Wells Fargo 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Wealth, Brokerage and Retirement (WBR)

segment reported revenue of $12.2billion and record net

income of $1.3billion in2012, driven by strong growth

in brokerage-managed account fees. WBR client assets

grew to $1.4trillion in2012, a 7percent increase from

2011, including 20percent growth in brokerage-managed

account assets and 6percent growth in average deposits.

WBR continued its success in cross-selling products to

clients. The average products grew during 2012 to more

than 10products per household.

What’s the outlook for revenue growth in2013? Though

we don’t set public revenue goals, we do set our sights

on continuing to grow by earning more of our customers’

business, growing market share across business lines, and

making acquisitions that make sense for our customers

and our business model.

Reducing expenses

At WellsFargo, we don’t believe growing and saving

are mutually exclusive objectives. This is why reducing

expenses is a top priority even as we emphasize growing

revenue. We want to grow eciently in ways that result in

products and services that our customers value.

This discipline is expressed by our “eciencyratio,”

which reflects how much we spend in expenses for every

dollar of revenue we earn. In2012, WellsFargo’s eciency

ratio was 58.5percent, the lowest of our industry’s four

largest companies. This meant we spent 58.5cents

for every dollar of revenue we generated. However,

we didn’t cut expenses solely to achieve this feat. We

struck a balance between managing expenses wisely and

spending on opportunities. So we hired people where we

saw opportunities for growth and reduced operations

where we no longer saw value for our customers.

Since 2008, we have reduced the size of our overall

real estate occupancy portfolio by more than 16million

square feet, net of growth. That’s almost six Empire

State Buildings. More than 4.5million square feet of this

reduction took place as we grew revenue in2012. So, we’ve

reduced our company’s physical footprint while improving

the productivity and eciency of the space weuse.

Sometimes the opportunity to save spans operations.

Education Financial Services, which oers private loans

for college students, and Shareowner Services, which

services companies and their shareholders, recognized

they each had seasonal volume peaks; other times, when

business slowed, they had too much sta. Now the two

organizations train each other’s teams, reducing the need

for each to hire seasonal temporary help. This has also

created development opportunities for team members.

Most important, Education Financial Services didn’t miss

out on opportunities to lend, and Shareowner Services

continued to receive high satisfaction scores from its

customers— including our shareholders.

Living our vision and values

Putting customers first, growing revenue, reducing

expenses— these are goals shared by many companies.

How they’re achieved is what ultimately reflects

a company’s culture. We evaluate our leaders on

their cultural performance as well as their financial

performance, knowing that our culture binds us together

as a team. At WellsFargo, we believe in the power of

plurals. It’s not about I, me, and mine. It’s about us, we,

and ours. Our formula for success is team success, not

individual success, and it works. The average tenure at

WellsFargo among my direct reports is 28years.

Our culture is outlined in The Vision & Values of

WellsFargo, a 41-page booklet that details our business

./-/ "4ƇɄ*0-Ʉ1'0 .ƇɄ)Ʉ*0-Ʉ- .*)Ʉ!*-Ʉ $)"ƆɄ./Ʉ4 -ƇɄ

we sent a refreshed version of this 19-year-old document

to each of our more than 265,000 team members and

made it available to the public on wellsfargo.com. Many

team members highlight favorite passages. Others refer

to our vision and values when they’re solving business

problems. It’s a document that’s widely used because it

sums up who we are today and how we plan to become

one of the world’s great companies.

A new advertising campaign we launched last year

brings an aspect of our vision and values to life— our

culture of listening to customers. Called “Conversations,”

the campaign showcases how trusted conversations with

our customers can aect their lives. One conversation

can lead to so much more. The stories highlighted in this

Annual Report reflect that. By listening to our customers

and deepening relationships with them, we support their

success. At WellsFargo, we live our vision and values.

That’s how we build trust, and that’s how we dierentiate

ourselves.

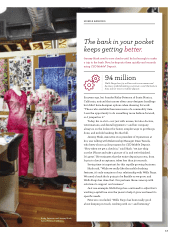

Connecting with communities and stakeholders

Our team members set WellsFargo apart through their

support of the communities we serve. Team members

make personal donations. They volunteer. They quickly

respond when disaster strikes.