under GAAP, fair value is the price that would be received to sell an asset or paid to transfer a liability between market participants in the principal market or in the most advantageous market when no principal market exists... -

Page 37

... represents the excess of the purchase price over the fair value of identifiable net assets acquired in business acquisitions. We evaluate goodwill for impairment at least annually. When evaluating goodwill for impairment we estimate the fair value of the reporting unit. There are several methods... -

Page 38

... 31, 2012 and 2011, respectively. (n) Insurance policy acquisition costs With regards to insurance policies issued or renewed on or after January 1, 2012, incremental costs that are directly related to the successful acquisition of new or renewal of insurance contracts are capitalized, subject... -

Page 39

... related to uncertain tax positions are generally included as a component of income tax expense. (t) New accounting pronouncements As of January 1, 2012, we adopted ASU 2010-26, "Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts", which specifies that only direct... -

Page 40

... new pronouncements will have a material effect on our Consolidated Financial Statements. (2) Significant business acquisitions Our long-held acquisition strategy is to acquire businesses with consistent earning power, good returns on equity and able and honest management at sensible prices. In 2012... -

Page 41

... Financial Statements (Continued) (2) Significant business acquisitions (Continued) consideration of $26.5 billion that consisted of cash of approximately $15.9 billion with the remainder in Berkshire common stock (80,931 Class A shares and 20,976,621 Class B shares). BNSF is based in Fort Worth... -

Page 42

... to Consolidated Financial Statements (Continued) (3) Investments in fixed maturity securities (Continued) Investments in fixed maturity securities are reflected in our Consolidated Balance Sheets as follows (in millions). December 31, 2012 2011 Insurance and other ...Finance and financial products... -

Page 43

... Statements (Continued) (4) Investments in equity securities (Continued) Investments in equity securities are reflected in our Consolidated Balance Sheets as follows (in millions). December 31, 2012 2011 Insurance and other ...Railroad, utilities and energy * ...Finance and financial products... -

Page 44

... 29 $2,182 2,603 (266) 1,017 $4,058 Investment gains/losses for each of the three years ending December 31, 2012 are reflected in our Consolidated Statements of Earnings as follows (in millions). 2012 2011 2010 Insurance and other ...Finance and financial products ... $1,327 472 $1,799 $1,973 209... -

Page 45

... of $953 million related to equity securities. The OTTI losses averaged about 20% of the original cost of the securities. (7) Receivables Receivables of insurance and other businesses are comprised of the following (in millions). December 31, 2012 2011 Insurance premiums receivable ...Reinsurance... -

Page 46

...-line basis over their estimated economic lives. Amortization expense was $1,008 million in 2012, $809 million in 2011 and $692 million in 2010. Estimated amortization expense over the next five years is as follows (in millions): 2013 - $1,190; 2014 - $1,076; 2015 - $733; 2016 - $639 and 2017... -

Page 47

...millions): 2013 - $730; 2014 - $574; 2015 - $436; 2016 - $314; 2017 - $193; and thereafter - $245. Property, plant and equipment of our railroad and our utilities and energy businesses is comprised of the following (in millions). Ranges of estimated useful life December 31, 2012 2011 Railroad: Land... -

Page 48

.../losses of our finance and financial products businesses included in our Consolidated Statements of Earnings for each of the three years ending December 31, 2012 were as follows (in millions). 2012 2011 2010 Equity index put options ...Credit default ...Other, principally interest rate and foreign... -

Page 49

...following table (in millions). 2012 2011 2010 Cash paid during the period for: Income taxes ...Interest: Insurance and other businesses ...Railroad and utilities and energy businesses ...Finance and financial products businesses ...Non-cash investing and financing activities: Liabilities assumed in... -

Page 50

...include charges associated with the changes in deferred charge balances related to retroactive reinsurance contracts incepting prior to the beginning of the year and net discounts recorded on liabilities for certain workers' compensation claims. The aggregate charges included in prior accident years... -

Page 51

... or other borrowings of BNSF, MidAmerican or their subsidiaries. Weighted Average Interest Rate December 31, 2012 2011 Finance and financial products: Issued by Berkshire Hathaway Finance Corporation ("BHFC") due 2013-2042 ...Issued by other subsidiaries due 2013-2036 ... 4.1% 5.0% $11,186 1,859... -

Page 52

... (in millions). 2013 2014 2015 2016 2017 Insurance and other ...Railroad, utilities and energy ...Finance and financial products ... $ 4,160 2,477 3,874 $10,511 $1,341 1,638 1,301 $4,280 $1,981 1,190 1,625 $4,796 $ 875 751 155 $1,781 $1,418 1,176 1,558 $4,152 (15) Income taxes The liabilities... -

Page 53

... 2012, Berkshire and the U.S. Internal Revenue Service ("IRS") tentatively resolved all proposed adjustments for the 2005 through 2009 tax years at the IRS Appeals level. In 2012, the IRS commenced auditing Berkshire's consolidated U.S. federal income tax returns for the 2010 and 2011 tax years... -

Page 54

... put options ...Credit default ...Other ...December 31, 2012-Assets and liabilities not carried at fair value: Other investments ...Loans and finance receivables ...Notes payable and other borrowings: Insurance and other ...Railroad, utilities and energy ...Finance and financial products ... $ 2,775... -

Page 55

...all of our investments in equity securities are traded on an exchange in active markets and fair values are based on the closing prices as of the balance sheet date. Level 2 - Inputs include directly or indirectly observable inputs (other than Level 1 inputs) such as quoted prices for similar assets... -

Page 56

...be used by market participants in pricing assets or liabilities. Fair value measurements of non-exchange traded derivative contracts and certain other investments are based primarily on valuation models, discounted cash flow models or other valuation techniques that are believed to be used by market... -

Page 57

... would use in determining exchange prices with respect to our contracts. We value equity index put option contracts based on the Black-Scholes option valuation model. Inputs to this model include current index price, contract duration, dividend and interest rate inputs (which include a Berkshire non... -

Page 58

...In September 2011, Berkshire's Board of Directors ("Berkshire's Board") approved a common stock repurchase program under which Berkshire may repurchase its Class A and Class B shares at prices no higher than a 10% premium over the book value of the shares. In December 2012, Berkshire's Board amended... -

Page 59

... losses ...220 102 69 Net pension expense ...$ 440 $ 282 $ 249 The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation prior to the valuation date. As of December 31, 2012 and 2011, the accumulated benefit obligation was $12,915 million... -

Page 60

... ending December 31, 2012 and 2011 consisted primarily of real estate and limited partnership interests. Pension plan assets are generally invested with the long-term objective of earning amounts sufficient to cover expected benefit obligations, while assuming a prudent level of risk. Allocations... -

Page 61

... average interest rate assumptions used in determining projected benefit obligations and net periodic pension expense were as follows. 2012 2011 Applicable to pension benefit obligations: Discount rate ...Expected long-term rate of return on plan assets ...Rate of compensation increase ...Discount... -

Page 62

.... 2013 2014 2015 2016 2017 After 2017 Total $1,186 $1,060 $930 $841 $716 $3,894 $8,627 Our subsidiaries regularly make commitments in the ordinary course of business to purchase goods and services used in their businesses. The most significant of these commitments relate to our railroad... -

Page 63

.... Business Identity Business Activity GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Primary Group BNSF Clayton Homes, XTRA, CORT and other financial services ("Finance and financial products") Marmon Underwriting private passenger automobile insurance mainly by direct... -

Page 64

...Revenues 2011 2010 Earnings before income taxes 2012 2011 2010 Operating Businesses: Insurance group: Underwriting: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Investment income ...Total insurance group ...BNSF ...Finance and financial products... -

Page 65

...) (22) Business segment data (Continued) Goodwill at year-end 2012 2011 Identifiable assets at year-end 2011 2012 2010 Operating Businesses: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...BNSF ...Finance and financial products... -

Page 66

... to Consolidated Financial Statements (Continued) (22) Business segment data (Continued) Premiums written and earned by the property/casualty and life/health insurance businesses are summarized below (in millions). 2012 Property/Casualty 2011 2010 2012 Life/Health 2011 2010 Premiums Written: Direct... -

Page 67

.... 2012 2011 2010 Insurance - underwriting ...Insurance - investment income ...Railroad ...Utilities and energy ...Manufacturing, service and retailing ...Finance and financial products ...Other ...Investment and derivative gains/losses ...Net earnings attributable to Berkshire Hathaway shareholders... -

Page 68

... from our insurance businesses are summarized below. Amounts are in millions. 2012 2011 2010 Underwriting gain (loss) attributable to: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Pre-tax underwriting gain ...Income taxes and noncontrolling... -

Page 69

...our strategy to be a lowcost auto insurer. In addition, we strive to provide excellent service to customers, with the goal of establishing long-term customer relationships. GEICO's underwriting results are summarized below. Dollars are in millions. 2012 Amount % 2011 Amount % 2010 Amount % Premiums... -

Page 70

... product lines. Our management does not evaluate underwriting performance based upon market share and our underwriters are instructed to reject inadequately priced risks. General Re's underwriting results are summarized in the following table. Amounts are in millions. Premiums written 2012 2011 2010... -

Page 71

... Re quota-share contract was not renewed in 2013. BHRG's underwriting activities also include life reinsurance and annuity businesses. BHRG's underwriting results are summarized in the table below. Amounts are in millions. Premiums earned 2012 2011 2010 Pre-tax underwriting gain/loss 2012 2011 2010... -

Page 72

...'s Discussion (Continued) Insurance-Underwriting (Continued) Berkshire Hathaway Reinsurance Group (Continued) capacity and desire to write substantially more business when appropriate pricing can be obtained. Premiums earned in 2012 from catastrophe and individual risk contracts exceeded 2011 by $65... -

Page 73

... and general liability coverages; U.S. Investment Corporation, whose subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as "Berkshire Hathaway Homestate Companies," providers of commercial multi-line insurance, including workers' compensation; Central... -

Page 74

... in 2010 related to BNSF. Investment income consists of interest and dividends earned on cash and investments of our insurance businesses. Pre-tax investment income in 2012 declined $271 million (6%) compared to 2011. The decline reflected the redemptions in 2011 of our investments in Goldman Sachs... -

Page 75

...). 2012 2011 Feb. 13, 2010 - Dec. 31, 2010 2010 Revenues ...Operating expenses: Compensation and benefits ...Fuel ...Purchased services ...Depreciation and amortization ...Equipment rents ...Materials and other ...Total operating expenses ...Interest expense ...Pre-tax earnings ...Income taxes... -

Page 76

... Powergrid Holdings Company ("Northern Powergrid"). The rates that utility and natural gas pipeline companies charge customers for energy and other services are generally subject to regulatory approval. Rates are based in large part on the costs of business operations, including a return on capital... -

Page 77

... are in millions. 2012 Revenues 2011 2010 2012 Earnings 2011 2010 PacifiCorp ...MidAmerican Energy Company ...Natural gas pipelines ...Northern Powergrid ...Real estate brokerage ...Other ...Earnings before corporate interest and income taxes ...Corporate interest ...Income taxes and noncontrolling... -

Page 78

... of business acquisitions in 2012 as well as the aforementioned increase in closed sales transactions. Revenues of the real estate brokerage business were $1,007 million in 2011, down 4% from $1,046 million in 2010, primarily due to a 4% decrease in average home sale prices. EBIT of the real estate... -

Page 79

... and Water Treatment sectors. Despite falling steel prices, Distribution Services increased market share in their market niches, driving annual revenues up 5% over 2011. Higher rail fleet utilization and higher rental rates, offset by lower external sales of railroad tank cars, provided most of... -

Page 80

... 27% from Forest River, which was attributable to increased volume and average sales prices. In 2012, revenues from building products and apparel increased 4% and 5%, respectively, as compared with 2011. However, revenues in 2012 of Iscar and CTB (before the impact of bolt-on acquisitions) declined... -

Page 81

... News and the BH Media Group, which includes the Omaha World-Herald acquired at the end of 2011, as well as 26 other daily newspapers and numerous other publications; and businesses that provide management and other services to insurance companies. Revenues of our other service businesses in 2012... -

Page 82

... and earnings from our finance and financial products businesses follows. Amounts are in millions. 2012 Revenues 2011 2010 2012 Earnings 2011 2010 Manufactured housing and finance ...Furniture/transportation equipment leasing ...Other ...Pre-tax earnings ...Income taxes and noncontrolling interests... -

Page 83

... and Financial Products (Continued) Earnings from our other finance business activities include investment income from a portfolio of fixed maturity and equity investments, a commercial mortgage servicing business in which we own 50% and from a small portfolio of long-held commercial real estate... -

Page 84

... from our equity index put option contracts of approximately $1.0 billion. The gains from equity index put option contracts were due to increased index values, foreign currency exchange rate changes and valuation adjustments on a small number of contracts where contractual settlements are determined... -

Page 85

...which were used to fund the repayment of $2.6 billion of notes that matured in February 2013. In September 2011, our Board of Directors authorized Berkshire Hathaway to repurchase Class A and Class B shares of Berkshire at prices no higher than a 10% premium over the book value of the shares. In the... -

Page 86

...to finance originated and acquired loans of Clayton Homes. The full and timely payment of principal and interest on the BHFC notes is guaranteed by Berkshire. We regularly access the credit markets, particularly through our railroad, utilities and energy and finance and financial products businesses... -

Page 87

...31, 2012 follows. Amounts are in millions. Total Estimated payments due by period 2013 2014-2015 2016-2017 After 2017 Notes payable and other borrowings ...Operating leases ...Purchase obligations ...Losses and loss adjustment expenses (2) ...Life, annuity and health insurance benefits (3) ...Other... -

Page 88

...in loss patterns. Data is analyzed by policy coverage, rated state, reporting date and occurrence date, among other ways. A brief discussion of each reserve component follows. We establish average reserve amounts for reported auto damage claims and new liability claims prior to the development of an... -

Page 89

...for these types of events may be established through the collaborative effort of actuarial, claims and other management personnel. For each significant coverage, we test the adequacy of the total loss reserves using one or more actuarial projections based on claim closure models, paid loss triangles... -

Page 90

... tort-asbestos/environmental ...Auto liability ...Other casualty (2) ...Other general liability ...Property ...Total ... $ 2,887 1,598 3,349 2,765 2,590 2,772 $15,961 (1) (2) Net of discounts of $1,990 million. Includes directors and officers, errors and omissions, medical malpractice and umbrella... -

Page 91

... are often increased as a result. In 2012, we conducted 270 claim reviews. Our actuaries classify all loss and premium data into segments ("reserve cells") primarily based on product (e.g., treaty, facultative and program) and line of business (e.g., auto liability, property, etc.). For each reserve... -

Page 92

... (Continued) General Re (Continued) In 2012, our reported claims for prior years' workers' compensation losses were less than expected by $192 million. However, further analysis of the workers' compensation reserve cells by segment indicated the need for maintaining IBNR reserves. These developments... -

Page 93

... is determined. We monitor claim payment activity and review ceding company reports and other information concerning the underlying losses. Since the claim-tail is expected to be very long for such contracts, we reassess expected ultimate losses as significant events related to the underlying losses... -

Page 94

... value of equity index put option contracts using a Black-Scholes based option valuation model. Inputs to the model include the current index value, strike price, interest rate, dividend rate and contract expiration date. The weighted average interest and dividend rates used as of December 31, 2012... -

Page 95

... to the pricing data or inputs obtained. Prices in a current market trade involving identical (or sufficiently similar) risks and contract terms as our equity index put option or credit default contracts could differ significantly from the fair values used in the financial statements. We do... -

Page 96

... Value December 31, 2012 Assets: Investments in fixed maturity securities ...Other investments (1) ...Loans and finance receivables ...Liabilities: Notes payable and other borrowings: Insurance and other ...Railroad, utilities and energy ...Finance and financial products ...Equity index put option... -

Page 97

...average levels of shareholder capital to provide a margin of safety against short-term price volatility. Market prices for equity securities are subject to fluctuation and consequently the amount realized in the subsequent sale of an investment may significantly differ from the reported market value... -

Page 98

... Price Risk Our diverse group of operating businesses use commodities in various ways in manufacturing and providing services. As such, we are subject to price risks related to various commodities. In most instances, we attempt to manage these risks through the pricing of our products and services... -

Page 99

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 100

... those same wonderful businesses, such as Coca-Cola, are consistent buyers of their own shares, which means that they, and we, gain from the cheaper prices at which they can buy. Overall, Berkshire and its long-term shareholders benefit from a sinking stock market much as a regular purchaser of food... -

Page 101

...own portfolios through direct purchases in the stock market. Charlie and I are interested only in acquisitions that we believe will raise the per-share intrinsic value of Berkshire's stock. The size of our paychecks or our offices will never be related to the size of Berkshire's balance sheet. 9. We... -

Page 102

...company during that holding period. For this to come about, the relationship between the intrinsic value and the market price of a Berkshire share would need to remain constant, and by our preferences at 1-to-1. As that implies, we would rather see Berkshire's stock price at a fair level than a high... -

Page 103

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 104

... of dividends. It would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in a number of diverse business activities of which the most important is the property and casualty insurance business and, accordingly, management has used the... -

Page 105

Berkshire's Corporate Performance vs. the S&P 500 by Five-Year Periods Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire...1980 1977-1981 1978-1982 1979-1983 1980... 2002-2006 2003-2007 2004-2008 2005-2009 2006-2010 2007-2011 2008-2012 ... Relative Results (1)-(2) 12... -

Page 106

... annual gain in pre-tax, non-insurance earnings per share is 21.0%. During the same period, Berkshire's stock price increased at a rate of 22.1% annually. Over time, you can expect our stock price to move in rough tandem with Berkshire's investments and earnings. Market price and intrinsic value... -

Page 107

... the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2012 Class A High Low High Class B Low High Class A Low High 2011 Class B Low... -

Page 108

... 942 1,086 Kern River Gas ...Kirby (1) ...Larson-Juhl ...Lubrizol ...The Marmon Group (4) ...McLane Company ...MidAmerican Energy (2) ...MidAmerican Energy Holdings (2) ...MidAmerican Renewables (2) ...MiTek Inc...Nebraska Furniture Mart ...NetJets ...Northern Natural Gas (2) ...Northern Powergrid... -

Page 109

BERKSHIRE HATHAWAY INC. REAL ESTATE BROKERAGE BUSINESSES Brand Major Cities Served Number of Agents Alabama RealtySouth Roberts Brothers Inc. Arizona Long Companies California Guarantee Real Estate Prudential California Realty Connecticut Prudential Connecticut Realty Florida EWM REALTORS® Georgia... -

Page 110

... NEWSPAPERS Publication City Circulation Daily Sunday Alabama Enterprise Ledger Opelika Auburn News Dothan Eagle Florida Jackson County Floridan Iowa The Daily Nonpareil Nebraska York News-Times The North Platte Telegraph Kearney Hub Star-Herald The Grand Island Independent Omaha World-Herald New... -

Page 111

...III, Co-Chair of the Bill and Melinda Gates Foundation DAVID S. GOTTESMAN, Senior Managing Director of First Manhattan Company, an investment advisory firm. CHARLOTTE GUYMAN, Former Chairman of the Board of Directors of UW Medicine, an academic medical center. DONALD R. KEOUGH, Chairman of Allen and... -

Page 112

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131